Foreclosure Vs Deed In Lieu Of Foreclosure

Description

How to fill out Conveyance Of Deed To Lender In Lieu Of Foreclosure?

Whether for professional objectives or personal matters, everyone must confront legal circumstances at some stage in their life.

Filling out legal paperwork necessitates meticulous care, starting from choosing the appropriate form template. For example, selecting an incorrect version of the Foreclosure Vs Deed In Lieu Of Foreclosure will result in rejection upon submission.

With a comprehensive US Legal Forms catalog available, you never have to waste time searching for the correct sample online. Utilize the library's straightforward navigation to find the suitable form for any circumstance.

- Obtain the required sample by utilizing the search bar or browsing the catalog.

- Review the form's description to ensure it aligns with your situation, jurisdiction, and locality.

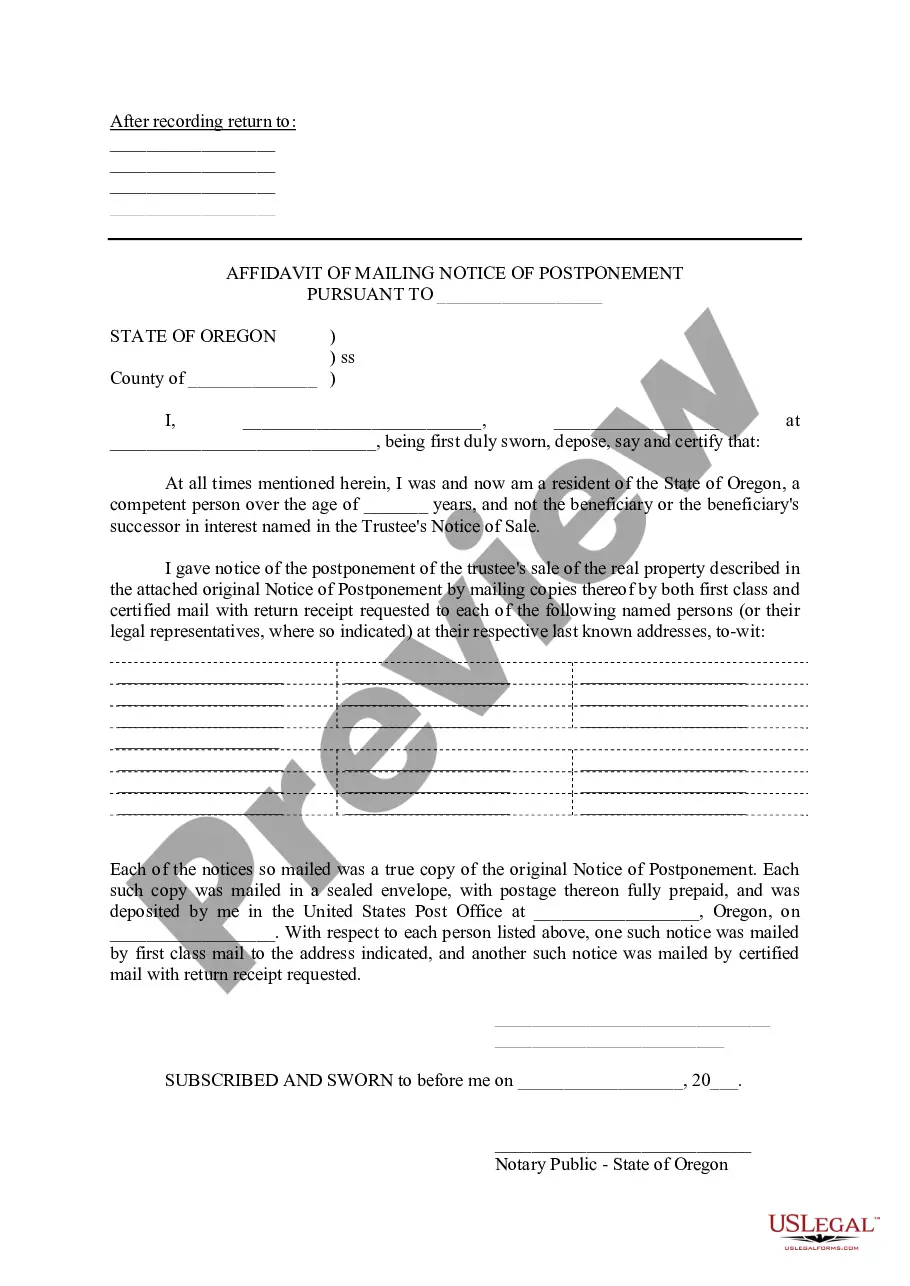

- Click on the form's preview to review it.

- If it is the incorrect document, return to the search tool to locate the Foreclosure Vs Deed In Lieu Of Foreclosure sample you need.

- Acquire the file if it suits your requirements.

- If you possess a US Legal Forms account, simply click Log in to access previously saved templates in My documents.

- If you do not yet have an account, you can secure the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the account registration form.

- Select your payment method: you may use a credit card or PayPal account.

- Pick the desired file format and download the Foreclosure Vs Deed In Lieu Of Foreclosure.

- Once saved, you can fill out the form using editing software or print and complete it manually.

Form popularity

FAQ

inlieu of foreclosure is an arrangement where you voluntarily turn over ownership of your home to the lender to avoid the foreclosure process.

A deed in lieu means you and your lender reach a mutual understanding that you're no longer able to make your mortgage loan payments. The lender agrees to avoid putting you into foreclosure when you hand the property over amicably. In exchange, the lender releases you from your obligations under the mortgage.

There are several advantages to a lender in accepting a deed in lieu of foreclosure. First, the lender becomes the owner of the property, allowing the lender to control its operation, take immediate steps to maximize its economic value, use and obtain all its income, and preserve valuable contracts and tenants.

Benefits Of A Deed In Lieu A deed in lieu can eliminate your deficiency if you owe more on your home than the home is worth. In exchange for giving the lender your deed voluntarily and keeping the home in good condition, your lender may agree to forgive your deficiency or greatly reduce it.

There's less negative impact on your credit score. As with any negative event impacting your credit, the higher your score is before the negative impact, the bigger the drop will be. With a deed in lieu of foreclosure, the drop might be anywhere from 50 to 125 points or higher.