Foreclosure Timelines By State For Real Estate Agents

Description

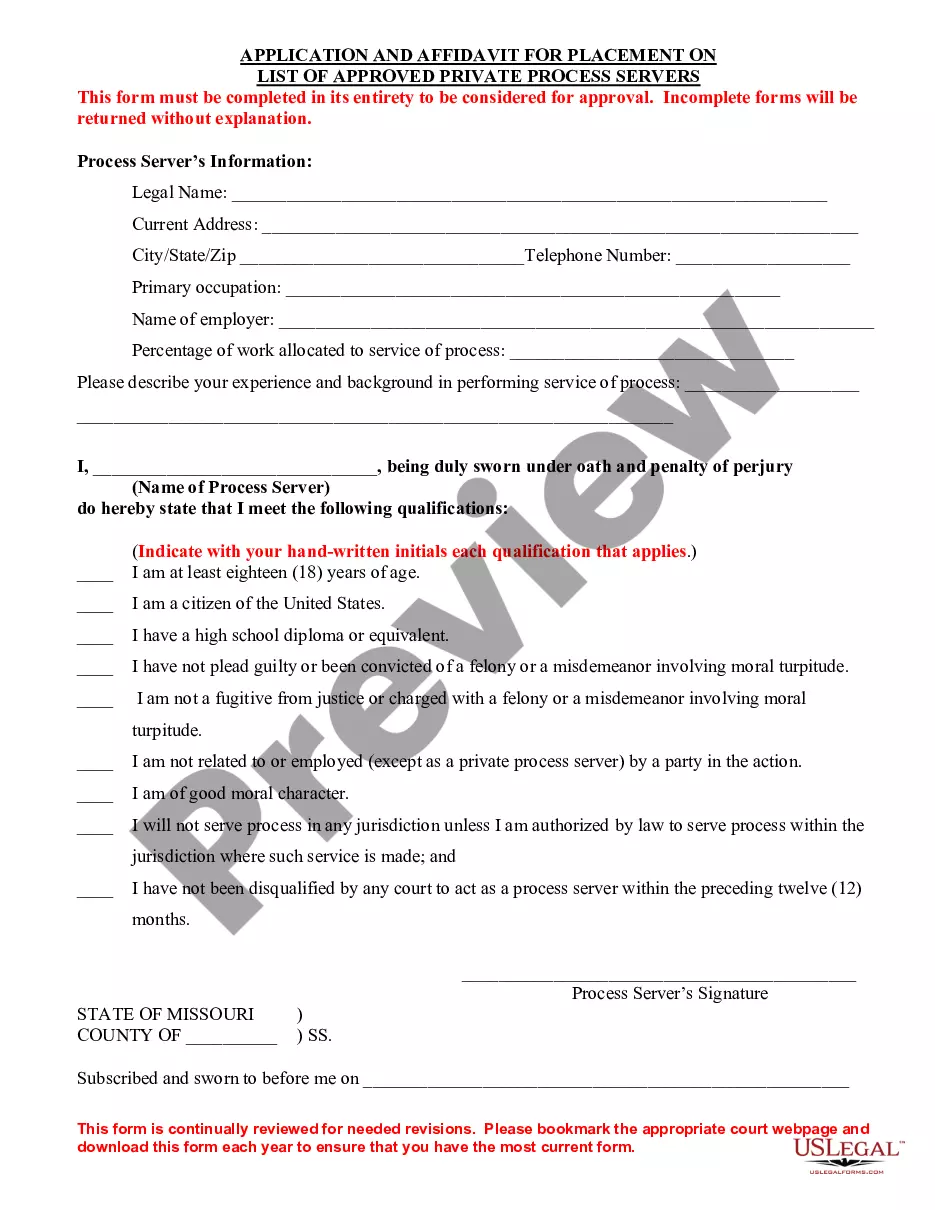

How to fill out Conveyance Of Deed To Lender In Lieu Of Foreclosure?

Handling legal documentation can be daunting, even for experienced experts.

If you're in pursuit of Foreclosure Timelines By State For Real Estate Agents and lack the opportunity to invest time in finding the suitable and current version, the process may be taxing.

Use cutting-edge tools to complete and manage your Foreclosure Timelines By State For Real Estate Agents.

Tap into a valuable repository of articles, guides, and resources pertinent to your circumstances and needs.

