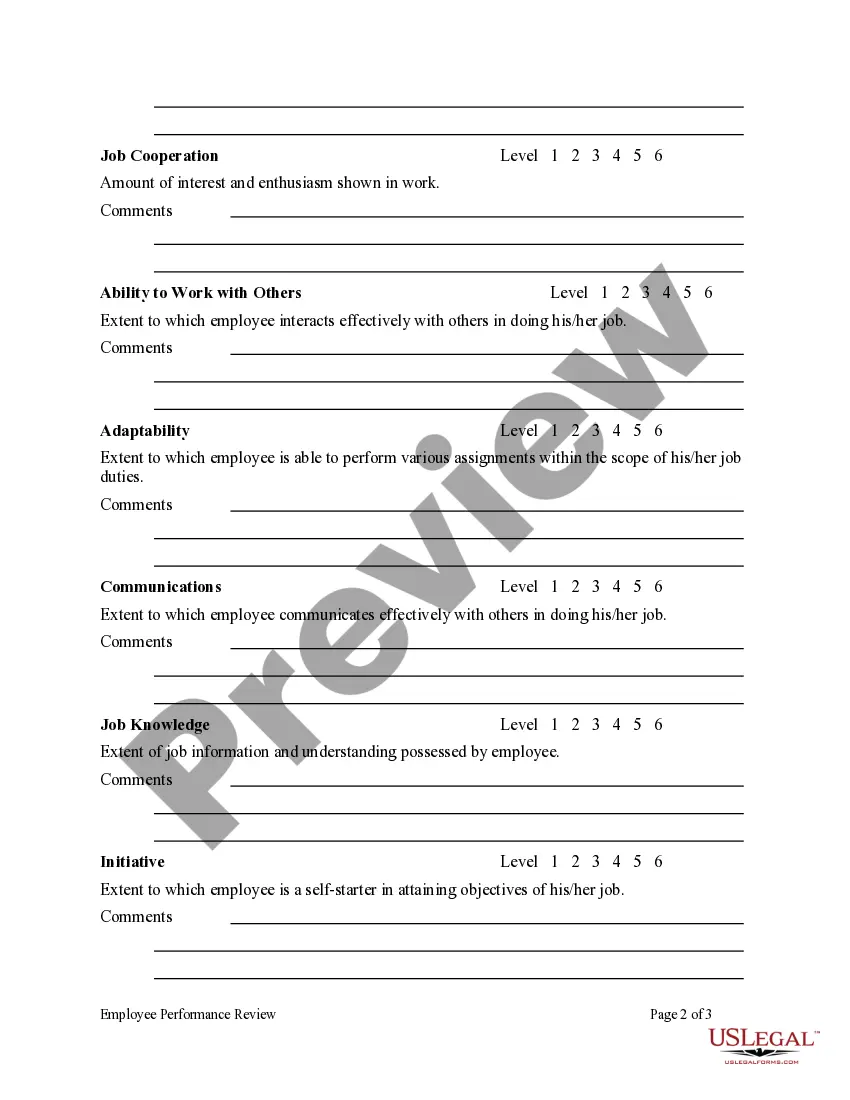

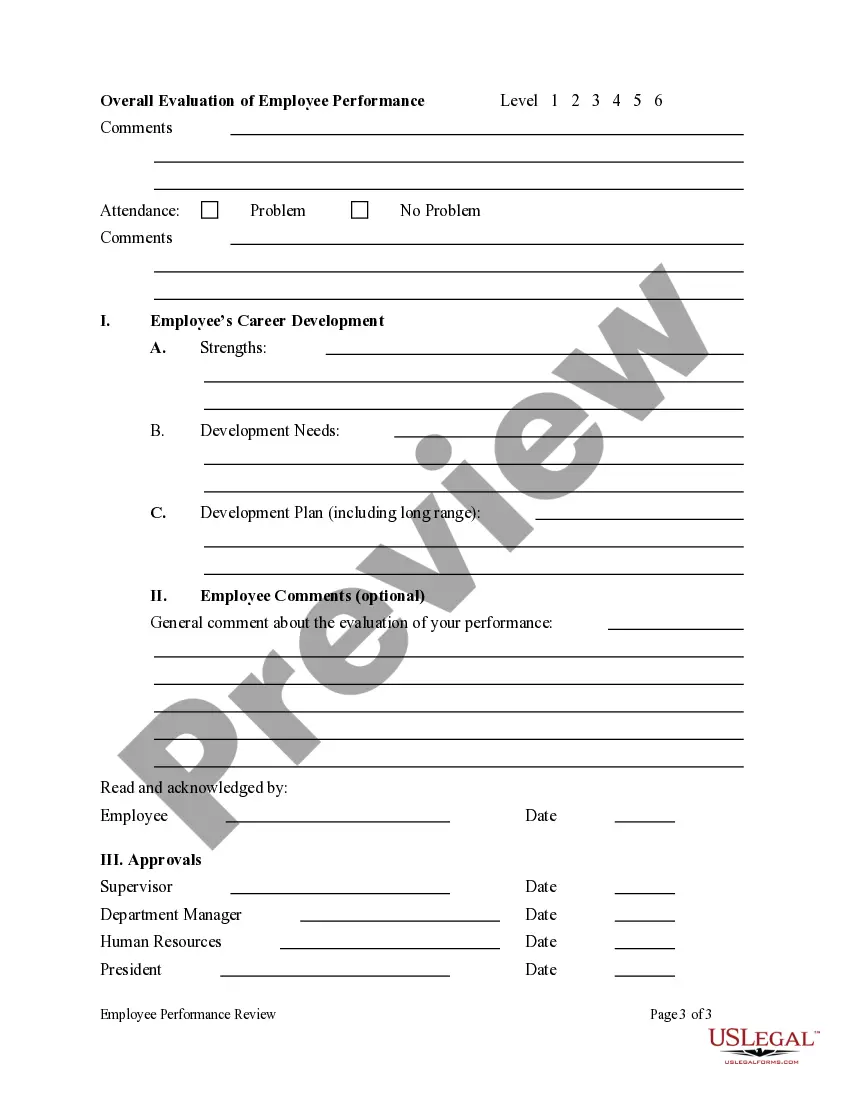

An employee performance evaluation sample with accounting is a method used by organizations to assess the performance and productivity of their accounting department employees. This evaluation process typically involves measuring key performance indicators (KPIs) and evaluating various skills and competencies required in the accounting field. A comprehensive employee performance evaluation sample with accounting should include the following elements: 1. Goal-setting: The evaluation should begin by setting clear and measurable performance goals for the accounting employees. These goals should align with the overall objectives of the accounting department and the organization. 2. Job knowledge and technical skills: Assessments should cover the employee's knowledge of accounting principles and best practices, as well as their proficiency in using accounting software and tools. This may involve testing their understanding of financial statements, tax regulations, and industry-specific accounting standards. 3. Attention to detail and accuracy: Accounting professionals are expected to maintain high levels of accuracy and attention to detail to ensure the integrity of financial records. The evaluation should assess their ability to identify errors, reconcile accounts, and produce error-free reports. 4. Timeliness and efficiency: Evaluations should gauge the employee's ability to carry out accounting tasks within specified deadlines while maintaining efficiency. This includes assessing their prioritization skills, time management, and ability to handle multiple responsibilities. 5. Problem-solving and analytical skills: Accountants often encounter complex financial issues and discrepancies. The evaluation should measure the employee's ability to diagnose problems, analyze data, and propose effective solutions to resolve issues. 