Any Trust Properties With Ev Charging

Description

How to fill out Inter Vivos QTIP Trust With Principal To Donor's Children On Spouse's Death?

Whether for corporate objectives or personal affairs, everyone must manage legal issues sooner or later in their lifetime.

Completing legal documents demands meticulous attention, starting from selecting the appropriate template.

With a vast US Legal Forms collection available, you never need to waste time searching for the correct template online. Utilize the library’s simple navigation to discover the appropriate document for any circumstance.

- Obtain the template you require by utilizing the search feature or catalog browsing.

- Review the document’s details to ensure it aligns with your situation, state, and locality.

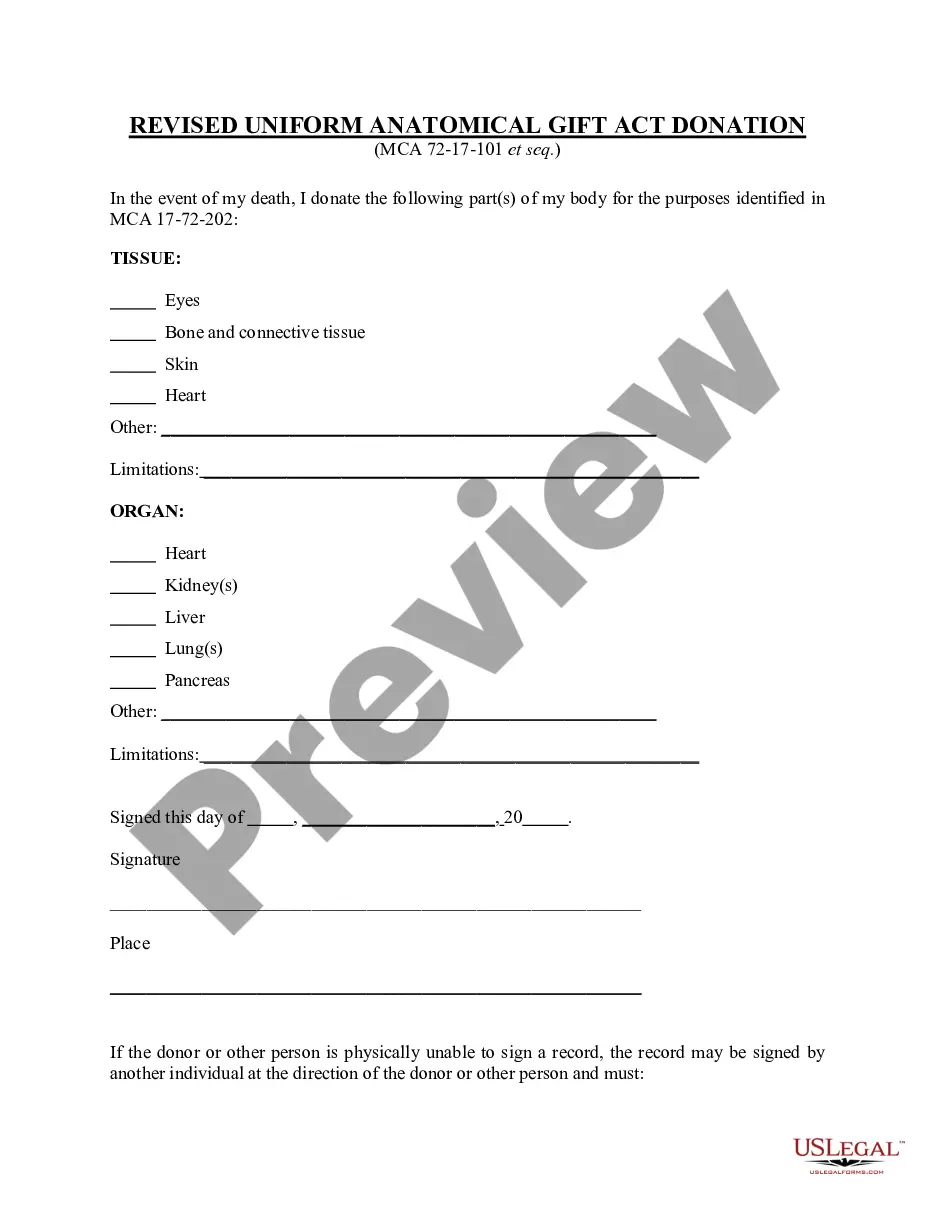

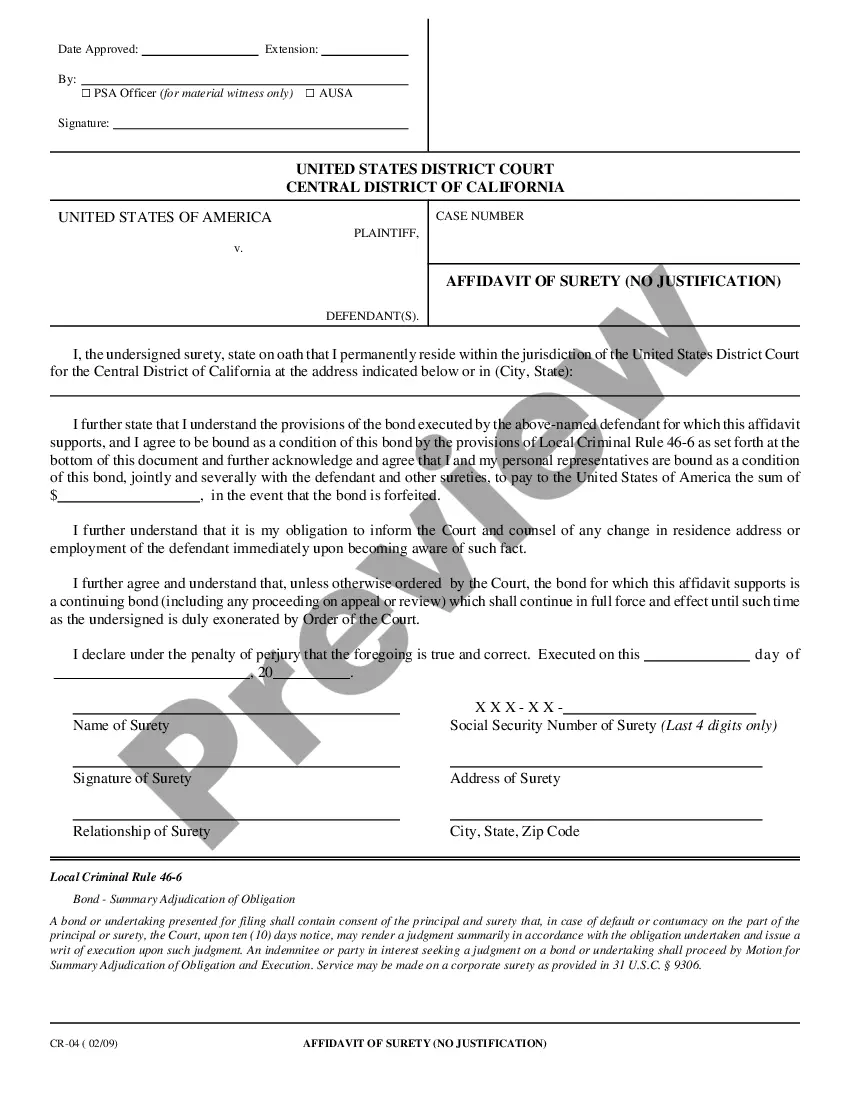

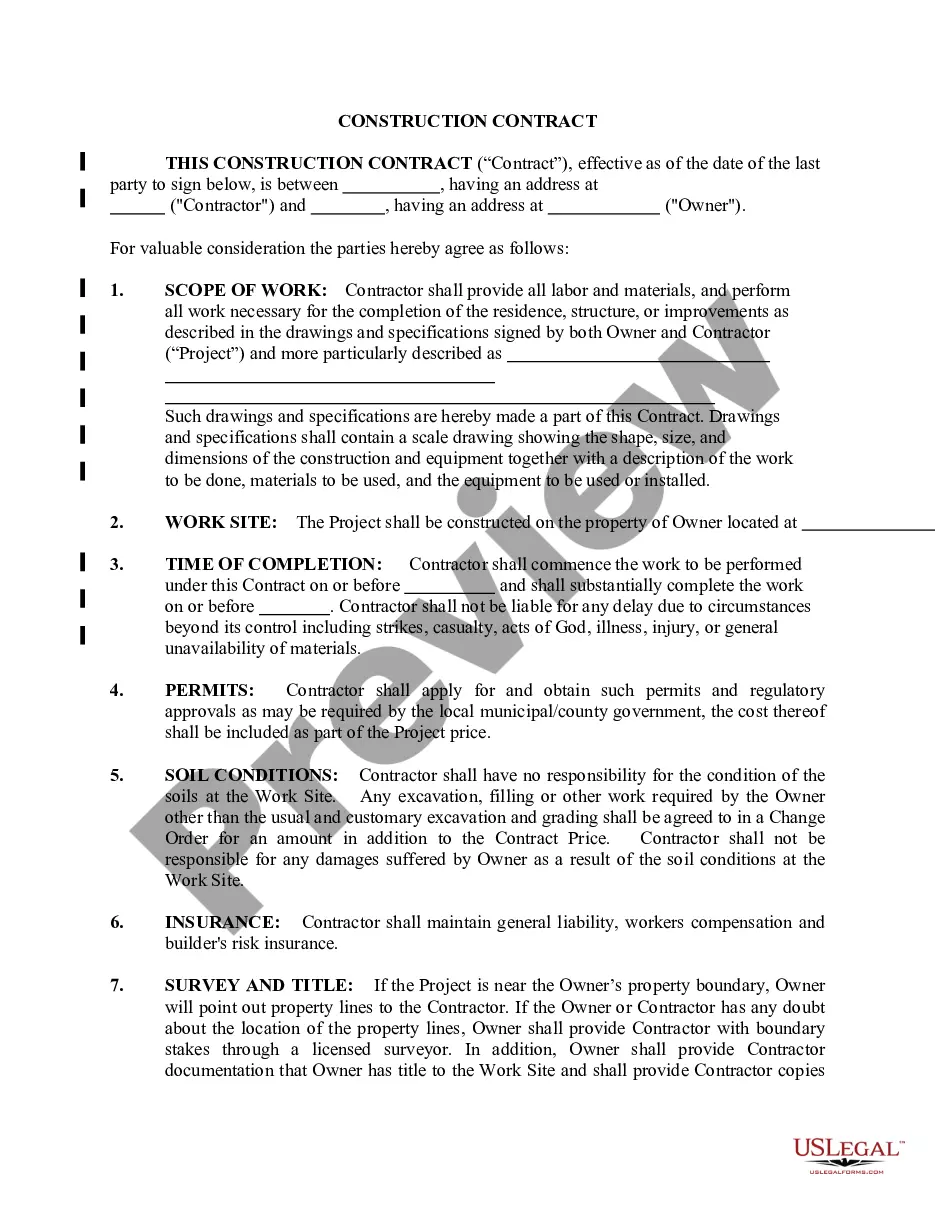

- Click on the document’s preview to inspect it.

- If it is the wrong document, return to the search tool to find the Any Trust Properties With Ev Charging template you need.

- Acquire the file once it fulfills your requirements.

- If you already have a US Legal Forms account, simply click Log in to access previously stored files in My documents.

