Deed In Lieu Of Foreclosure Form New York

Description

How to fill out Conveyance Of Deed To Lender In Lieu Of Foreclosure?

It's widely known that you cannot instantly become a legal professional, nor can you learn how to swiftly complete a Deed In Lieu Of Foreclosure Form New York without having specific expertise.

Assembling legal documents is a lengthy process that necessitates particular training and abilities. So why not entrust the drafting of the Deed In Lieu Of Foreclosure Form New York to the experts.

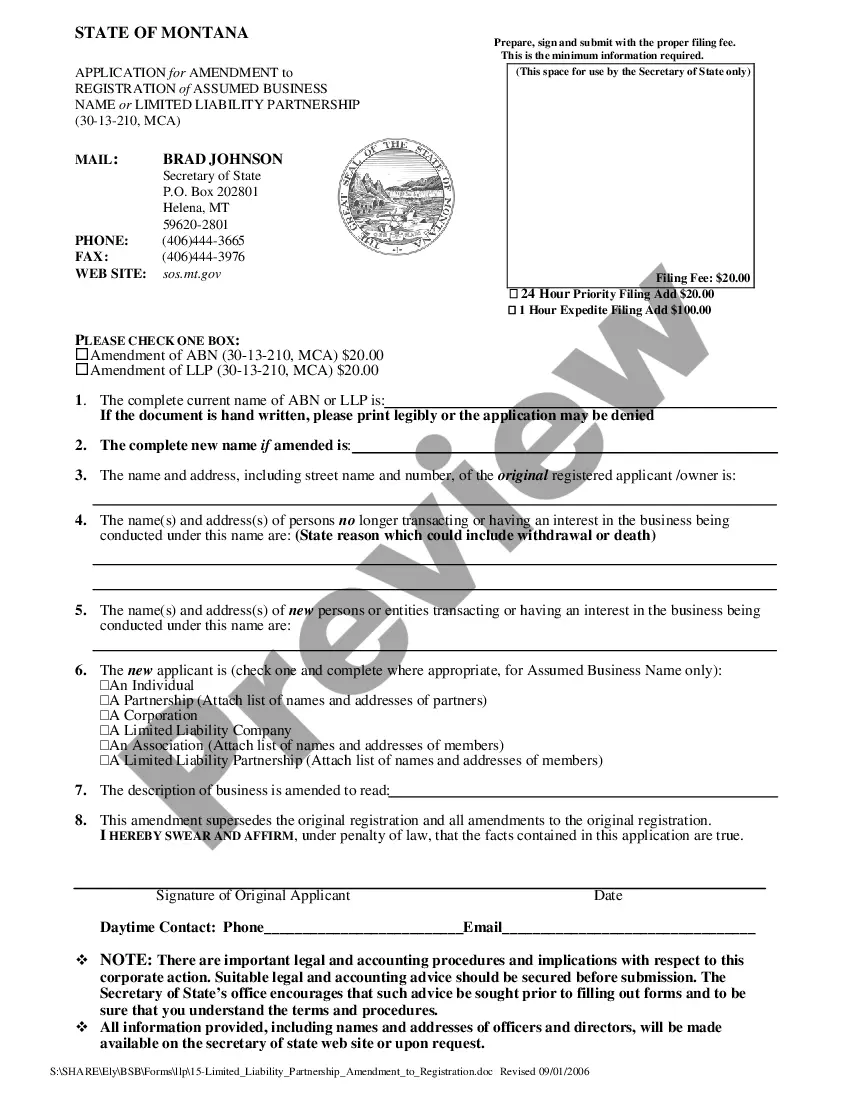

With US Legal Forms, one of the most extensive collections of legal templates, you can find everything from court filings to in-office communication forms. We understand how crucial it is to comply with federal and state laws and regulations. Therefore, on our site, all forms are specific to your location and current.

You can access your forms again through the My documents tab at any time. If you are a current customer, simply Log In, and locate and download the template from the same tab.

