Foreclosure Process Timeline With Nevada

Description

How to fill out Conveyance Of Deed To Lender In Lieu Of Foreclosure?

Managing legal documents can be overwhelming, even for experienced experts.

When searching for a Foreclosure Process Timeline With Nevada and lacking the time to find the suitable and current version, the steps may become challenging.

Tap into a valuable resource library of articles, guides, and materials relevant to your situation and needs.

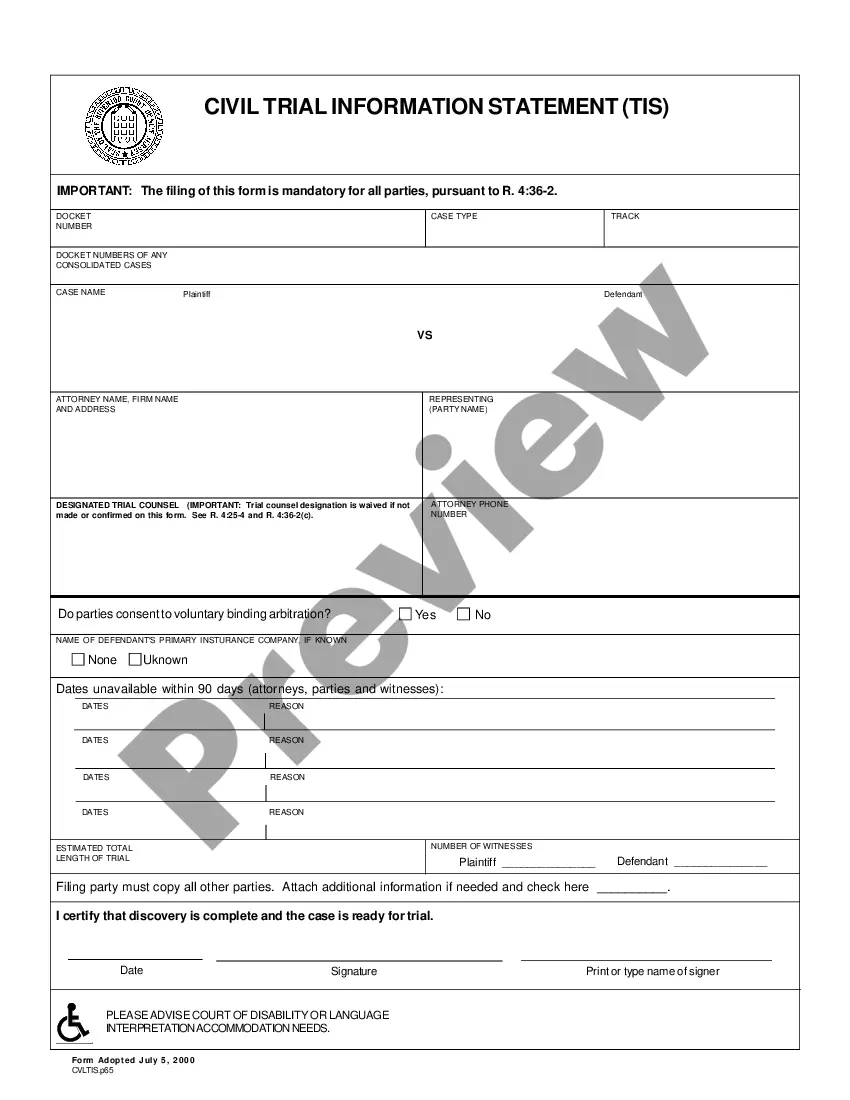

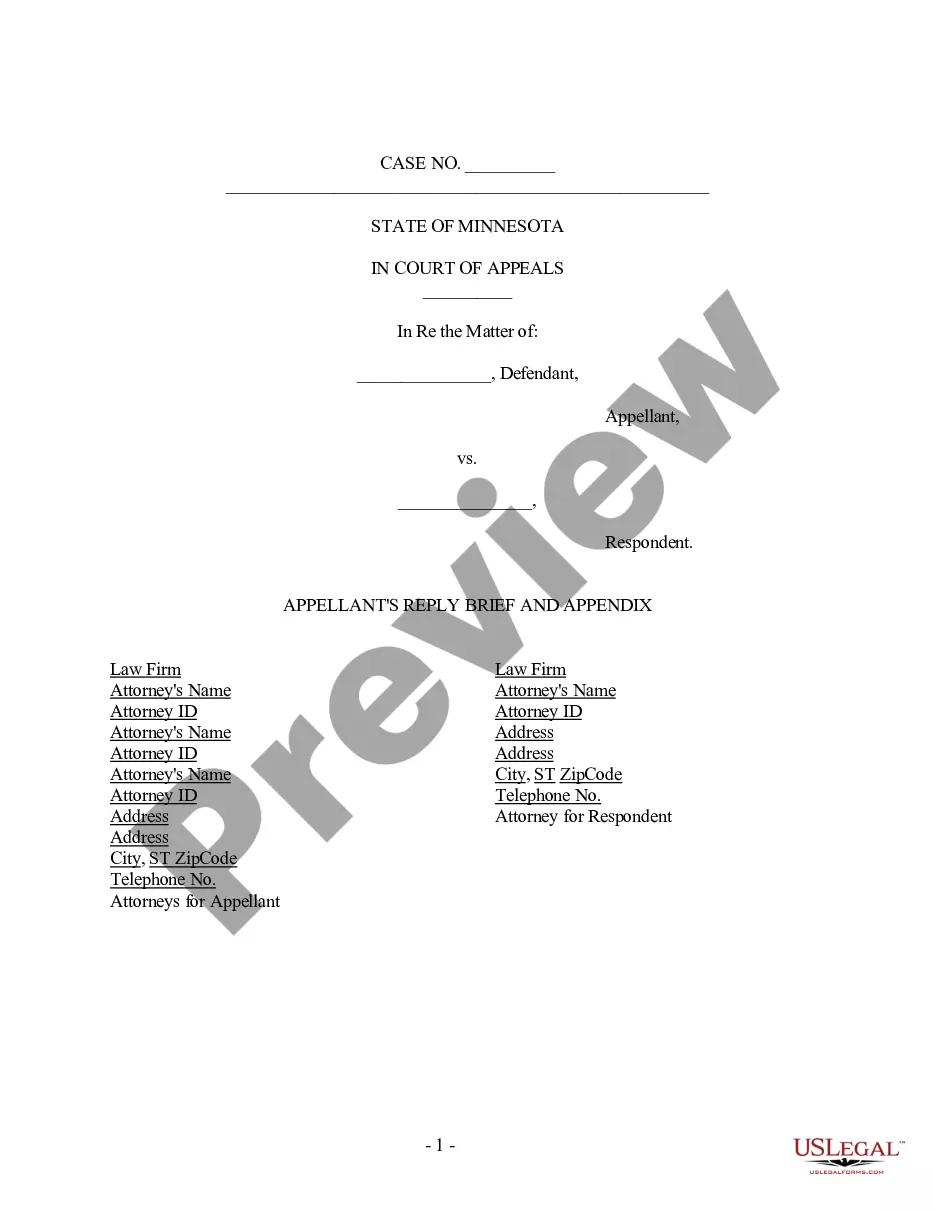

Save time and effort searching for the required documents, and use US Legal Forms’ advanced search and Review feature to locate Foreclosure Process Timeline With Nevada and obtain it.

Transform your daily document management into a seamless and user-friendly experience today.

- If you have a subscription, Log In to your US Legal Forms account, search for the form, and acquire it.

- Check the My documents tab to view the documents you've previously saved and organize your folders as needed.

- If this is your first experience with US Legal Forms, create an account and enjoy unlimited access to all platform benefits.

