Final Account Estate Template For Real

Description

How to fill out Contest Of Final Account And Proposed Distributions In A Probate Estate?

Getting a go-to place to access the most current and relevant legal templates is half the struggle of dealing with bureaucracy. Finding the right legal documents needs accuracy and attention to detail, which explains why it is very important to take samples of Final Account Estate Template For Real only from reliable sources, like US Legal Forms. A wrong template will waste your time and hold off the situation you are in. With US Legal Forms, you have little to be concerned about. You may access and see all the information concerning the document’s use and relevance for the situation and in your state or county.

Consider the listed steps to complete your Final Account Estate Template For Real:

- Utilize the catalog navigation or search field to locate your template.

- View the form’s information to check if it suits the requirements of your state and area.

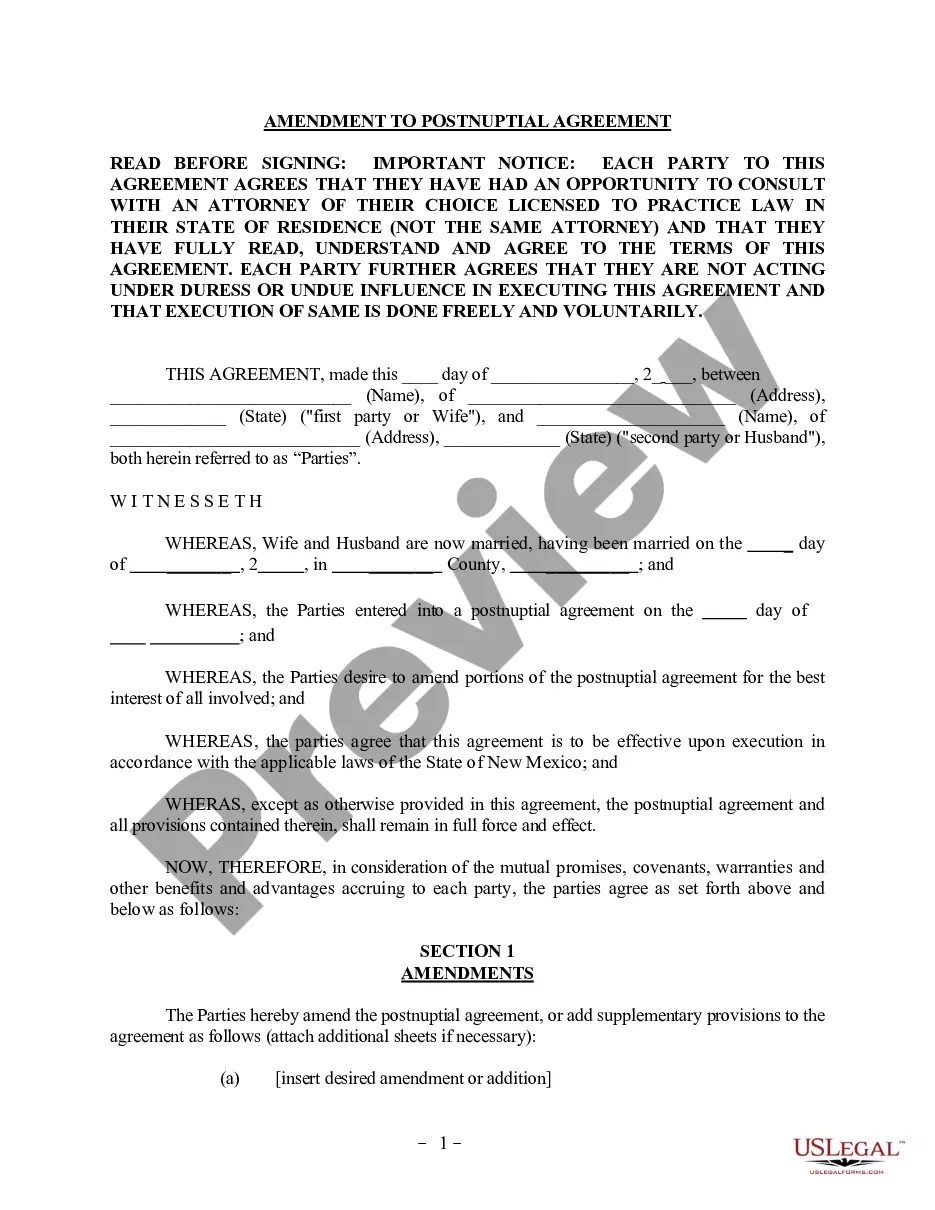

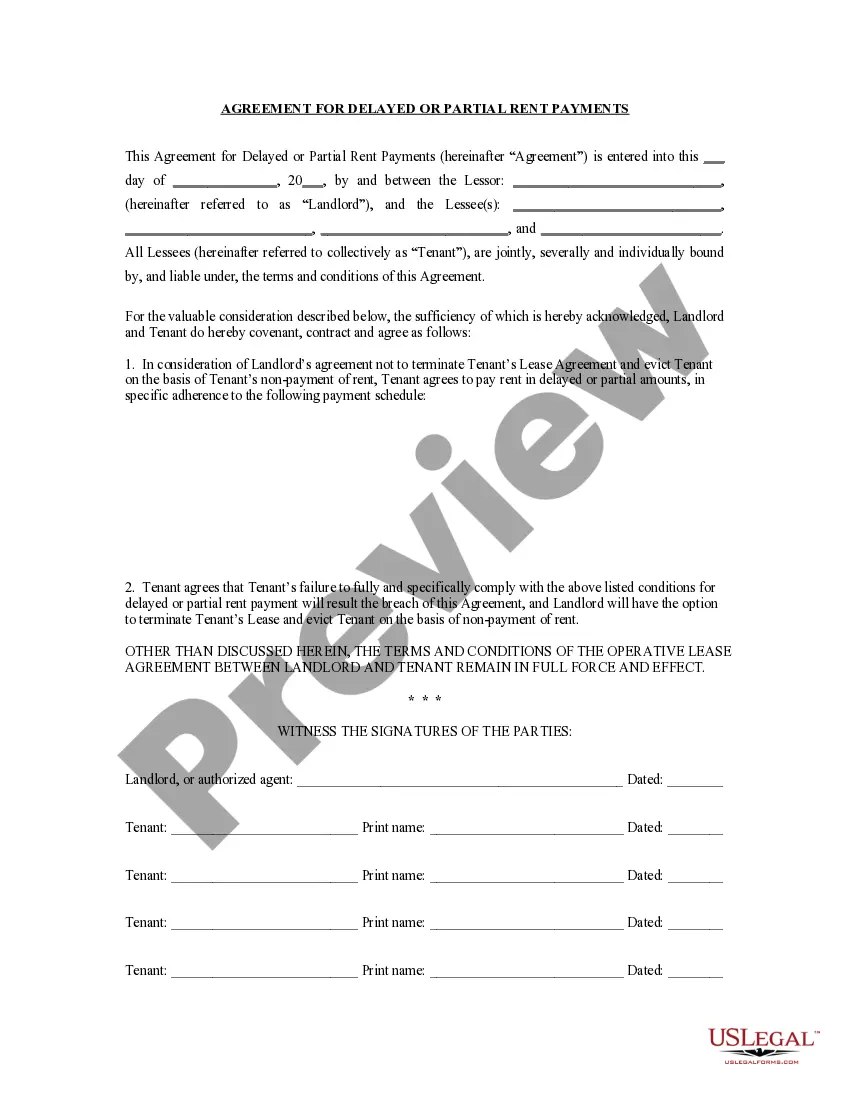

- View the form preview, if there is one, to make sure the template is definitely the one you are searching for.

- Resume the search and look for the proper template if the Final Account Estate Template For Real does not suit your needs.

- When you are positive about the form’s relevance, download it.

- If you are a registered user, click Log in to authenticate and access your selected templates in My Forms.

- If you do not have a profile yet, click Buy now to get the template.

- Select the pricing plan that suits your needs.

- Proceed to the registration to complete your purchase.

- Finalize your purchase by selecting a payment method (credit card or PayPal).

