Final Estate Sample With 500

Description

How to fill out Contest Of Final Account And Proposed Distributions In A Probate Estate?

The Final Estate Sample With 500 you see on this page is a multi-usable formal template drafted by professional lawyers in accordance with federal and regional laws and regulations. For more than 25 years, US Legal Forms has provided people, organizations, and attorneys with more than 85,000 verified, state-specific forms for any business and personal situation. It’s the quickest, simplest and most reliable way to obtain the paperwork you need, as the service guarantees the highest level of data security and anti-malware protection.

Obtaining this Final Estate Sample With 500 will take you just a few simple steps:

- Search for the document you need and review it. Look through the sample you searched and preview it or review the form description to confirm it satisfies your needs. If it does not, utilize the search option to find the right one. Click Buy Now when you have located the template you need.

- Subscribe and log in. Choose the pricing plan that suits you and register for an account. Use PayPal or a credit card to make a prompt payment. If you already have an account, log in and check your subscription to continue.

- Get the fillable template. Pick the format you want for your Final Estate Sample With 500 (PDF, DOCX, RTF) and download the sample on your device.

- Fill out and sign the document. Print out the template to complete it manually. Alternatively, use an online multi-functional PDF editor to quickly and precisely fill out and sign your form with a legally-binding] {electronic signature.

- Download your paperwork one more time. Utilize the same document once again anytime needed. Open the My Forms tab in your profile to redownload any earlier purchased forms.

Subscribe to US Legal Forms to have verified legal templates for all of life’s scenarios at your disposal.

Form popularity

FAQ

Per stirpes. One of the simplest strategies for asset distribution among heirs, this method requires that the estate be divided equally among each branch of the family. So, if an heir (a child) should pass away before the parents, their share would be passed along in equal shares to their heirs (the grandchildren).

Final expenses. Funeral, burial, cremation or interment costs can be considered part of estate expenses, though these may not be covered by estate assets. Instead, they may be paid out of the death benefit associated with the deceased person's life insurance policy.

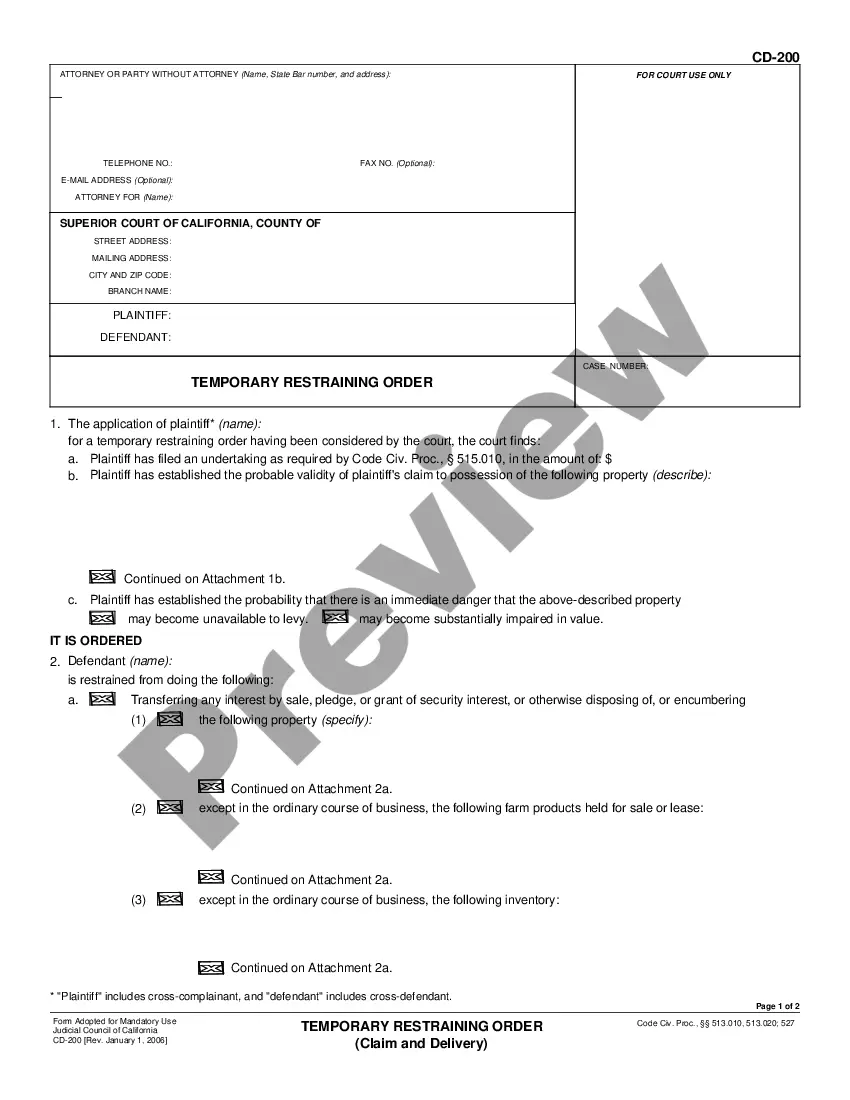

A Final Account is a complete record detailing the assets, receipts, and disbursements made during a probate administration.

How to Determine Estate Value Figure out how much everything is worth. That includes real estate, vehicles, insurance policies, personal items and anything else your loved one owned. Subtract the value of any assets that don't have to go through probate. ... Carry out the simplified probate process.

Some of the most important expenses paid by the estate include: Outstanding debts, such as credit cards, medical bills or liens. Repairs or maintenance costs for estate property. Appraisals that are necessary to determine the value of estate assets. Closing costs associated with the sale of a home.