Whatever the intention of your documents—whether for financial and legal matters or personal use—our platform is here to assist you. Experience US Legal Forms now!

- Utilize the search bar at the top of the page to locate the document you need.

- If available, preview it and review the accompanying description to confirm if Deed In Lieu Of Foreclosure Form New York matches your needs.

- If you require a different template, restart your search.

- Create a free account and choose a subscription plan to purchase the template.

- Click Buy now. After processing the payment, you can obtain the Deed In Lieu Of Foreclosure Form New York, fill it out, print it, and send or mail it to the appropriate individuals or organizations.

Form popularity

FAQ

A deed in lieu of foreclosure can negatively impact your credit score, but not as severely as a foreclosure. Generally, you might see a drop of 100 to 150 points. While this can make obtaining new credit more difficult, the impact diminishes over time. To manage this process effectively, using a deed in lieu of foreclosure form New York can provide you with essential documentation and support for your next steps.

Taking a deed in lieu of foreclosure offers several advantages. This option can allow for a quicker resolution to a challenging financial situation, minimizing the lengthy foreclosure process. Additionally, it may enable you to avoid the stigma and stress associated with foreclosure, providing a smoother transition to new housing. Completing a deed in lieu of foreclosure form New York with the right guidance can simplify your experience.

Yes, you can buy a house after a deed in lieu of foreclosure. Though this situation might affect your credit score, many lenders may still consider you for a new mortgage after a waiting period. Typically, this waiting period can range from two to four years, depending on the lender and your overall financial situation. Using a deed in lieu of foreclosure form New York can streamline the process and provide you with a fresh start.

One significant disadvantage of a deed in lieu of foreclosure is the potential impact on your credit score. While it may be less damaging than a traditional foreclosure, having the deed in lieu of foreclosure form New York recorded can still negatively affect your credit. This offers a long-term financial drawback as it may limit your ability to obtain new credit. It’s crucial to consider this aspect before proceeding, as U.S. Legal Forms can assist you in understanding the implications and completing the necessary forms.

The duration of a deed in lieu of foreclosure process in New York can vary, but typically, it takes about 30 to 90 days. This timeline depends on various factors, such as lender response time and the completeness of the deed in lieu of foreclosure form New York. By preparing all necessary documents in advance and working with a knowledgeable lender, you can potentially expedite the process. U.S. Legal Forms offers streamlined resources to help you complete your deed in lieu of foreclosure form New York efficiently.

An example of a deed in lieu of foreclosure can illustrate how the process works. Consider a homeowner who can no longer afford mortgage payments and contacts their lender to negotiate a deed in lieu arrangement. After reaching an agreement, the homeowner signs over the property to the lender, who then cancels the mortgage debt in return. This type of arrangement can simplify a financial situation and is often documented using a deed in lieu of foreclosure form New York.

Filing a deed in lieu of foreclosure involves several key steps. Begin by contacting your lender to initiate the process and confirm their willingness to accept your deed. Then, prepare the necessary paperwork which includes signing the deed and any required forms, before submitting them to the appropriate county office for recording. This ensures you are fully compliant when utilizing a deed in lieu of foreclosure form New York.

To file a deed in lieu of foreclosure, first, contact your lender to confirm their acceptance of your request. After receiving approval, gather necessary documents, including the signed deed and any agreements. Finally, record the deed with the county clerk's office to officially complete the process and ensure all records reflect the change. This step is vital when using a deed in lieu of foreclosure form New York.

When writing a deed in lieu of foreclosure letter, start with a formal greeting and clearly state your intent to transfer the property. Include relevant information such as your mortgage account number, property address, and reasons for your request. By using a professional format and expressing your willingness to cooperate with the lender, you can enhance the likelihood of a positive response regarding the deed in lieu of foreclosure form New York.

One major disadvantage of a deed in lieu of foreclosure is that it can significantly impact your credit score, just as a foreclosure would. This negative impact can hinder your ability to secure future loans or mortgages for years. It's essential to weigh this consequence against the benefits of using a deed in lieu of foreclosure form New York.