- Select the file format for downloading Final Account Estate Template For Real.

- Once you have the form on your gadget, you may change it using the editor or print it and complete it manually.

Eliminate the headache that accompanies your legal documentation. Check out the extensive US Legal Forms catalog where you can find legal templates, check their relevance to your situation, and download them on the spot.

Form popularity

FAQ

By way of example, in a relatively simple estate an informal accounting can consist of copies of all of the estate account statements and a copy of the fiduciaries check register. If there was real property sold by the fiduciary a copy of the closing statement should be provided to the beneficiaries.

All beneficiaries do not need to formally approve estate accounts; however, it is best practice for the Executor(s) and main beneficiaries to sign the estate accounts to show a legal agreement across all parties. Nevertheless, the beneficiaries are entitled to receive a copy of them and review the information.

A Final Account is a complete record detailing the assets, receipts, and disbursements made during a probate administration.

How to open an estate account Begin the probate process. The steps for beginning this process depend on the state in which the deceased person resided. ... Obtain a tax ID number for the estate account. ... Bring all required documents to the bank. ... Open the estate account.

An informal accounting for an estate is a document that outlines the financial activities of the estate. This type of accounting is often used to prepare financial statements of affairs. It includes details about assets and liabilities, income and expenses, donations or transfers from the estate, and tax information.