6. Communication and teamwork: Assessments should cover the employee's interpersonal skills, ability to collaborate with team members, and communicate financial information effectively. This may involve evaluating their written and verbal communication skills, presentation abilities, and their contribution to team projects. 7. Adaptability and learning agility: The evaluation should assess the employee's willingness to adapt to changes in accounting standards, software updates, or organizational processes. This includes their ability to learn quickly, embrace new technologies, and adapt to evolving business needs. Different types of employee performance evaluation samples in accounting may include: 1. Self-evaluation: Employees are given the opportunity to reflect on their own performance and provide input on their strengths, weaknesses, and areas for improvement. 2. 360-degree evaluation: This involves gathering feedback from multiple sources, including supervisors, peers, and subordinates, to provide a holistic assessment of the employee's performance. 3. Objective-based evaluation: Employees are evaluated based on predefined objectives and metrics, allowing for a more quantifiable assessment of their performance against specific goals. 4. Developmental evaluation: This type of evaluation focuses on identifying areas for employee growth and development, providing feedback and guidance to enhance their skills and capabilities. In conclusion, an employee performance evaluation sample with accounting is a crucial tool for organizations to measure and enhance their accounting department's performance. By utilizing various evaluation methods and considering the aforementioned factors, employers can identify areas of improvement, foster professional growth, and ensure the overall success of their accounting team.

