Dismissal Without Notice Meaning

Description

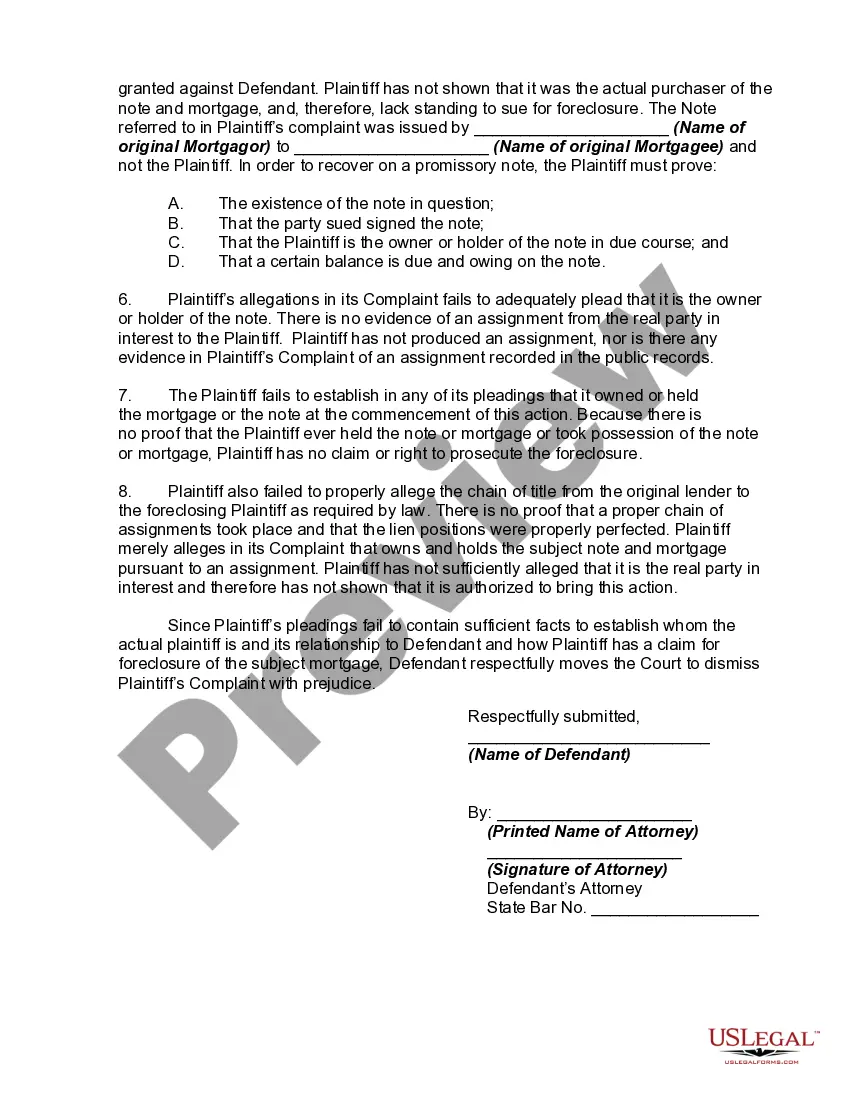

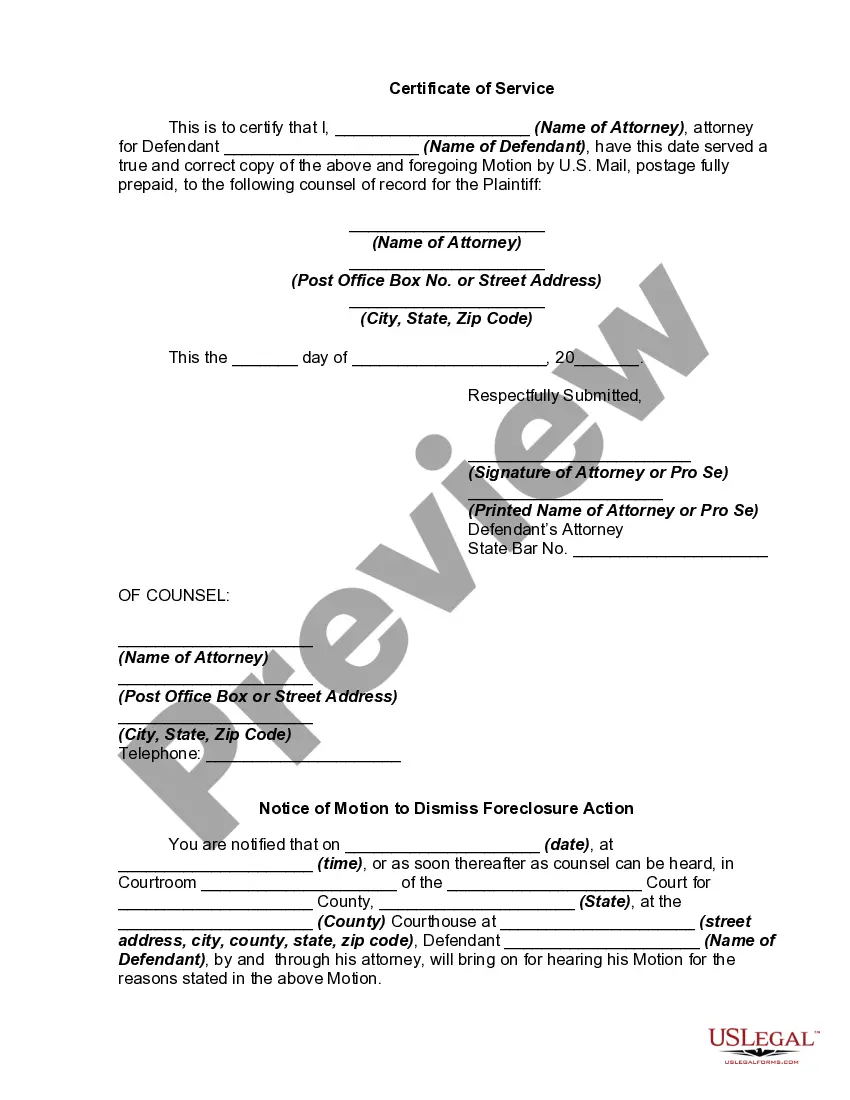

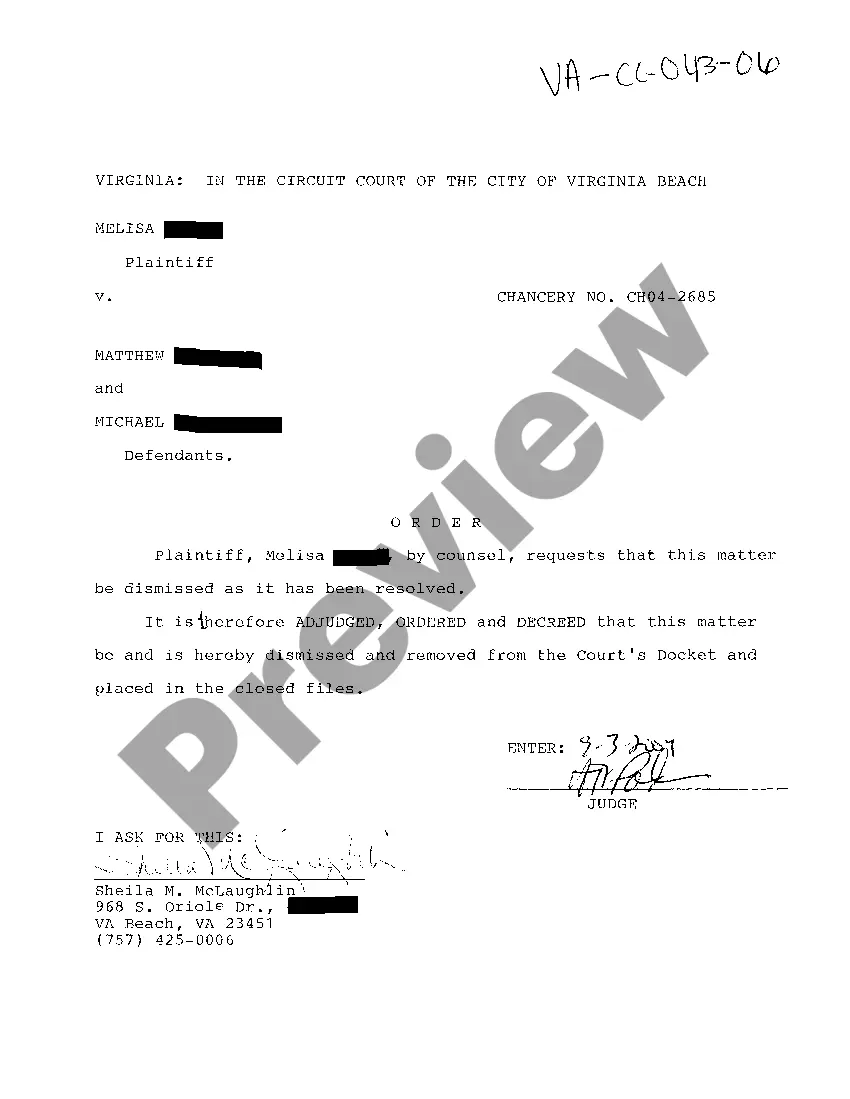

How to fill out Motion To Dismiss Foreclosure Action And Notice Of Motion?

Regardless of whether it is for professional reasons or personal matters, everyone eventually encounters legal circumstances in their lives. Completing legal documentation requires meticulous care, beginning with selecting the correct form template.

For example, if you choose an incorrect version of a Dismissal Without Notice Meaning, it will be rejected once submitted. Thus, it is essential to find a reliable source of legal documents like US Legal Forms.

With a comprehensive US Legal Forms catalog available, you never need to waste time searching for the correct template online. Take advantage of the library’s straightforward navigation to find the proper template for any circumstance.

- Retrieve the template you require by utilizing the search bar or browsing the catalog.

- Review the form’s description to confirm it aligns with your situation, state, and county.

- Click on the form’s preview to view it.

- If it is not the correct document, return to the search feature to locate the Dismissal Without Notice Meaning sample you require.

