Vacate Complaint With Attorney

Description

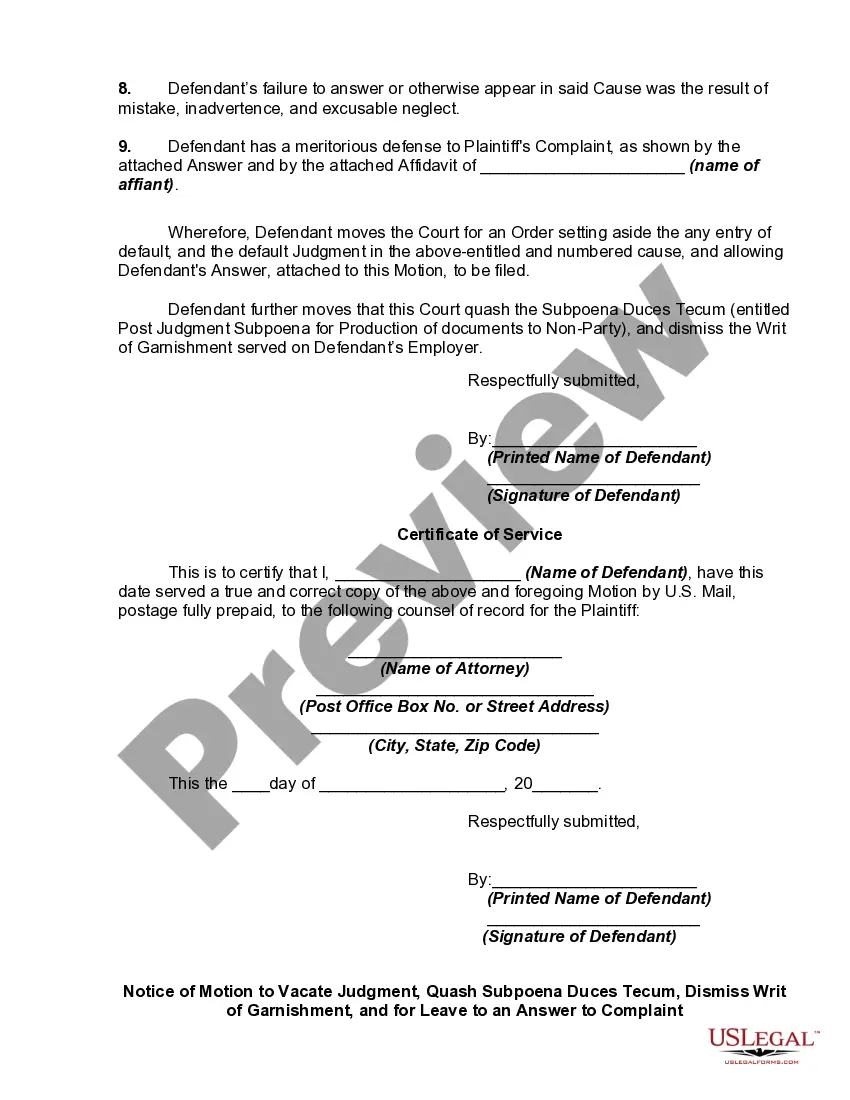

How to fill out Motion To Vacate Judgment, Quash Subpoena Duces Tecum, Dismiss Writ Of Garnishment, And For Leave To File An Answer To Complaint?

It’s widely recognized that one cannot become a legal specialist overnight, nor can one swiftly learn how to compose a Vacate Complaint With Attorney without possessing a unique skill set.

Drafting legal documents is a lengthy endeavor necessitating particular educational background and expertise. So why not entrust the preparation of the Vacate Complaint With Attorney to the experts.

With US Legal Forms, one of the most extensive legal template repositories, you can discover everything from court documentation to formats for internal business correspondence.

You can regain access to your documents from the My documents section at any moment. If you are a current client, you can simply Log In, and locate and download the template from the same section.

Regardless of the reason for your documentation—be it fiscal and legal, or personal—our platform has you covered. Experience US Legal Forms today!

- Locate the document you need using the search functionality at the top of the webpage.

- Preview it (if this feature is available) and examine the accompanying description to determine if Vacate Complaint With Attorney aligns with your needs.

- If you require another template, restart your search.

- Create a complimentary account and select a subscription plan to acquire the document.

- Click Buy now. Once the transaction is finalized, you can download the Vacate Complaint With Attorney, complete it, print it, and send or mail it to the appropriate parties or organizations.

Form popularity

FAQ

USDA defines a farm as any place that produced and sold?or normally would have produced and sold?at least $1,000 of agricultural products during a given year. USDA uses acres of crops and head of livestock to determine if a place with sales less than $1,000 could normally produce and sell at least that amount.

A smallholding or smallholder is a small farm operating under a small-scale agriculture model. Definitions vary widely for what constitutes a smallholder or small-scale farm, including factors such as size, food production technique or technology, involvement of family in labor and economic impact.

There are three forms of legal entities that farmers typically choose for their business: sole proprietorship, partnership, or limited liability company. In addition to the for-profit entities, a farm may choose to be a nonprofit corporation.

23.26(1) ?Farm? as used in section 96.19(6)?g?(3) and as used in these rules means one or more plots of land not necessarily contiguous, including structures and buildings, used either primarily for raising or harvesting any agricultural or horticultural commodity, including the raising, shearing, feeding, caring for, ...

Iowa Family Farm Tax Credit Eligibility: All land used for agricultural or horticultural purposes in tracts of 10 acres or more and land of less than 10 acres if contiguous to qualifying land of more than 10 acres. The owner or designated person must be actively engaged in farming the land.

Purchases by farmers may be exempt from Iowa sales and / or use tax. Just because something is purchased by a farmer, it is NOT automatically tax exempt. Anyone claiming exemption must be able to show they are entitled to it. See Purchases and Sales: Taxable and Exempt below.

Total land in farms for Iowa during 2021 was 30.5 million acres. The average farm size in Iowa in 2021 was 359 acres, down 1 acre from 2020. The number of farms in the United States for 2021 is estimated at 2,012,050, down 6,950 farms from 2020.