Account Estate Application For Tfn

Description

How to fill out Contest Of Final Account And Proposed Distributions In A Probate Estate?

Locating a reliable source for the latest and pertinent legal templates is a significant part of managing bureaucracy.

Selecting the appropriate legal documents demands precision and meticulousness, which is why it is essential to obtain samples of Account Estate Application For Tfn solely from trustworthy sources, such as US Legal Forms.

Eliminate the stress associated with your legal documentation. Explore the vast US Legal Forms collection to discover legal templates, verify their relevance to your situation, and download them instantly.

- An incorrect template will squander your time and delay the matter you are facing.

- With US Legal Forms, you have minimal concerns.

- You can access and view all the details about the document’s applicability and significance for your situation and in your state or territory.

- Follow these steps to complete your Account Estate Application For Tfn.

- Use the library navigation or search bar to locate your template.

- Check the form’s description to verify if it meets the criteria of your state and county.

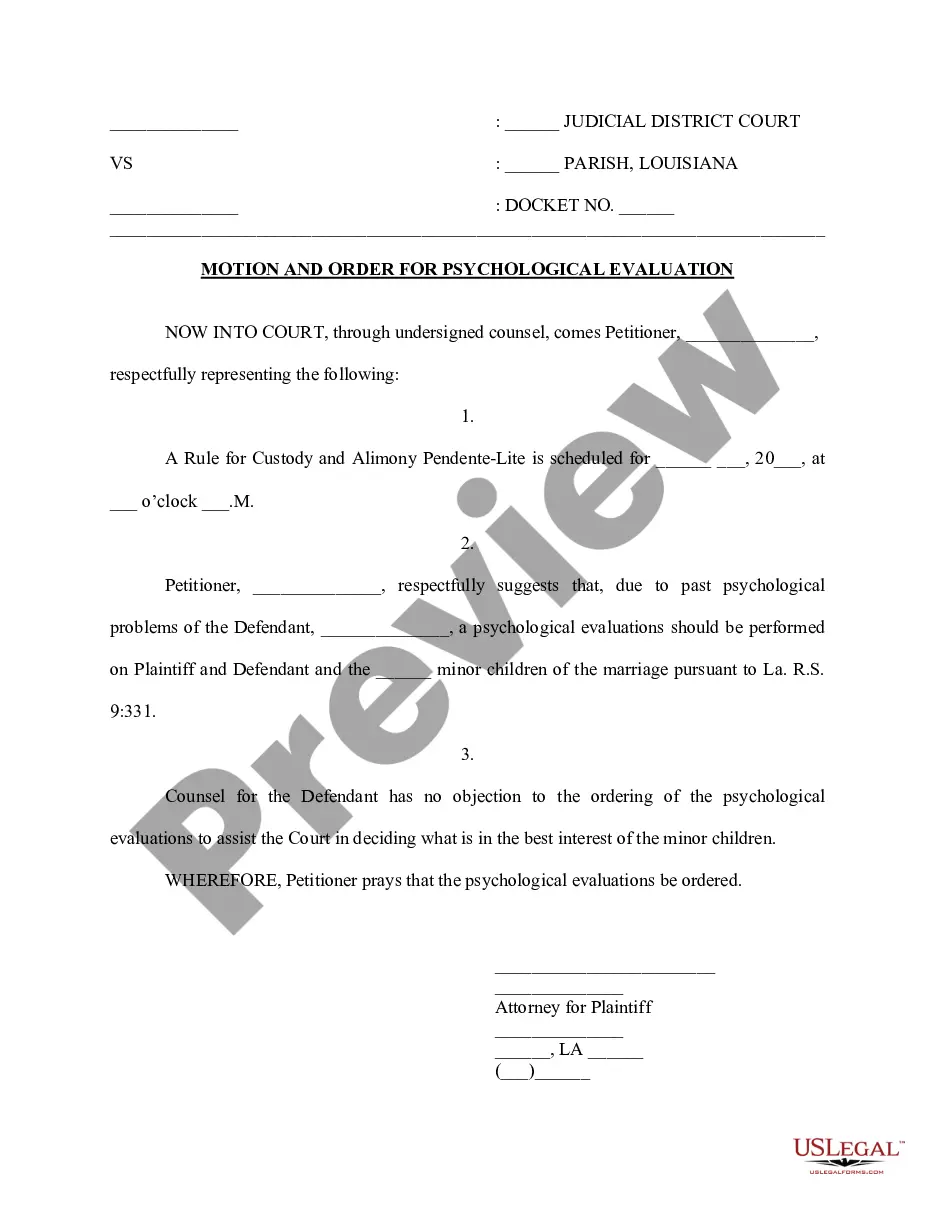

- View the form preview, if available, to ensure it is indeed the template you are looking for.

- Return to the search and find the appropriate document if the Account Estate Application For Tfn does not meet your requirements.

- Once you are confident about the form’s applicability, download it.

- If you are a registered user, click Log in to verify and access your chosen templates in My documents.

- If you do not yet have an account, click Buy now to acquire the template.

- Choose the pricing plan that suits your needs.

- Continue with the registration to complete your purchase.

- Conclude your purchase by selecting a payment option (credit card or PayPal).

- Choose the document format for downloading Account Estate Application For Tfn.

- Once you have the form on your device, you can edit it with the editor or print it and fill it out manually.

Form popularity

FAQ

How to Complete a TFN Declaration - YouTube YouTube Start of suggested clip End of suggested clip Surname if you have changed your name if not leave it blank. Question 5 fill in your email. AddressMoreSurname if you have changed your name if not leave it blank. Question 5 fill in your email. Address question 6 fill in your date of birth. Question 7 select your type of income.

You need a TFN so you do not pay more tax than necessary. It also helps you with starting a job or lodging a tax return. Once a TFN has been issued, you keep it for life; there is no need to reapply if your circumstances change.

You may also complete a Tax file number ? application or enquiry for a deceased estate (NAT 3236) if you need a TFN for a deceased estate. You can order a copy of this form from our website at ato.gov.au/onlineordering or by phoning our automated publications distribution service on 1300 720 092 at any time.

Lodging your TFN declaration data online is a quick, secure way to meet your reporting obligations.

TFN declaration Each of your employees should complete a Tax file number declaration. This allows you to work out the amount you withhold from payments to the employee. You must lodge TFN declaration details with us, unless your employee has completed the employee commencement forms in ATO Online Services.