Final Account Estate Template With Formulas

Description

How to fill out Contest Of Final Account And Proposed Distributions In A Probate Estate?

Working with legal paperwork and operations can be a time-consuming addition to your day. Final Account Estate Template With Formulas and forms like it usually require you to search for them and navigate the way to complete them properly. As a result, if you are taking care of financial, legal, or personal matters, having a thorough and convenient web catalogue of forms at your fingertips will help a lot.

US Legal Forms is the best web platform of legal templates, boasting over 85,000 state-specific forms and a variety of resources to assist you to complete your paperwork easily. Explore the catalogue of appropriate papers accessible to you with just a single click.

US Legal Forms gives you state- and county-specific forms offered at any time for downloading. Shield your papers administration procedures with a high quality services that lets you make any form within a few minutes without having additional or hidden cost. Just log in in your profile, find Final Account Estate Template With Formulas and download it right away within the My Forms tab. You may also access formerly saved forms.

Would it be your first time making use of US Legal Forms? Register and set up up an account in a few minutes and you will get access to the form catalogue and Final Account Estate Template With Formulas. Then, stick to the steps listed below to complete your form:

- Ensure you have discovered the proper form by using the Preview option and reading the form information.

- Select Buy Now when ready, and select the monthly subscription plan that meets your needs.

- Choose Download then complete, sign, and print the form.

US Legal Forms has 25 years of expertise helping users control their legal paperwork. Obtain the form you require today and improve any operation without breaking a sweat.

Form popularity

FAQ

When calculating the value of an estate, the gross value is the sum of all asset values, and the net value is the gross value minus any debts: in other words, the actual worth of the estate.

There is no set format for estate accounts, however they should as a minimum detail all estate assets as they were at the date of death, all liabilities and any increases/ decreases in the value of estate assets once they have been liquidated.

Final expenses. Funeral, burial, cremation or interment costs can be considered part of estate expenses, though these may not be covered by estate assets. Instead, they may be paid out of the death benefit associated with the deceased person's life insurance policy.

An executor is often in receipt of checks in the deceased's name, in payment of amounts owed to the deceased while they were alive. An estate account makes it easy for the executor to endorse and deposit these payments.

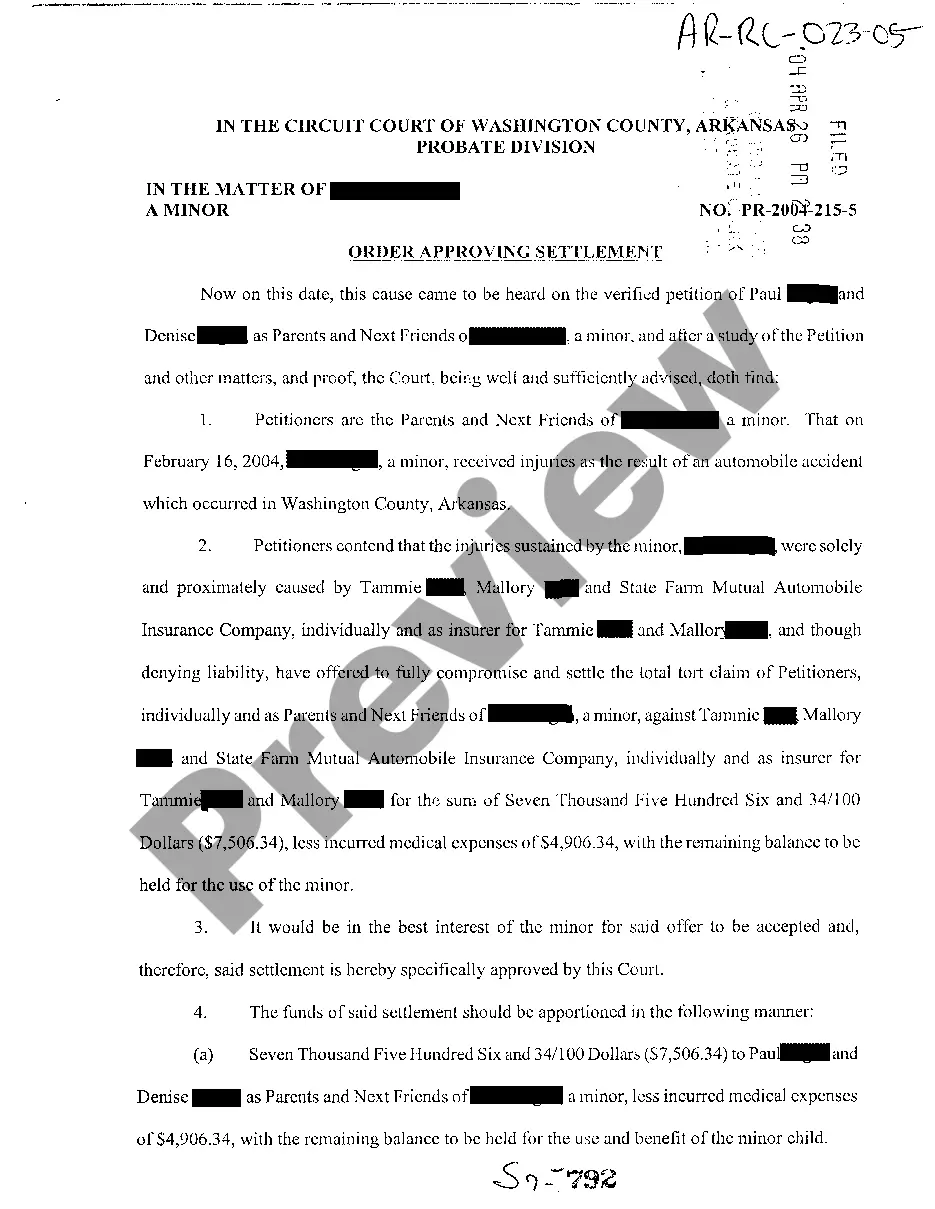

A Final Account is a complete record detailing the assets, receipts, and disbursements made during a probate administration.