Nonprofit Organization Corporation With Adults With Disabilities

Description

How to fill out Bylaws Of A Nonprofit Organization - Multistate?

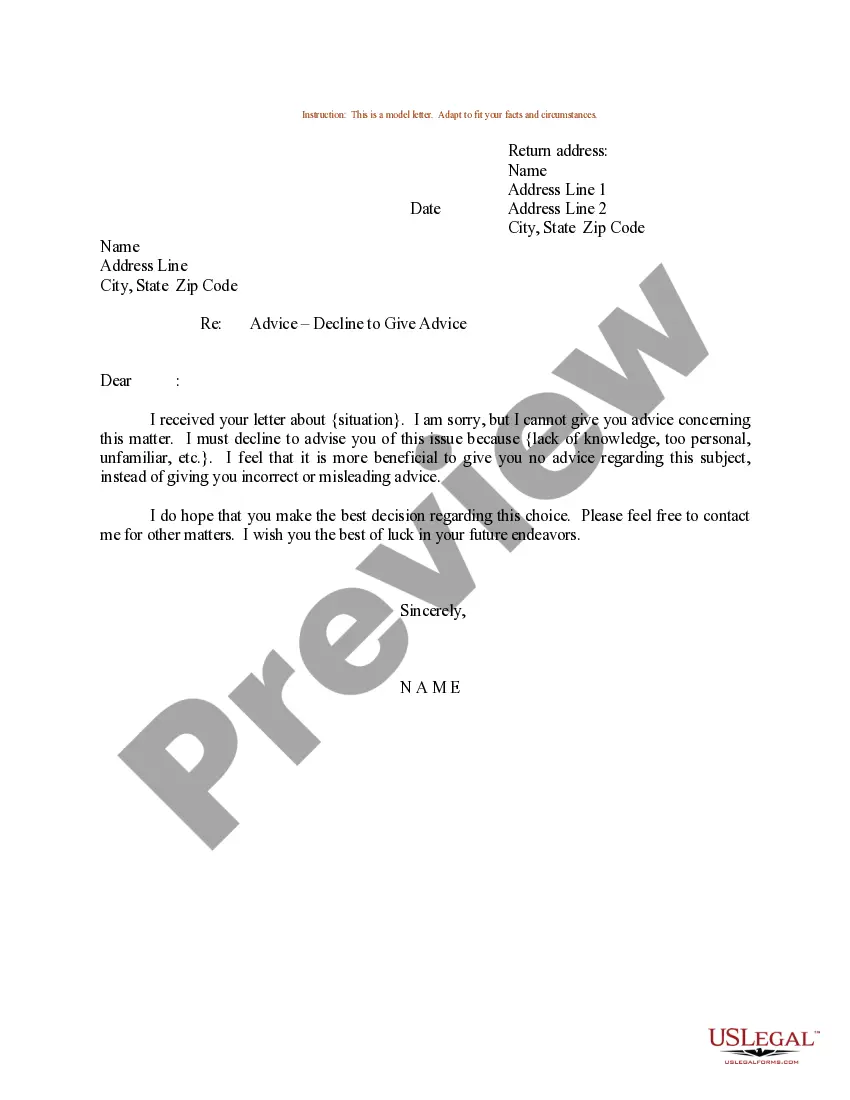

Legal document managing may be overwhelming, even for the most skilled specialists. When you are looking for a Nonprofit Organization Corporation With Adults With Disabilities and do not have the a chance to spend looking for the appropriate and up-to-date version, the processes can be demanding. A robust online form catalogue could be a gamechanger for anyone who wants to deal with these situations effectively. US Legal Forms is a market leader in web legal forms, with more than 85,000 state-specific legal forms accessible to you whenever you want.

With US Legal Forms, it is possible to:

- Gain access to state- or county-specific legal and business forms. US Legal Forms covers any requirements you could have, from individual to enterprise documents, all in one location.

- Use innovative resources to accomplish and deal with your Nonprofit Organization Corporation With Adults With Disabilities

- Gain access to a useful resource base of articles, guides and handbooks and resources relevant to your situation and needs

Save time and effort looking for the documents you will need, and make use of US Legal Forms’ advanced search and Review tool to locate Nonprofit Organization Corporation With Adults With Disabilities and acquire it. If you have a membership, log in to the US Legal Forms profile, search for the form, and acquire it. Take a look at My Forms tab to find out the documents you previously saved as well as to deal with your folders as you see fit.

If it is your first time with US Legal Forms, make a free account and have limitless usage of all benefits of the library. Listed below are the steps for taking after accessing the form you want:

- Confirm it is the proper form by previewing it and looking at its information.

- Be sure that the sample is approved in your state or county.

- Select Buy Now once you are all set.

- Select a subscription plan.

- Find the formatting you want, and Download, complete, sign, print and send out your papers.

Enjoy the US Legal Forms online catalogue, backed with 25 years of experience and stability. Change your day-to-day papers management into a easy and user-friendly process right now.

Form popularity

FAQ

Applications for nonprofit status must be submitted online to the IRS. If an organization is eligible to apply for nonprofit status with Form 1023-EZ, the process can take as little as four weeks. For those who must file Form 1023, the process could take up to six months or longer.

501(c)(3) organizations fall into one of three primary categories: public charities, private foundations, and private operating foundations. Public charity. Public charities are what most people recognize as those organizations with active programs.

Checklist for Starting a Nonprofit Organization: Define who you are. Build your Board of Directors. Legally Incorporate your Nonprofit. Secure Start-up Funding. Begin Early Operations. Next Steps to Accept Online Donations. Free Nonprofit Checklist Template (Downloadable)

profit founder may pay themselves a fair salary for the work they do running the organization. Likewise, they can compensate fulltime and parttime employees for the work they do. Nonprofit founders earn money for running the organizations they founded.

A 501(c) organization and a 501(c)3 organization are similar in designation, however they differ slightly in their tax benefits. Both types of organization are exempt from federal income tax, however a 501(c)3 may allow its donors to write off donations whereas a 501(c) does not.