Any Trust Property Without A Will

Description

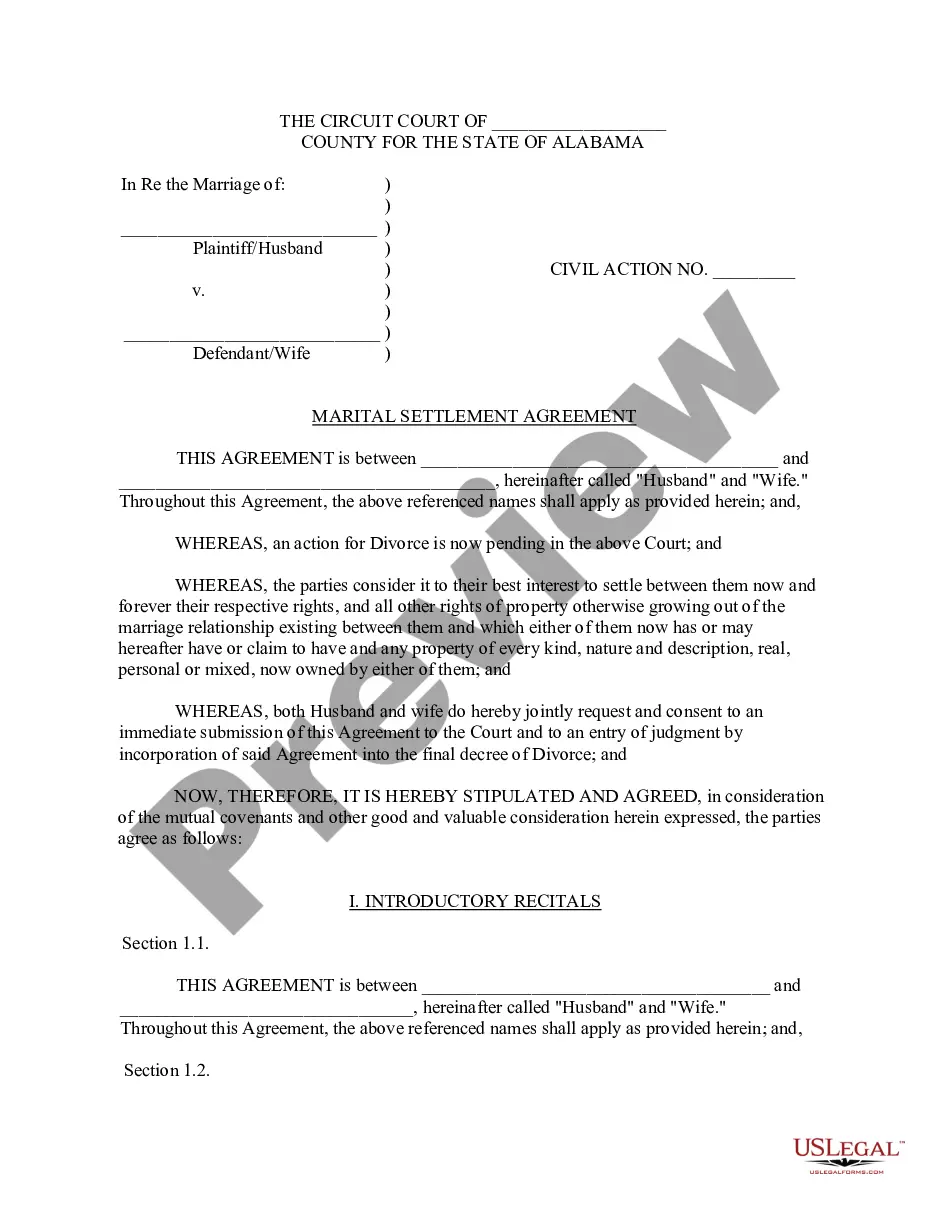

How to fill out Inter Vivos QTIP Trust With Principal To Donor's Children On Spouse's Death?

Whether for commercial objectives or for personal affairs, everyone eventually faces legal issues at some stage in their lives. Completing legal papers requires meticulous care, starting from selecting the appropriate form template.

For example, if you choose an incorrect version of the Any Trust Property Without A Will, it will be denied upon submission. Thus, it is vital to find a reliable source for legal documents such as US Legal Forms.

With a comprehensive catalog of US Legal Forms available, you need not waste time searching for the correct template online. Utilize the library’s straightforward navigation to find the suitable form for any circumstance.

- Obtain the template you require by using the search bar or browsing the catalog.

- Review the form’s description to ensure it aligns with your situation, state, and county.

- Click on the form’s preview to inspect it.

- If it is not the correct form, return to the search feature to find the Any Trust Property Without A Will template you need.

- Download the document if it meets your specifications.

- If you already possess a US Legal Forms account, simply click Log in to retrieve previously stored documents in My documents.

- If you do not have an account yet, you can obtain the form by clicking Buy now.

- Choose the appropriate pricing option.

- Complete the account registration form.

- Select your payment method: use a credit card or PayPal account.

- Choose the file format you desire and download the Any Trust Property Without A Will.

- Once downloaded, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

Although you are not required by law to have legal representation when buying or selling a property in Vermont, it is in your best interest to do so.

5 tips for selling your home without a realtor in Vermont Make minor repairs. Small upgrades and repairs can do a lot to sway potential buyers. ... Price your Vermont home competitively. ... Stage and market your home. ... Prepare for showings. ... Negotiate for the best possible price.

The decision to hire a real estate lawyer in Vermont is generally based on the type and complexity of the transaction, and your unique needs. Although you are not required by law to have legal representation when buying or selling a property in Vermont, it is in your best interest to do so.

The sales tax rate is 6%. Vermont Use Tax is imposed on the buyer at the same rate as the sales tax. If you are a new business, go to Getting Started with Sales and Use Tax to learn the basics of Vermont Sales and Use Tax.

States that mandate the physical presence of an attorney, or restrict other types of closing duties to attorneys, include: Alabama, Connecticut, Delaware, District of Columbia, Florida, Georgia, Kansas, Kentucky, Maine, Maryland, Massachusetts, Mississippi, New Hampshire, New Jersey, New York, North Dakota, ...

Download fillable PDF forms from the web. Free, unlimited downloads! Order forms online. . Order forms by email. tax.formsrequest@vermont.gov.

Yes, you can sell your house in Vermont as is. And it's easier than you think. For an ?as is? transaction Vermont home sellers and buyers sign Vermont ?as is? real estate contract issued by Vermont Realtors. This contract contains contingencies involved in an as-is Vermont home sale.

You do not need to register for an account to file an appeal. If you wish to mail your appeal, you should include the Taxpayer Appeal Form (TAX-610) that came with your NOA and include supporting documentation that outlines why you are appealing.