- Here are the steps to follow after you find the form you need.

- Verify it is the correct form by previewing it and reviewing its details.

- Access state- or county-specific legal and business forms.

- US Legal Forms addresses all the needs you may encounter, from individual to business documents, consolidated in one location.

- Utilize sophisticated tools to complete and manage your Foreclosure Process Timeline With Nevada.

Form popularity

FAQ

Typically, you can miss around three to five house payments before foreclosure proceedings begin. However, the exact timeline may vary based on your lender's policies and state regulations. Understanding the foreclosure process timeline with Nevada can provide clarity on how many missed payments lead to foreclosure. It's crucial to communicate with your lender as soon as you anticipate difficulties making payments.

Being 120 days delinquent means that a homeowner has missed four consecutive mortgage payments. At this stage, lenders may begin to take collection actions. It's essential to understand that missing payments can lead to a complicated foreclosure process, as seen in the foreclosure process timeline with Nevada. Staying informed about your financial obligations can help you avoid this situation.

The foreclosure process in Mississippi typically involves several stages, including a default period, notice of default, and a foreclosure sale. Homeowners often receive a default notice after falling behind on payments. In Mississippi, the lender may initiate foreclosure proceedings as soon as the homeowner defaults. Understanding the foreclosure process timeline with Nevada can help you navigate similar situations.

The foreclosure process timeline with Nevada generally ranges from a few months to up to a year, depending on the specific circumstances of the case. Factors such as the type of foreclosure (judicial or non-judicial) and whether the homeowner contests the process can extend this timeline. Understanding the different stages of foreclosure helps homeowners prepare for what lies ahead. US Legal Forms can provide valuable resources and forms to help manage each step efficiently.

Yes, there is a redemption period for foreclosure in Nevada, typically lasting six months. After a foreclosure sale, homeowners can still redeem their property during this time by paying the outstanding amount owed. This aspect of the foreclosure process timeline with Nevada provides an additional layer of protection for homeowners, allowing them a chance to reclaim their property even after it has been sold. Don't miss this opportunity to understand your rights and options.

In the foreclosure process timeline with Nevada, redemption refers to the right of a borrower to reclaim their property after the foreclosure sale. This usually involves paying off the mortgage debt, along with any applicable fees, within a certain period. Redemption allows the original owner to regain possession of their home, highlighting the importance of knowing your rights during the foreclosure process. It's essential to act quickly if you plan to utilize this option.

The 37-day foreclosure rule is an important aspect of the foreclosure process timeline with Nevada. This rule states that once a Notice of Default is filed, the homeowner has 37 days to cure the default by paying the overdue amount. If the homeowner does not take action within this period, the lender can proceed with the foreclosure process, leading to potential sale and loss of property. Understanding this timeline is crucial for homeowners who want to protect their rights.

The foreclosure process timeline with Nevada can vary, typically taking between three to twelve months to complete. This duration depends on whether the foreclosure is judicial or non-judicial, and various factors can influence the timeline. Homeowners should remain proactive and seek legal advice early in the process to minimize delays. USLegalForms provides essential tools and templates to simplify your navigation through the timeline of foreclosure.

In Nevada, the redemption period following a foreclosure sale allows homeowners a chance to reclaim their property within a set timeframe. Generally, this period lasts for six months for judicial foreclosures and is not applicable for non-judicial foreclosures as sales are typically immediate. Understanding the specifics of this period can help you take the right action before it's too late. To find more helpful legal resources regarding your rights during this period, visit USLegalForms.

The 6 stages of foreclosure in Nevada mirror the phases outlined previously. These stages include Pre-foreclosure, Initiation of Foreclosure, Auction, Redemption, and Eviction. Each stage has distinct characteristics that affect your rights and options. Understanding these stages can empower you to make informed decisions during a challenging time. USLegalForms offers resources to assist you in navigating these stages seamlessly.