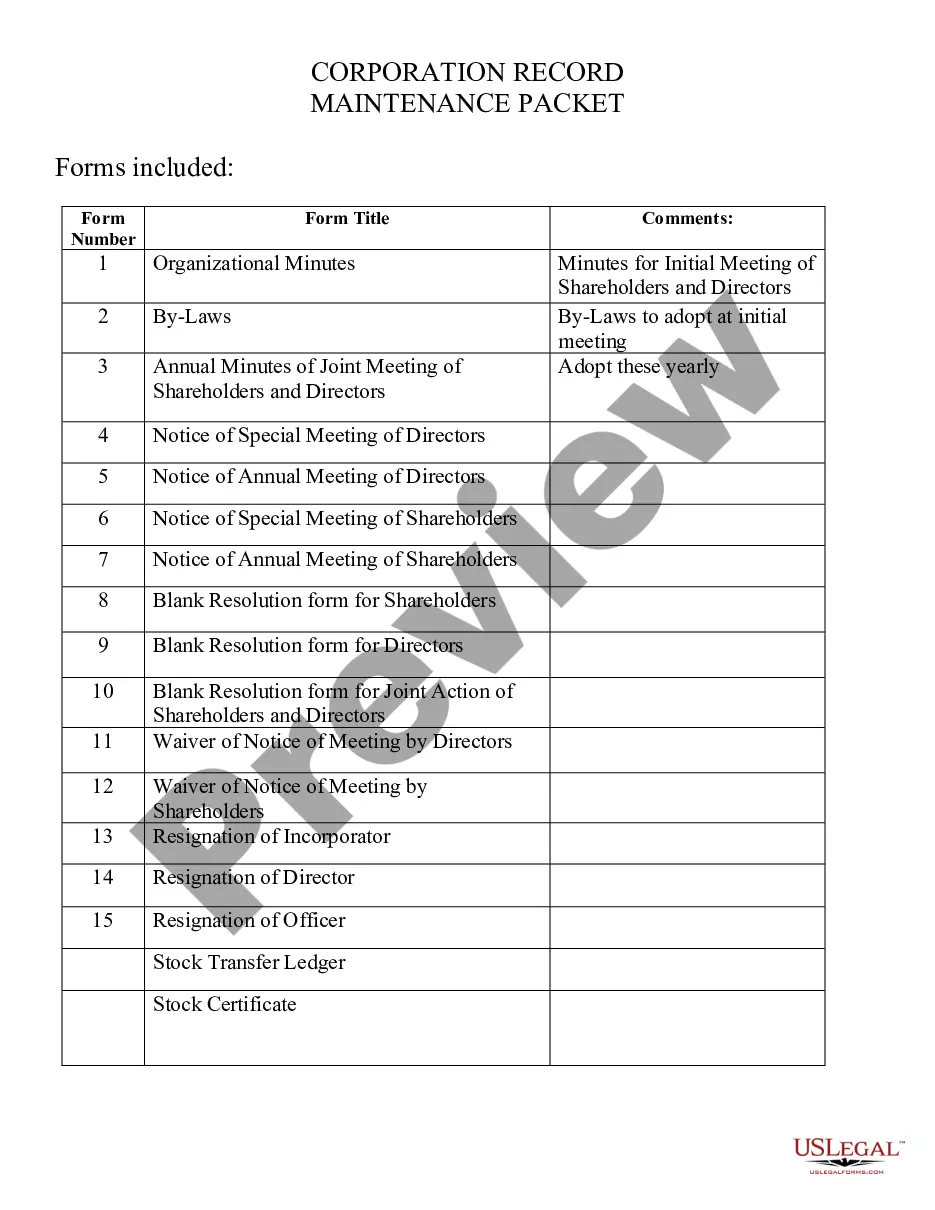

Evaluate that this is the correct document by previewing it and examining its details. Ensure that the template is accepted in your state or county. Click Buy Now when you are set. Choose a monthly subscription plan. Select the file format you desire, and Download, complete, eSign, print, and deliver your documents. Experience the US Legal Forms online library, backed by 25 years of expertise and dependability. Transform your daily document management into a seamless and user-friendly experience today.

- Conserve time and resources in locating the documents you require, utilizing US Legal Forms’ sophisticated search and Preview function to find and download Foreclosure Timelines By State For Real Estate Agents.

- If you're a monthly subscriber, Log In to your US Legal Forms account, search for the document, and download it.

- Check your My documents section to review the documents you've previously accessed and to organize your folders as you see fit.

- If you are new to US Legal Forms, create a complimentary account and enjoy unrestricted access to all platform benefits.

- After obtaining the form you need, follow these steps.

- Leverage a powerful web form library that can transform the way you navigate these challenges effectively.

- US Legal Forms is an industry frontrunner in online legal documents, providing over 85,000 state-specific legal forms available at your convenience.

- Gain access to state- or county-specific legal and business forms that cater to all your needs, from personal to business paperwork, all in one location.

Form popularity

FAQ

Which state has the longest foreclosure process? The state with the longest foreclosure process is Hawaii, followed by Louisiana, Kentucky, Nevada, and Connecticut.

The redemption period is often six months. But the process can be shortened, so in some cases it may only take a few weeks. The main issue is how much equity is in the property. If the mortgage debt exceeds the equity in the property, the lender will probably apply to shorten the redemption period.

The foreclosure process can take less than three months to a year or more. There are specific steps in the process, but each situation is different. If you and the lender agree on next steps, you may not have to go to court.

Process and Timeline ? Save Funds and Prepare to Move on Short Notice. The foreclosure process usually takes a timeline of about 6 ? 10 months to complete. During this time, you will likely not make any further mortgage payments.

In the foreclosure process a demand letter is usually sent after the second missed payment. This letter can be sent by the lender directly, a collections company or a lawyer. In all instances this letter will state that if arrears are not paid up, a foreclosure will be commenced against the land owner.