Lieu Agreement Deed Format

Description

How to fill out Conveyance Of Deed To Lender In Lieu Of Foreclosure?

Utilizing legal document examples that adhere to federal and local regulations is essential, and the internet provides numerous choices to select from.

However, what's the purpose of spending time searching for the suitable Lieu Agreement Deed Format sample online if the US Legal Forms digital library already houses such templates in a single location.

US Legal Forms is the largest online legal repository with more than 85,000 editable templates crafted by lawyers for various business and personal scenarios.

Review the template using the Preview feature or through the text outline to confirm it fits your needs. Search for an alternative sample using the search tool at the top of the page if necessary. Click Buy Now once you’ve located the appropriate form and select a subscription plan. Create an account or Log In and process the payment via PayPal or a credit card. Choose the format for your Lieu Agreement Deed Format and download it. All documents acquired through US Legal Forms are reusable. To re-download and complete forms previously purchased, access the My documents tab in your account. Enjoy the most comprehensive and user-friendly legal document service!

- They are easy to navigate with all documents organized by state and intended use.

- Our experts stay updated with legal changes, ensuring your documents are always current and compliant when acquiring a Lieu Agreement Deed Format from our site.

- Obtaining a Lieu Agreement Deed Format is swift and straightforward for both existing and new users.

- If you already possess an account with an active subscription, Log In and download the document template you need in your desired format.

- If you are new to our site, follow the steps below.

Form popularity

FAQ

State what each side agrees to do. Clearly write out the terms of the loan. Include information about the date of the loan, the payment terms, interest, schedule of payments, late charges, default, and any other details in the agreement. Explain that the contract represents the entire agreement.

Drawbacks Of A Deed In Lieu No guarantee of acceptance: Your lender isn't obligated to accept your deed in lieu of foreclosure. Your credit will still take a hit: While a deed in lieu arrangement won't harm your credit as drastically as a foreclosure, you can still expect your score to drop.

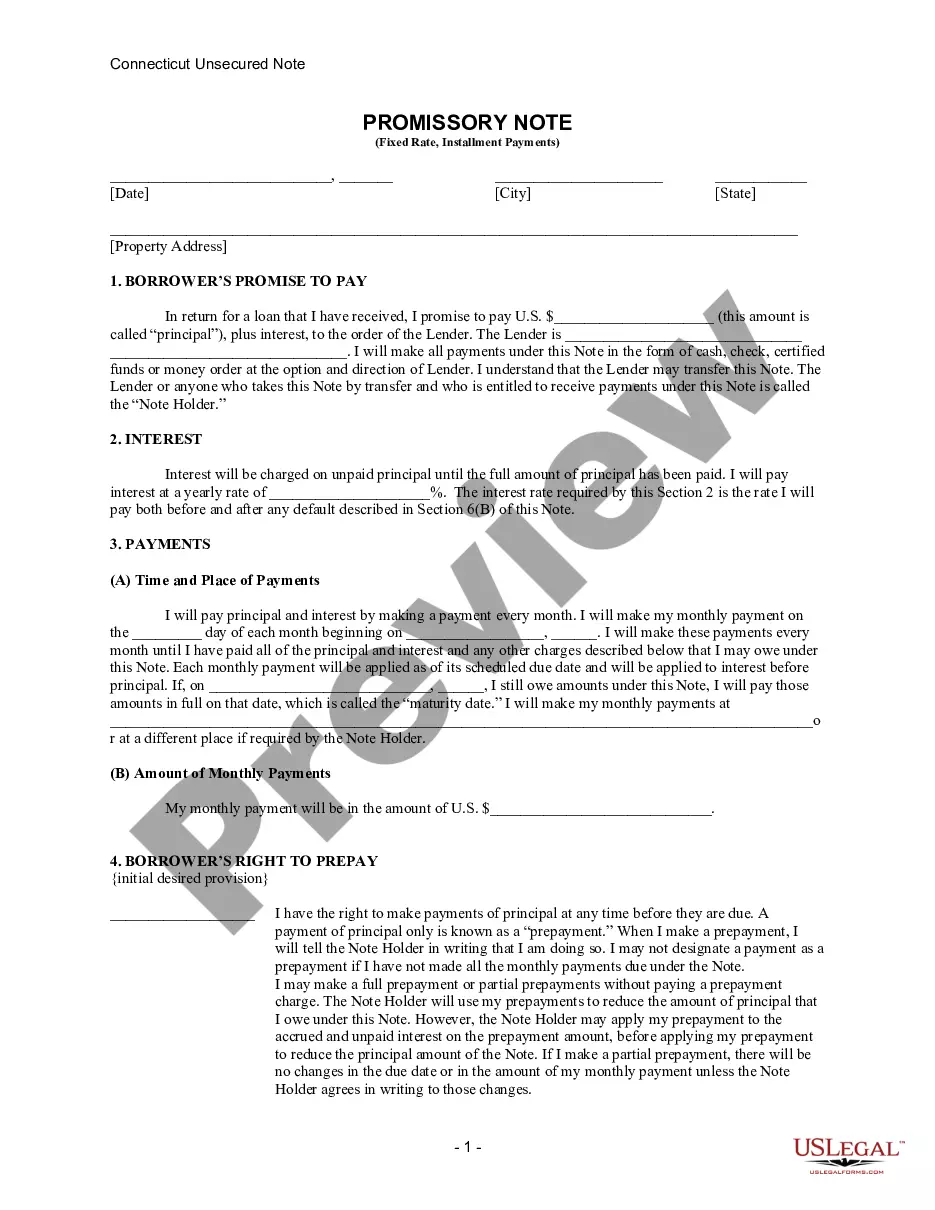

A deed in lieu of foreclosure is the process of when a homeowner transfers the deed of their home to the lender, without the legal process of a foreclosure.

The main difference between a deed and a deed of trust is that a deed is a transfer of ownership, while a deed of trust is a security interest. A deed of trust is used to secure a loan, while a deed is used to transfer ownership of a property.

A deed in lieu of foreclosure is a deed instrument in which a mortgagor (i.e. the borrower) conveys all interest in a real property to the mortgagee (i.e. the lender) to satisfy a loan that is in default and avoid foreclosure proceedings.