- Acquire the template once it suits your needs.

- If you possess a US Legal Forms account, simply click Log in to access previously saved templates in My documents.

- If you do not have an account yet, you can obtain the form by clicking Buy now.

- Select the relevant pricing option.

- Complete the account registration form.

- Choose your payment method: utilize a credit card or PayPal account.

- Select the desired file format and download the Dismissal Without Notice Meaning.

- Once saved, you can fill out the form using editing software or print it and complete it by hand.

Form popularity

FAQ

If delinquent property taxes go unpaid, a lien attaches to the property and continues from the time the taxes become delinquent until the taxes are paid, up to 11 years from the date the taxes become delinquent.

KENTUCKY PROPERTY TAX CALENDAR - THE COLLECTION CYCLE ACTIONDATETax Bills Delivered to SheriffBy September 15Taxes are Due and Payable with 2% DiscountSeptember 15 ? November 1Taxes are Payable at Face ValueNovember 2 ? December 31Unpaid Tax Bills Become Delinquent. Pay with a 5% PenaltyJanuary 1 ? January 313 more rows

Ing to KRS 132.010 (9) "Agricultural land" means: Any tract of land, including all income-producing improvements, of at least ten contiguous acres in area used for the production of livestock, livestock products, poultry, poultry products and/or the growing of tobacco and/or other crops including timber.

Homestead Exemption? Section 170 of the Kentucky Constitution also authorizes a homestead exemption for property owners who are at least 65 years of age or who have been determined to be totally disabled and are receiving payments pursuant to their disability.

KRS 139.481 requires that farmers who are eligible for agriculture exemptions from sales and use tax apply for and use their Agriculture Exemption (AE) Number to claim the applicable tax exemptions. This pre-qualification process will greatly reduce exemption claims by those not qualified for the exemptions.

The Kentucky Department of Revenue has increased the maximum homestead exemption to $46,350 for the 2023 and 2024 tax years.

This application must be completed and submitted to the property owner's local Property Valuation Administrator's (PVA) office no later than December 31 of the eligible tax year. The completed application can be submitted online, by mail or in person.

Kentucky's Right to Farm Law, passed in 1980 and last amended in 1996, gives existing farms a degree of pro- tection from nuisance complaints.