Foreclosure Deed In Mortgage

Description

How to fill out Conveyance Of Deed To Lender In Lieu Of Foreclosure?

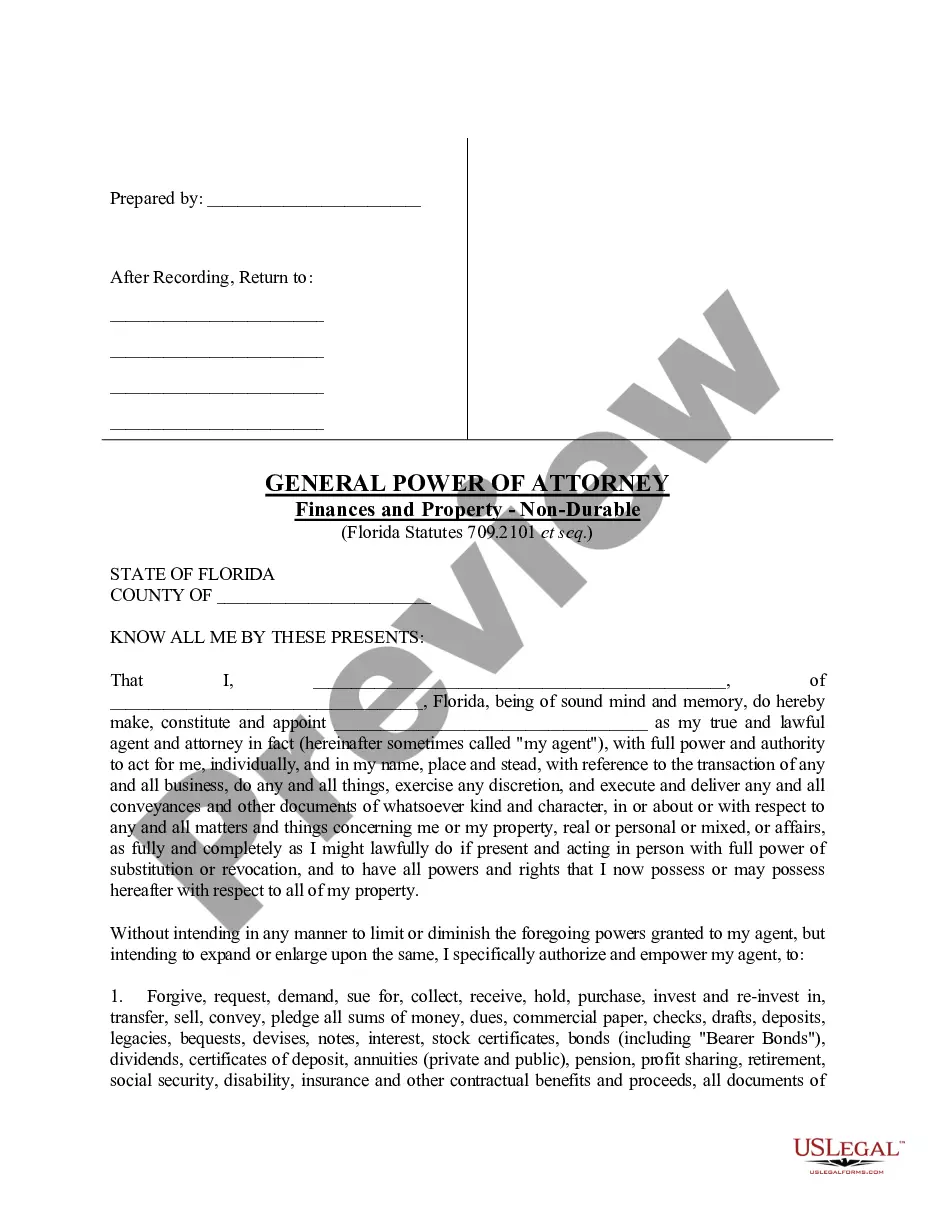

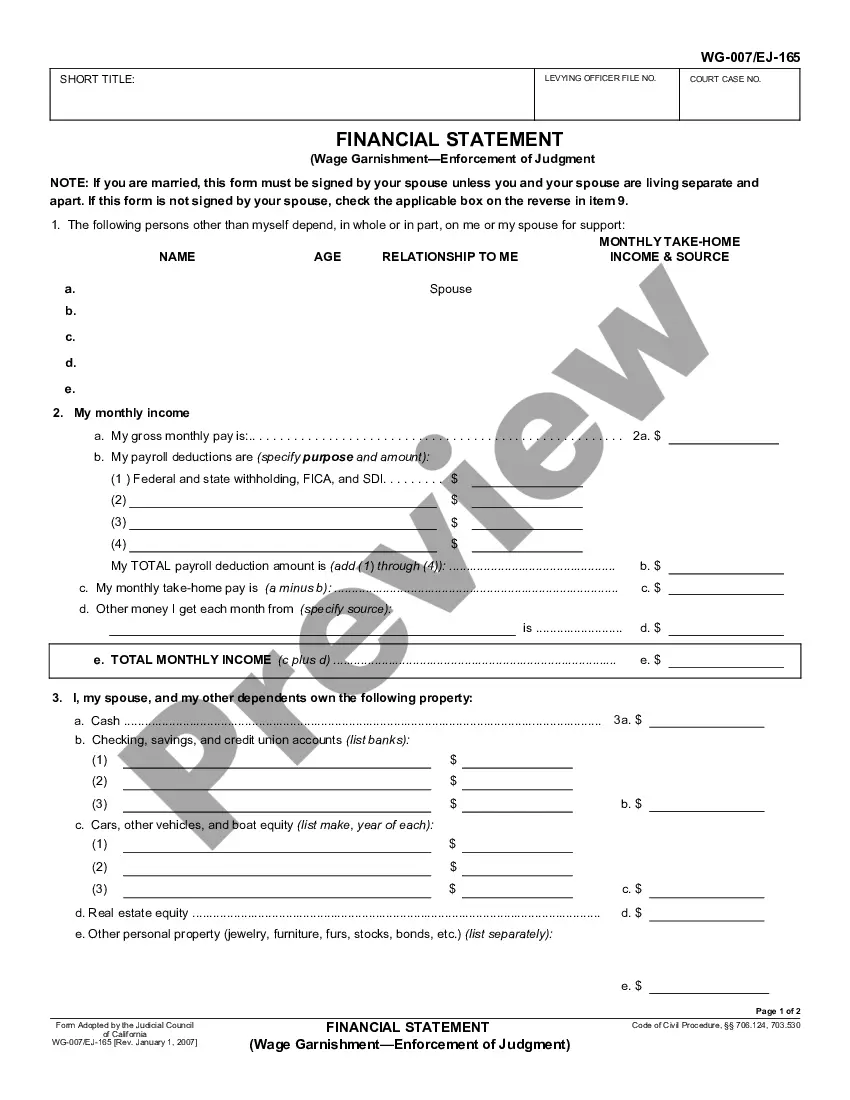

It’s widely known that you cannot become a legal authority instantly, nor can you comprehend how to swiftly prepare a Foreclosure Deed In Mortgage without a specialized skill set.

Drafting legal documents is a lengthy process that requires specific training and expertise. So why not entrust the creation of the Foreclosure Deed In Mortgage to the professionals.

With US Legal Forms, which boasts one of the largest collections of legal documents, you can discover everything from court filings to templates for office correspondence. We recognize the significance of compliance and adherence to federal and local regulations. That’s why, on our platform, all forms are tailored to specific locations and are current.

Click on Buy now. Once the payment is finalized, you can acquire the Foreclosure Deed In Mortgage, complete it, print it, and send or mail it to the appropriate individuals or organizations.

You can regain access to your documents from the My documents tab at any time. If you’re an existing customer, you can simply Log In and find and download the template from the same section.

- Start with our platform and obtain the form you need in just a few minutes.

- Locate the required form using the search bar at the top of the page.

- Preview it (if this feature is available) and review the accompanying description to determine if the Foreclosure Deed In Mortgage is what you’re looking for.

- If you need another form, restart your search.

- Create a free account and select a subscription plan to purchase the template.

Form popularity

FAQ

Foreclosure Can Take Months or Years Notice of default: The lender typically issues a notice of default, indicating its intention to foreclose, when the loan becomes 90 days past due. Typically, the notice indicates legal foreclosure will begin in 90 days unless the borrower brings their payments up to date.

In case of a simple mortgage, either the sale of the mortgaged property is possible or one can individually file suit against the mortgagor whereas the right of foreclosure is available only on the mortgage by conditional sale.

The right of redemption allows homeowners to keep their homes if they pay back what they owe even after their lender starts the foreclosure process or puts the home up for sale at public auction.

This right is available under Section 67 of the Transfer of Property Act, 1882. After the principal amount has become due, and before payment of mortgage money by mortgagor or before decree of redemption has been passed by Court, mortgagee has a right to obtain a decree of foreclosure from the Court.

Maintain this Checklist When Going for Home Loan Foreclosure Collect Original Documents. ... Get Lien on the Property Terminated. ... Get the 'No Dues' Certificate (NDC) ... Ask for the Updated Non-Encumbrance Certificate. ... Collect the Security Cheque. ... Make Sure that Your Credit Score is Updated in the Latest Report.