Employee Performance Evaluation Sample With Accounting

Description

How to fill out Employee Performance Evaluation Sample With Accounting?

Finding a go-to place to access the most recent and relevant legal samples is half the struggle of handling bureaucracy. Choosing the right legal papers needs precision and attention to detail, which explains why it is very important to take samples of Employee Performance Evaluation Sample With Accounting only from reliable sources, like US Legal Forms. An improper template will waste your time and delay the situation you are in. With US Legal Forms, you have little to worry about. You may access and check all the information concerning the document’s use and relevance for your situation and in your state or region.

Consider the following steps to complete your Employee Performance Evaluation Sample With Accounting:

- Make use of the library navigation or search field to find your sample.

- View the form’s information to see if it matches the requirements of your state and region.

- View the form preview, if available, to ensure the template is definitely the one you are interested in.

- Get back to the search and find the appropriate document if the Employee Performance Evaluation Sample With Accounting does not fit your requirements.

- If you are positive regarding the form’s relevance, download it.

- When you are a registered user, click Log in to authenticate and gain access to your picked forms in My Forms.

- If you do not have a profile yet, click Buy now to get the template.

- Select the pricing plan that suits your preferences.

- Proceed to the registration to finalize your purchase.

- Complete your purchase by selecting a payment method (credit card or PayPal).

- Select the file format for downloading Employee Performance Evaluation Sample With Accounting.

- When you have the form on your device, you can change it using the editor or print it and finish it manually.

Remove the hassle that comes with your legal documentation. Explore the comprehensive US Legal Forms catalog to find legal samples, check their relevance to your situation, and download them immediately.

Form popularity

FAQ

#1 Determine Your Goals Evaluating employee productivity. Charting employees' skills growth or professional development. Identifying efficiency shortcomings or trends. Exploring how your system impacts your company's overall financial health, like:

How to write an accountant reference letter Request information. ... Greet the recipient. ... Define your relationship to the subject. ... Describe their relevant skills and personality traits. ... Use examples. ... Create a meaningful conclusion. ... Sign the letter. ... Proofread and send your letter.

A good performance appraisal will include specific goals for improvement, so it's vital to: clearly state the employee's strengths. demonstrate the employee's weaknesses. highlight areas for growth. give clear direction for future professional development.

20 Staff Accountant Performance Review Phrases ?You effectively managed multiple tasks throughout the year.? ?Your accuracy when handling financial data was impressive.? ?You have solid interpersonal skills when working with clients and other stakeholders.?

Here are a few accounting goals you can include in your performance appraisal: Broadening your skill set. ... Improving personal characteristics. ... Accomplishing specific milestones or objectives. ... Learning from others. ... Improving work quality. ... Taking initiative. ... Improving productivity. ... Improving collaboration with colleagues.