Conveyance Documents With Iphone

Description

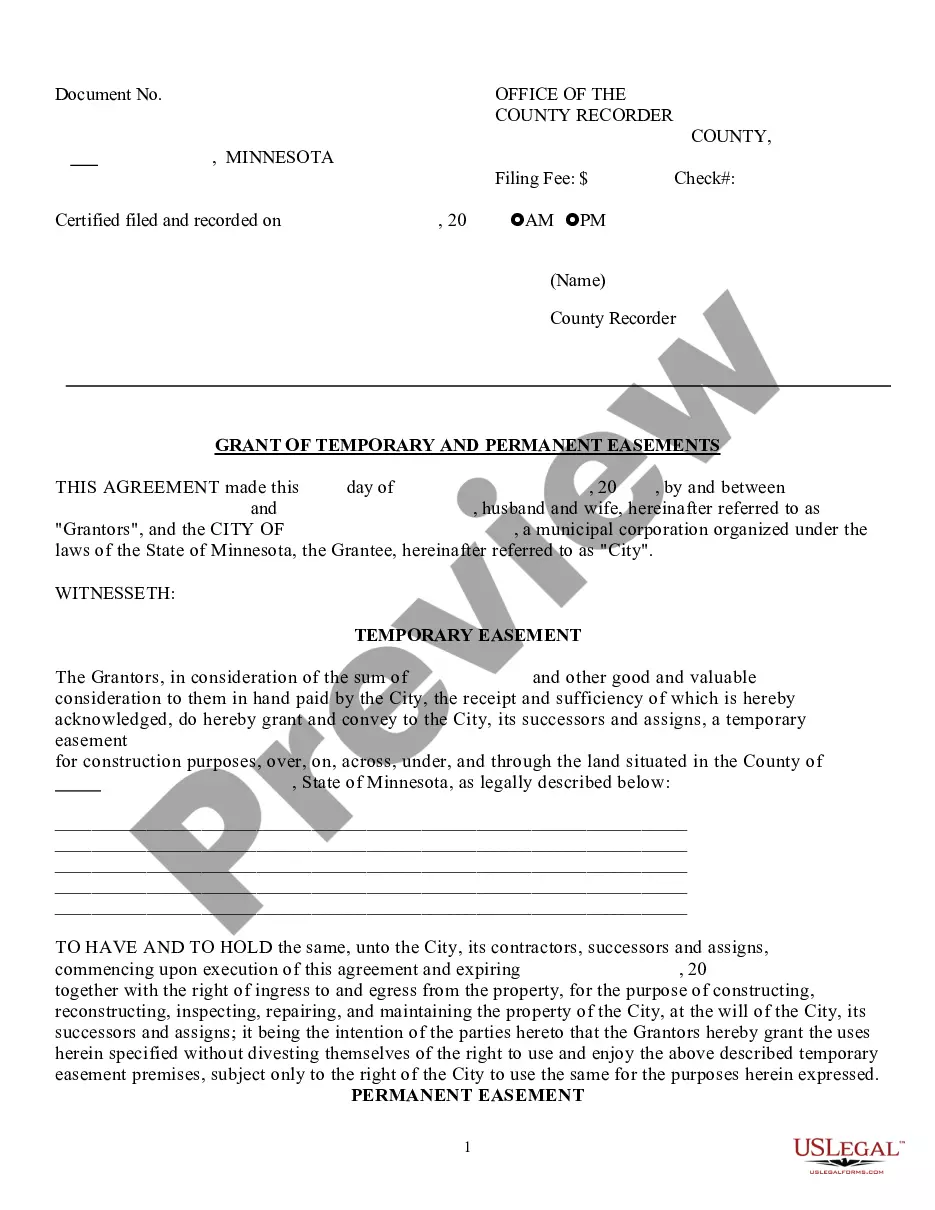

How to fill out Conveyance Of Deed To Lender In Lieu Of Foreclosure?

Creating legal documents from the ground up can occasionally feel a bit daunting.

Specific situations may entail hours of investigation and considerable financial investment.

If you’re looking for a simpler and more cost-effective method to prepare Conveyance Documents With Iphone or any other forms without unnecessary complications, US Legal Forms is always readily accessible.

Our online repository of over 85,000 current legal templates covers nearly every aspect of your financial, legal, and personal matters.

However, before rushing to download Conveyance Documents With Iphone, consider these pointers: Review the form preview and descriptions to ensure you are viewing the correct document. Verify that the template you select aligns with the laws and regulations of your state and county. Choose the appropriate subscription plan to obtain the Conveyance Documents With Iphone. Download the form, then fill it out, sign it, and print it. US Legal Forms boasts a solid reputation and over 25 years of experience. Join us now and make document completion a straightforward and efficient process!

- With just a few clicks, you can promptly access state- and county-compliant documents carefully assembled for you by our legal experts.

- Utilize our website whenever you require a dependable and credible service to swiftly find and download the Conveyance Documents With Iphone.

- If you’re familiar with our site and have already created an account, simply Log In, locate the form and download it, or re-download it anytime in the My documents section.

- Don't possess an account? No worries. Setting it up is quick and easy, allowing you to explore the library.

Form popularity

FAQ

To scan a legal document with your iPhone, open the Notes app and tap the camera icon. Select 'Scan Documents' and position your iPhone over the document to capture the image automatically or manually. This method ensures you create clear scans of conveyance documents with iPhone easily, which you can then save or share as needed.

Uniform Commercial Code (UCC) filings allow creditors to notify other creditors about a debtor's assets used as collateral for a secured transaction. UCC liens filed with Secretary of State offices act as a public notice by the "creditor" of the creditor's interest in the property.

Fill in the debtor's name and mailing address. It may be an individual, or it may be in the name of a business or organization. If the loan is in the name of the business, include the business mailing address. There is space for additional debtors. Include them exactly as they appeared on the loan agreement.

A UCC filing is the official notice lenders use to indicate that they have a security interest in a borrower's assets or property. The UCC filing establishes a lien against the collateral the borrower uses to secure the loan ? giving the lender the right to claim that collateral as repayment in the case of default.

A UCC lien filing remains on your business credit report for 5 years. This has no negative effect on your credit score, however, when someone checks your credit report it is visible and that can play a factor in your ability to be approved for things other than just business funding.

Remember: as long as an asset has a UCC lien filed against it, you're not allowed to transfer, sell, or use it as collateral for any other loan.

Ask the lender to terminate the lien upon payoff. A good rule of thumb is to request that your lender file a UCC-3 form with your secretary of state as soon as possible after you pay off your loan. The UCC-3 will terminate the lien on your company's assets (or assets) and remove the UCC-1 filing.

Information Request (Form UCC11) (Texas) SOSDirect Online Services ? Internet Filings OnlyFiling FeeInitial FilingUCC Financing Statement (UCC1)$5.00Manufactured-Home Transaction60.00Public-Finance Transaction60.0016 more rows

An Example of a UCC Lien Filing If you secure equipment financing, the lender will file a UCC lien to state that if the debt for the espresso machine is not repaid, the lender has the right to repossess the espresso machine or seize other assets from your business.