Nonprofit Organization Corporation For Community Service

Description

How to fill out Bylaws Of A Nonprofit Organization - Multistate?

Locating a reliable resource for obtaining the latest and suitable legal documents is a significant part of navigating bureaucracy.

Identifying the appropriate legal paperwork requires precision and meticulousness, which is why it is essential to source samples of Nonprofit Organization Corporation For Community Service exclusively from trustworthy providers, such as US Legal Forms. An incorrect document will consume your time and prolong your current situation. With US Legal Forms, you have minimal worries.

Eliminate the complications associated with your legal paperwork. Browse the comprehensive US Legal Forms catalog where you can discover legal templates, verify their relevance to your situation, and download them instantly.

- Use the library navigation or search bar to find your template.

- Review the form’s details to ensure it meets the criteria of your state and locality.

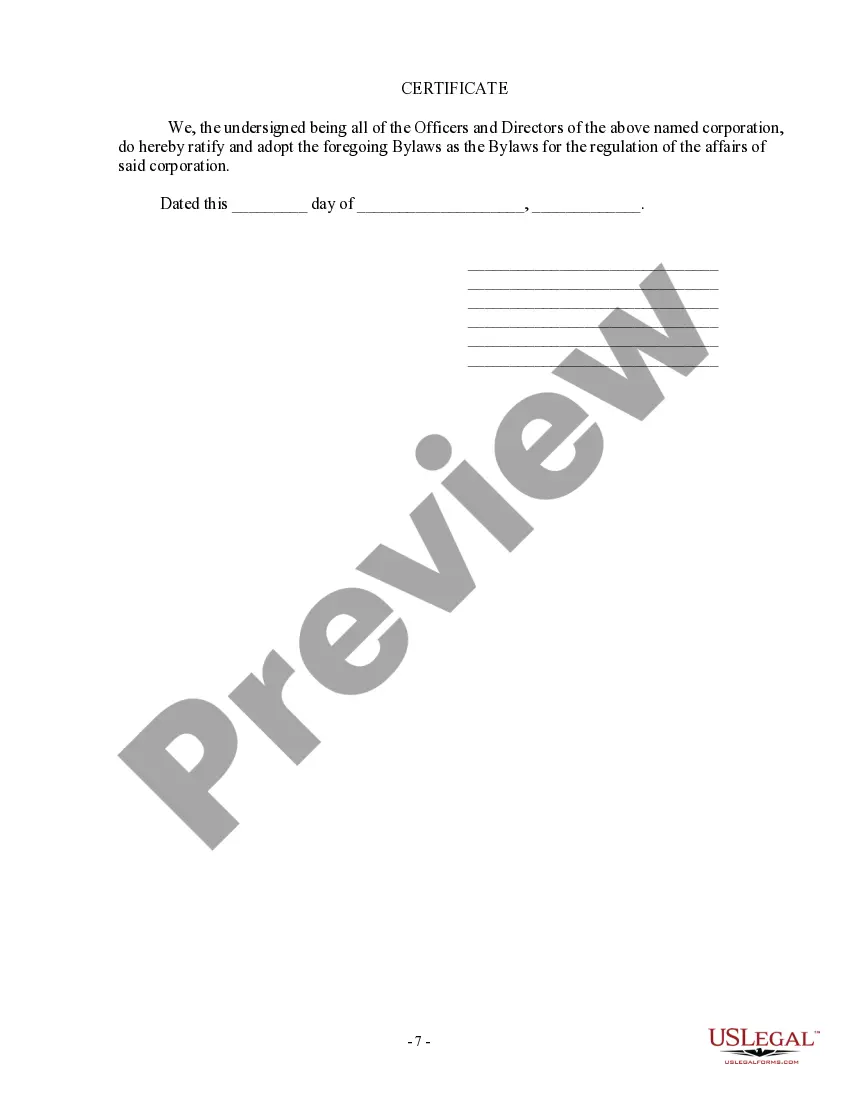

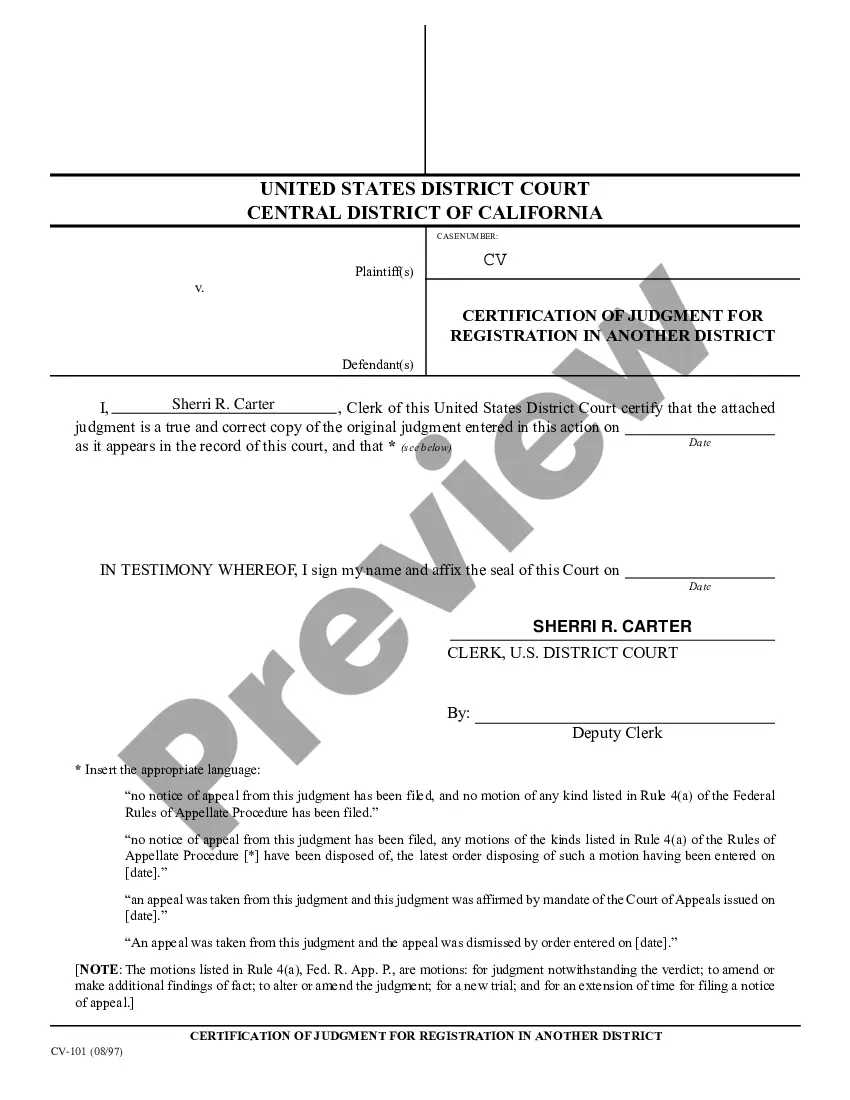

- Check the form preview, if provided, to confirm that the form matches what you need.

- Return to the search to locate an appropriate template if the Nonprofit Organization Corporation For Community Service does not meet your requirements.

- When you are confident about the form’s relevance, download it.

- If you are a registered user, click Log in to verify and access your selected forms in My documents.

- If you do not yet have an account, click Buy now to purchase the form.

- Select the pricing plan that best fits your needs.

- Proceed with the registration to complete your purchase.

