Foreclosure Process Timeline For Egypt

Description

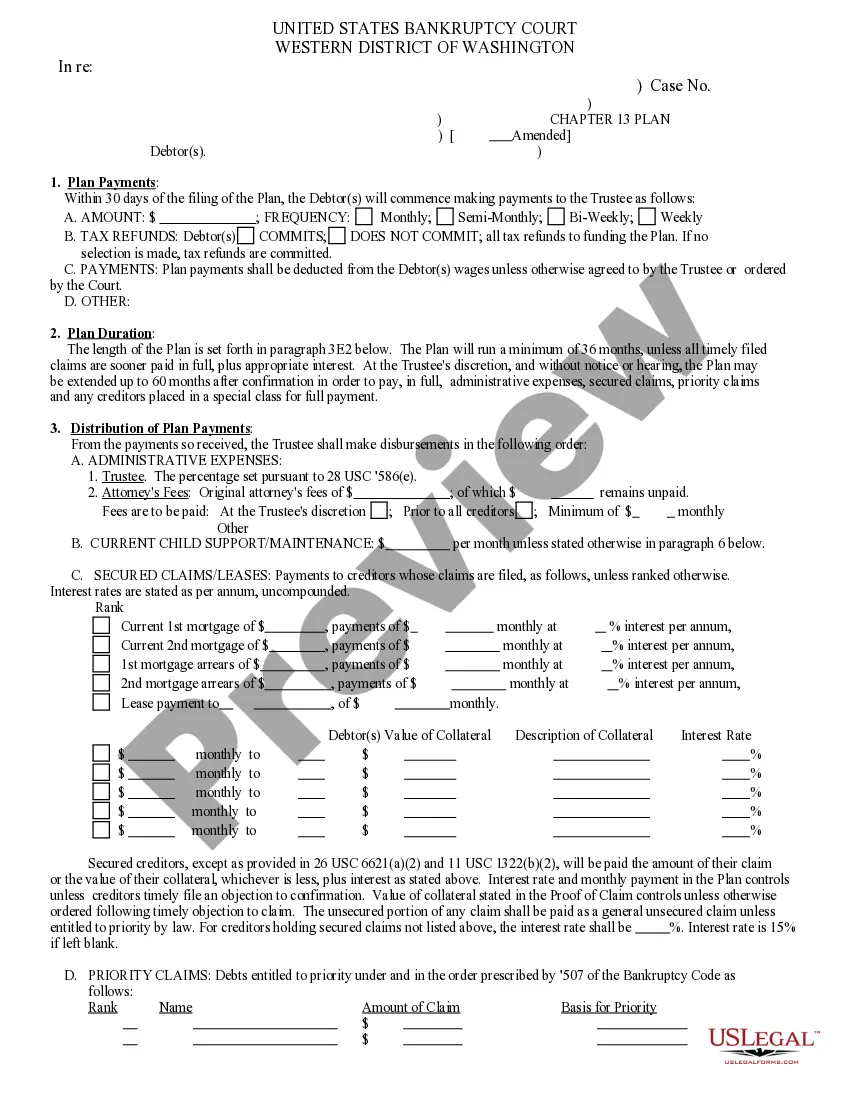

How to fill out Conveyance Of Deed To Lender In Lieu Of Foreclosure?

