How Does Timeshare Work

Description

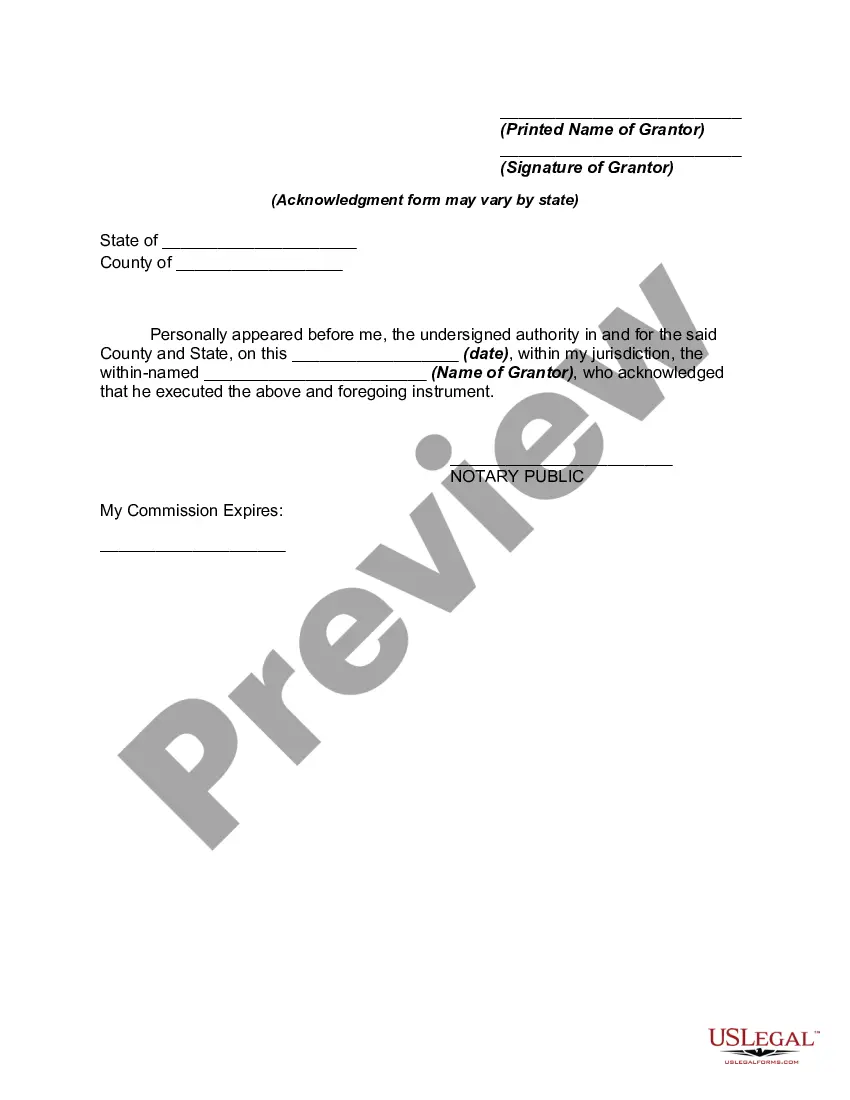

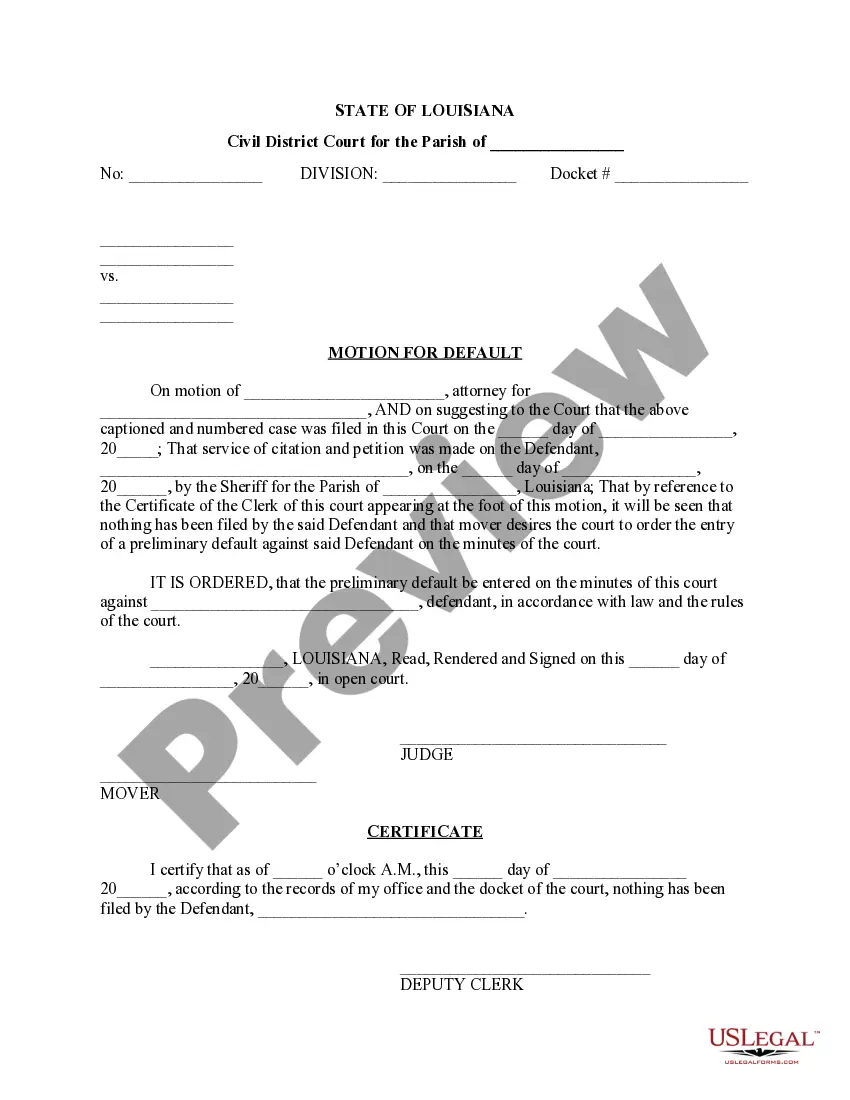

How to fill out Deed To Time Share Condominium With Covenants Of Title?

- Log in to your US Legal Forms account if you're already a member. Ensure your subscription is current, and if necessary, renew it per your payment plan.

- Review the Preview mode and form description to select the appropriate document that meets your requirements and adheres to local regulations.

- If you notice inconsistencies, utilize the Search tab to find the correct template tailored to your needs.

- Proceed to purchase the document by clicking the Buy Now button and selecting a subscription plan that suits you, ensuring you register your account.

- Complete the payment process by entering your credit card information or using your PayPal account.

- Download the required form to your device and access it anytime via the My Forms section in your profile.

By utilizing US Legal Forms, individuals and attorneys can create and execute legal documents swiftly, with access to an extensive library comprising over 85,000 forms.

Don't miss out on the convenience and expertise that US Legal Forms offers—start your journey towards hassle-free legal documentation today!

Form popularity

FAQ

Stopping payments on a timeshare can be complex. While some owners might consider letting their timeshare go, it's essential to understand the contract. Ignoring payments can lead to legal action or affect your credit score. A better approach is to explore options like resale or cancellation through a reliable platform like US Legal Forms.

When it comes to reporting a timeshare on your tax return, you must classify it as a second home if you rent it out. You can often deduct mortgage interest and property taxes, just as you would with your primary residence. Additionally, if you incur rental income, you will need to report that. Learning how does timeshare work can provide clarity on tax implications.

The 1 in 4 rule refers to a guideline that suggests you should only use your timeshare a maximum of once every four years to avoid excess fees and usage complications. Basically, this helps maintain fairness among owners in multi-owner properties. Understanding this rule is key when exploring how does timeshare work in ensuring that everyone gets a chance to enjoy their purchased time. Consider this when planning your vacations.