- Finalize your transaction by choosing a payment method (credit card or PayPal).

- Select the document format for downloading Nonprofit Organization Corporation For Community Service.

- After you have the form on your device, you can modify it using the editor or print it to complete it by hand.

Form popularity

FAQ

profit organization is a type of organization that is set up to provide goods and services to the public in a way that does not generate a profit. Nonprofit organizations are established to serve a charitable, educational, religious, or other purpose that benefits the public.

Community-serving nonprofit organizations focus on providing services to the community either globally or locally. Community-serving nonprofits include organizations that deliver aid and development programs, medical research, education, and health services.

How to Fill Out the Form W-9 for Nonprofits Step 1 ? Write your corporation name. ... Step 2 ? Enter your business name. ... Step 3 ? Know your entity type. ... Step 4 ? Your exempt payee code. ... Step 5 ? Give your street address. ... Step 6 ? Give your city, state, and zip code. ... Step 7 ? List account numbers.

Non-profit organizations include churches, public schools, public charities, public clinics and hospitals, amateur sports organizations, political organizations, legal aid societies, volunteer services, organizations, labor unions, professional associations, research institutes, museums, and some governmental agencies.

Nonprofits are formed explicitly to benefit the public good; not-for-profits exist to fulfill an owner's organizational objectives. Nonprofits can have a separate legal entity; not-for-profits cannot have a separate legal entity.