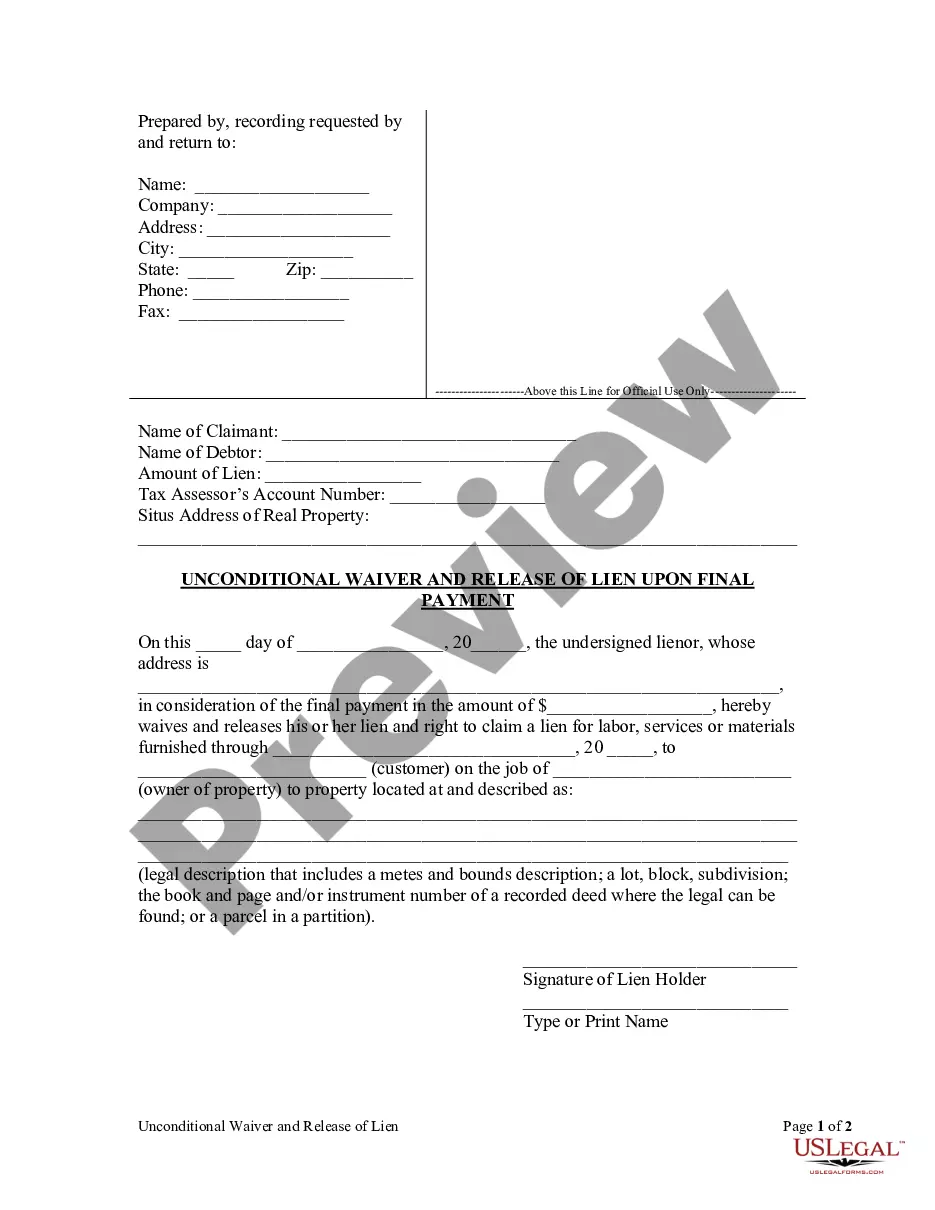

Securing a reliable source for obtaining the latest and pertinent legal documents is a significant part of navigating bureaucracy.

Acquiring the appropriate legal forms requires precision and meticulousness, which is why it's crucial to source the Foreclosure Process Timeline For Egypt exclusively from reputable providers, such as US Legal Forms. An incorrect template can squander your time and delay your situation.

After you have the form on your device, you can either edit it using the editor or print it out to fill it out manually. Alleviate the stress associated with your legal documentation by exploring the extensive catalog of US Legal Forms, where you can discover legal templates, verify their relevance to your case, and download them instantly.

- Use the library navigation or search function to find your template.

- Check the form's description to verify if it meets the standards of your state and area.

- Preview the form, if available, to confirm that the template is what you need.

- If the Foreclosure Process Timeline For Egypt doesn't align with your requirements, return to the search for the correct document.

- Once you are confident about the form's applicability, download it.

- If you are an authorized user, click Log in to verify your identity and gain access to your chosen templates in My documents.