- If you do not possess an account yet, you can obtain the document by clicking Buy now.

- Select the appropriate pricing option.

- Fill out the profile registration form.

- Choose your payment method: you can use a credit card or PayPal account.

- Select the file format you prefer and download the Any Trust Properties With Ev Charging.

- Once it is saved, you can complete the document using editing software or print it and finish it manually.

Form popularity

FAQ

Does the landlord want a security deposit? Does the landlord want first and last month's rent? Some landlords require first and last month's rent as well as a security deposit. Except in Burlington and Barre, it is legal for the landlord to ask for advance payment of rent.

§ 4460. (c) A landlord may only enter the dwelling unit without consent or notice when the landlord has a reasonable belief that there is imminent danger to any person or to property. (Added 1985, No. 175 (Adj. Sess.), § 1.)

Vermont. Vermont is one of the least landlord friendly states of 2023. The state's property tax rate of 1.82% is the fourth highest in the US. If a landlord fails to make repairs, tenants may pay for the repairs themselves and deduct the cost from their rent payments or withhold rent altogether.

Notice of Entry ? Vermont requires a 48-hour notice from the landlord before entering and may only enter between 9 a.m. and 9 p.m. Repairs ? It is the landlord's responsibility to keep the rental in safe and healthy living conditions. Landlords must make repairs within 30 days after being notified by the tenant.

Vermont Tenants is a statewide tenant advocacy program run by the Champlain Valley Office of Economic Opportunity (CVOEO). The Vermont Landlord Association is a trade association that helps landlords throughout Vermont.

If a landlord breaches a tenant's right to privacy and peaceful and quiet enjoyment of the apartment, the landlord could be sued for damages in extreme cases, and in addition could be cited by the police for unlawful trespass. In Vermont state law, see: (V.S.A., TITLE 9, Chapter 137, § 4460.

Jain says, "The rent agreement must contain a clause that the tenant will not sublet, assign or otherwise part with the possession of the premises to any third party and that he will not use the property for any purpose contrary to law."

Warranty of Habitability. As applied to leases, the old common-law doctrine of caveat emptor?Let the buyer beware.? At common law, once the tenant has signed the lease, she must take the premises as she finds them. said that once the tenant has signed the lease, she must take the premises as she finds them.