Final Account Estate Sample With Adjustments

Description

How to fill out Contest Of Final Account And Proposed Distributions In A Probate Estate?

Legal oversight can be daunting, even for the most proficient experts. When you seek a Final Account Estate Example With Adjustments and lack the time to search for the correct and updated version, the processes can be taxing.

A comprehensive web form collection could transform the experience for anyone aiming to manage these situations effectively.

Benefit from a valuable repository of articles, guides, and materials pertinent to your circumstances and requirements.

Conserve time and effort in searching for the documents you require, and employ US Legal Forms’ sophisticated search and Review tool to locate Final Account Estate Example With Adjustments and download it.

Ensure that the sample is valid in your state or county. Select Buy Now when you are prepared. Choose a monthly subscription plan. Locate the file format you need, and Download, complete, eSign, print, and send your documents. Make the most of the US Legal Forms web collection, backed by 25 years of experience and reliability. Transform your everyday document management into a seamless and user-friendly process today.

- If you have a subscription, Log Into your US Legal Forms account, search for the form, and download it.

- Visit the My documents tab to access the documents you previously saved and manage your folders as desired.

- If it's your first experience with US Legal Forms, create an account and gain unlimited access to all the advantages of the library.

- Here are the actions to follow after obtaining the form you require.

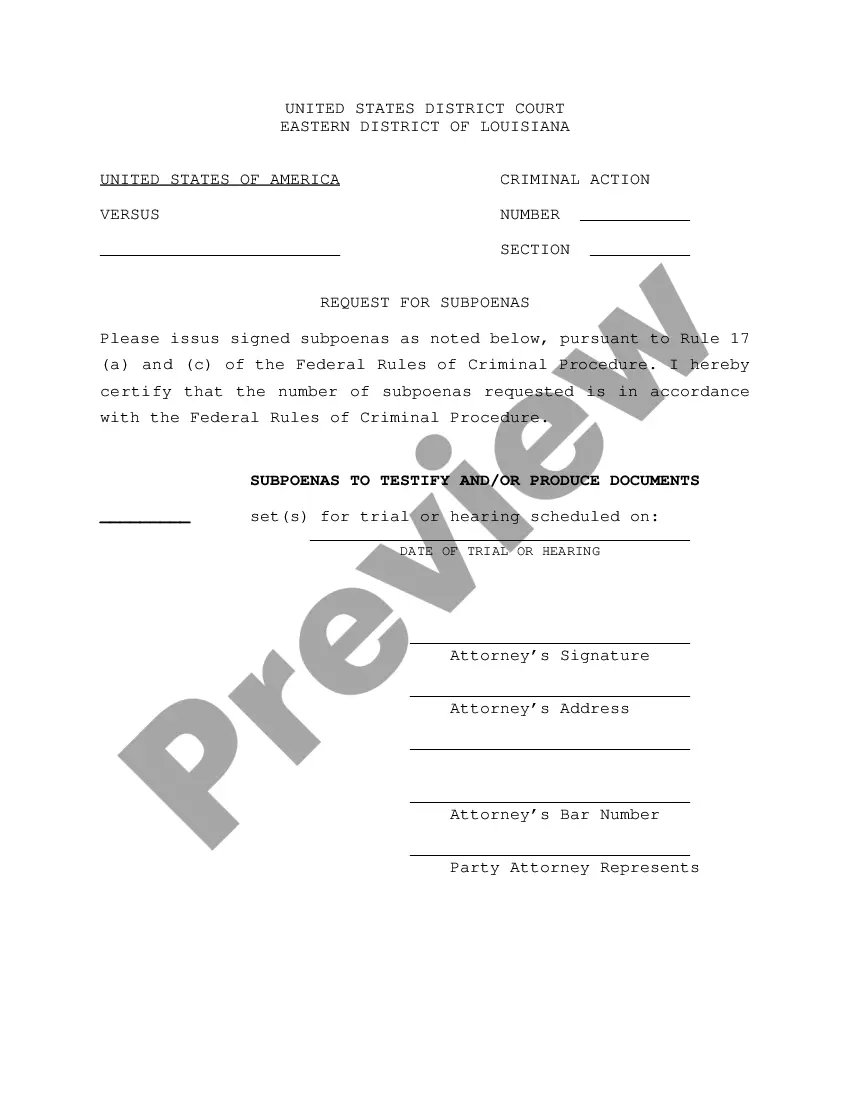

- Confirm that this is the correct form by previewing it and reviewing its details.

- Access state- or county-specific legal and business documents.

- US Legal Forms fulfills any needs you may have, from personal to corporate documentation, all in one location.

- Utilize cutting-edge tools to complete and manage your Final Account Estate Example With Adjustments.

Form popularity

FAQ

The first thing to understand is that the check belongs to the decedent's estate, not to you. As such, you'll need legal authority to cash or deposit the check. Typically, this requires being named as the executor or administrator of the estate via the probate process.

Typically, you need to make it known that you are the executor of the estate and are not taking responsibility for the transaction yourself. You can do this by simply signing your name and putting your title of executor of the estate afterward.

There is no set format for estate accounts, however they should as a minimum detail all estate assets as they were at the date of death, all liabilities and any increases/ decreases in the value of estate assets once they have been liquidated.

Every state sets the priority ing to which claims must be paid. The estate's beneficiaries only get paid once all the creditor claims have been satisfied. Usually, estate administration fees, funeral expenses, support payments, and taxes have priority over other claims.

It is comparable to a balance sheet, as the Final Account reports all the ?ins and outs? for the estate, starting with the beginning value of the Inventory and ending with the value of the property on hand for distribution to the beneficiaries.