- If you don't have an account yet, click Buy now to acquire the template.

- Select the pricing tier that best fits your needs.

- Proceed with the registration to finalize your purchase.

- Complete your purchase by choosing a payment method (credit card or PayPal).

- Select the format for downloading the Foreclosure Process Timeline For Egypt.

Form popularity

FAQ

After a foreclosure, the foreclosure process timeline for Egypt typically requires a waiting period before qualifying for a new mortgage. Usually, lenders expect a wait of about two to seven years, depending on individual circumstances and lender policies. It is essential to improve your credit score and demonstrate financial recovery during this time. Using resources like US Legal Forms can help you navigate the necessary steps to apply for a mortgage successfully.

Yes, pre-foreclosure does appear on credit reports, marking the beginning of a borrower's struggles with mortgage payments. This indication can negatively impact your credit score since lenders view it as a sign of financial distress. Awareness of your credit report is vital during the foreclosure process timeline for Egypt, and being proactive can help you mitigate further damage. Using resources like UsLegalForms can assist you with keeping track of your situation.

The foreclosure process timeline for Egypt usually kicks off after a homeowner is 3 to 6 months behind on mortgage payments. Once a borrower defaults, the lender typically waits a few months to see if the situation can be resolved. If payments are not made, the lender may move forward with legal action to initiate foreclosure. Knowing this helps you understand when it is essential to seek assistance or alternatives.

In the foreclosure process timeline for Egypt, a pre-foreclosure typically lasts several months. This stage begins after a borrower misses a few mortgage payments and the lender initiates the process. Generally, you can expect that if no payments are made, foreclosure proceedings may start as soon as 3 to 6 months after falling behind. This makes understanding your timeline crucial for taking timely action.

The 37-day foreclosure rule refers to a specific timeline within the foreclosure process in Egypt. Under this rule, lenders must provide notice to borrowers at least 37 days before initiating foreclosure proceedings. This timeline is crucial for borrowers, as it gives them an opportunity to address their financial situation before legal action is taken. Understanding the foreclosure process timeline for Egypt can help borrowers better prepare and potentially avoid losing their property.

In Pennsylvania, the foreclosure process timeline typically involves judicial actions, meaning the lender must file a lawsuit to foreclose. This process allows the borrower to receive a notice and contest the foreclosure in court. Generally, once the court grants the foreclosure, the lender can proceed with selling the property at auction. Understanding these legal requirements is essential, and resources from USLegalForms can provide valuable guidance to navigate Pennsylvania's foreclosure laws effectively.

Getting into pre-foreclosure can occur quickly after a borrower misses a payment, typically within 30 days. During the pre-foreclosure period, the borrower receives notices from the lender, indicating the potential for foreclosure. The pre-foreclosure stage lasts until the property is officially placed on the market for auction. It serves as a critical time for borrowers to explore options to avoid total foreclosure, and platforms like USLegalForms offer resources to assist in navigating this challenging phase.

The foreclosure procedure timeline in Egypt usually takes several months, depending on various factors, including local regulations and the complexity of the case. Typically, the process can last anywhere from six months to a year. In some situations, delays may occur due to borrower defenses, which can complicate and extend the timeline. Thus, being proactive and seeking help can significantly streamline the procedure.

The duration to close a foreclosure can vary significantly, but generally, the foreclosure process timeline for Egypt may range from a few months to over a year. Factors influencing this timeframe include local laws, the lender's procedures, and the borrower's responsiveness. If the property attracts competitive bids at auction, this could also expedite the process. Ultimately, understanding the specific conditions in your area can provide clearer expectations.

The foreclosure process timeline for Egypt typically includes six key phases: default notification, public notice of the foreclosure, the right of redemption, auction, confirmation of sale, and eviction. Initially, the lender notifies the borrower of the default, giving them a chance to rectify the issue. Following that, a public notice is issued, allowing others to bid at auction. If the property sells, there's a chance for eviction if the previous owner doesn’t vacate within the stipulated timeframe.