Foreclosure In Deed

Description

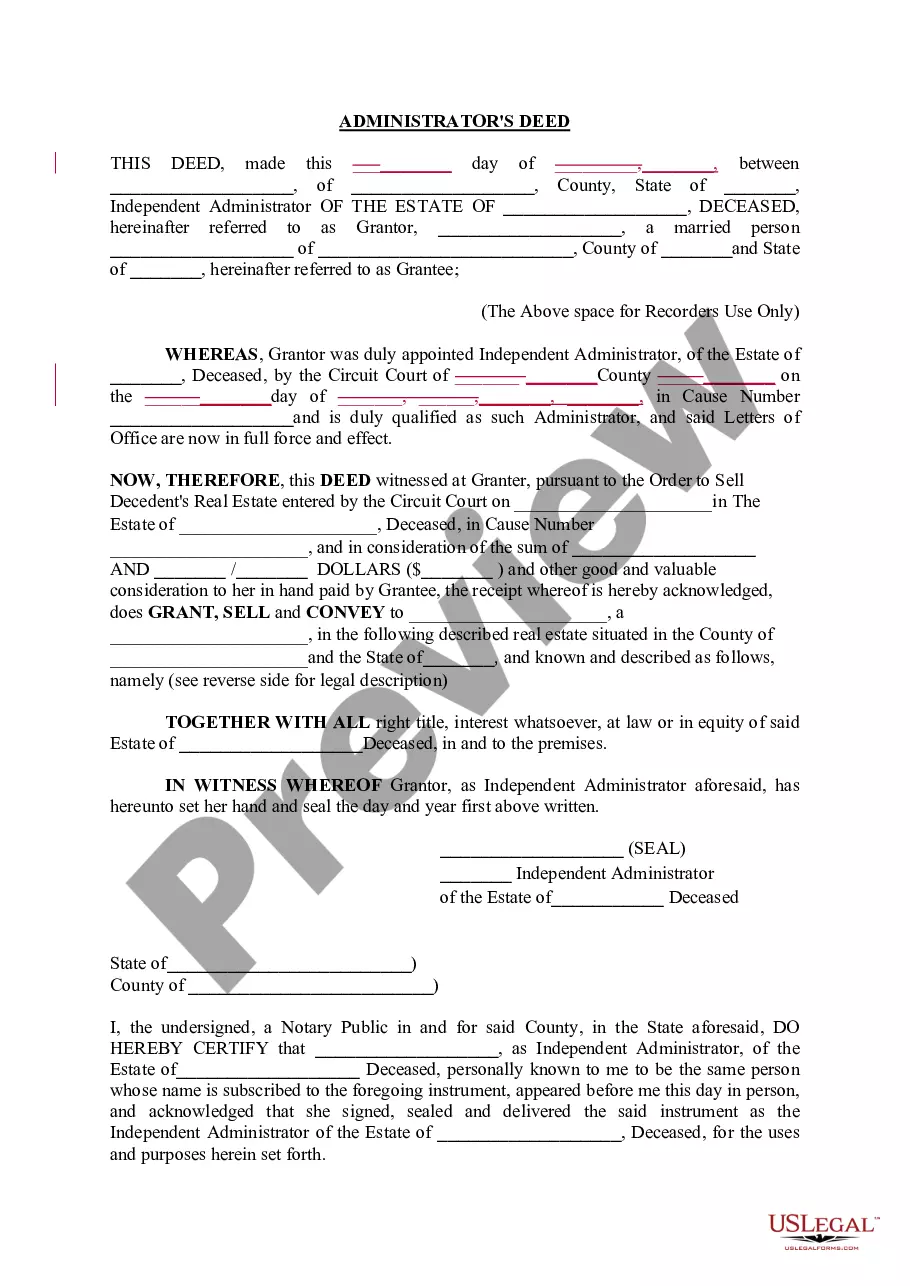

How to fill out Conveyance Of Deed To Lender In Lieu Of Foreclosure?

Dealing with legal documents and procedures can be a lengthy addition to your schedule. Foreclosure In Deed and similar forms typically necessitate that you search for them and find the optimal way to fill them out correctly.

Thus, whether you are managing financial, legal, or personal issues, having a thorough and easily accessible online repository of forms readily available will be extremely beneficial.

US Legal Forms is the leading online service for legal templates, featuring over 85,000 state-specific forms and various tools to help you complete your documents effortlessly.

Explore the collection of relevant documents at your disposal with just a single click.

After that, follow the steps below to fill out your form: Ensure you have the correct form using the Preview feature and reviewing the form description. Click Buy Now when ready, and choose the monthly subscription plan that suits your requirements. Click Download then fill out, sign, and print the form. US Legal Forms has 25 years of experience assisting clients in managing their legal documents. Find the form you need today and streamline any process with ease.

- US Legal Forms provides state- and county-specific forms that are accessible anytime for download.

- Safeguard your document management tasks using a premium service that enables you to generate any form within minutes without incurring extra or unexpected charges.

- Simply Log In to your account, locate Foreclosure In Deed and obtain it immediately from the My documents section.

- You can also retrieve previously downloaded forms.

- Is this your first experience with US Legal Forms? Sign up and create a free account in a few moments and you’ll have access to the form library and Foreclosure In Deed.

Form popularity

FAQ

Foreclosure is the legal process in which the ownership shifts to the bank or lender if the homeowner fails to pay the loan; home in foreclosure is the property undergoing the foreclosure process and foreclosed home or REO refers to the property which has gone through the foreclosure process and is now owned by the ...

Foreclosure Can Take Months or Years Notice of default: The lender typically issues a notice of default, indicating its intention to foreclose, when the loan becomes 90 days past due. Typically, the notice indicates legal foreclosure will begin in 90 days unless the borrower brings their payments up to date.

The right of foreclosure can be exercised only upon the failure of the mortgagor to repay the principal amount. The mortgagee can absolutely bar the mortgagor from exercising his right of redemption by obtaining a court decree. The right of foreclosure, however, is not applicable in case of all the mortgages.

Follow these simple steps to foreclose your home loan Inform the lender. Lenders have hundreds of loans running simultaneously. ... Get all the paperwork in order. ... Assessment of payments. ... Get a NOC. ... Remove Lien on the property. ... Retrieve security cheques. ... Get a New Encumbrance Certificate (EC) ... Retrieve the documents.

The most common foreclosure process in Texas is non-judicial, which means the lender can foreclose without going to court, so long as the deed of trust contains a power of sale clause. A power of sale clause is a paragraph in the deed of trust that authorizes the non-judicial foreclosure sale.