Example Of Nonprofit Bylaws

Description

How to fill out Bylaws Of A Nonprofit Organization - Multistate?

Creating legal documents from the ground up can occasionally feel a bit daunting.

Certain circumstances may demand extensive research and substantial financial commitment.

If you're looking for a simpler and more economical method of drafting Example Of Nonprofit Bylaws or other forms without excessive hassle, US Legal Forms is readily available.

Our online repository of over 85,000 current legal forms encompasses nearly every aspect of your financial, legal, and personal issues.

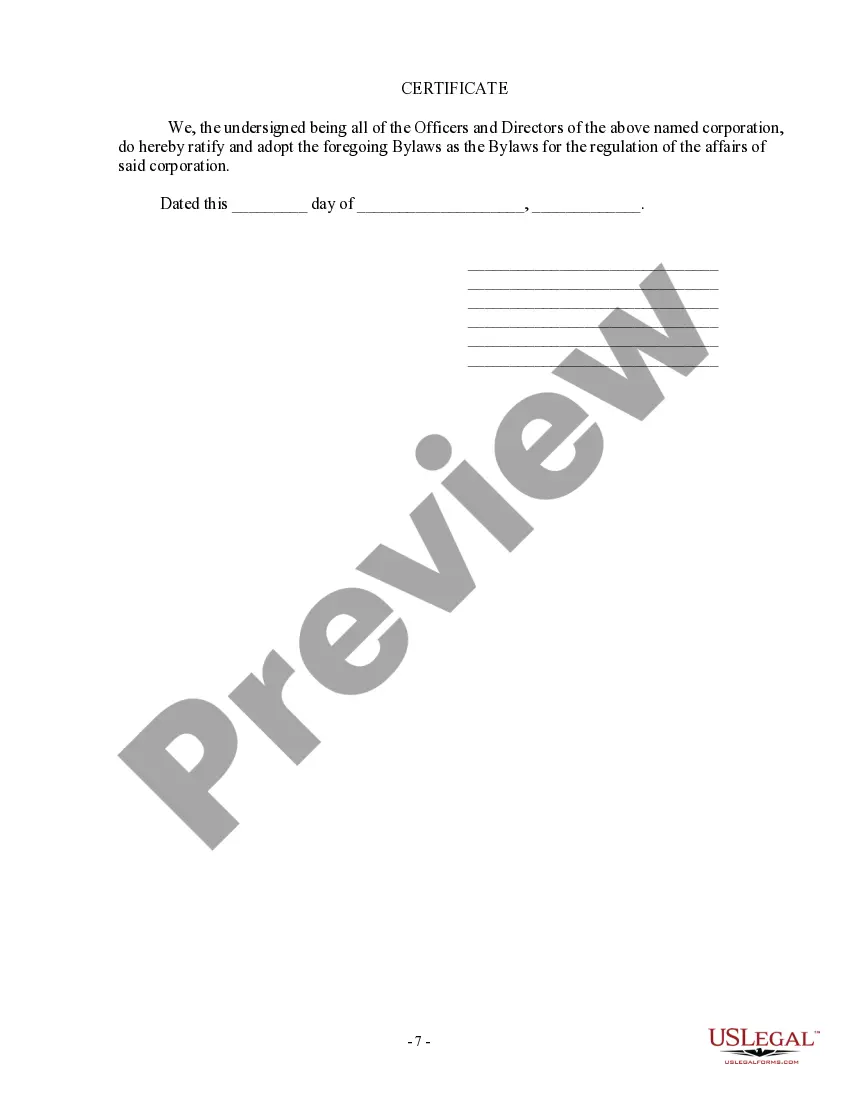

However, before rushing to download the Example Of Nonprofit Bylaws, consider these suggestions: Review the document preview and descriptions to ensure you are on the correct form. Confirm that the template you choose adheres to the rules and regulations of your state and county. Select the most appropriate subscription option to obtain the Example Of Nonprofit Bylaws. Download the file, then complete, validate, and print it out. US Legal Forms boasts an impeccable reputation and over 25 years of experience. Join us today and simplify your document processing!

- With just a few clicks, you can promptly access state- and county-specific templates carefully crafted by our legal experts.

- Utilize our platform whenever you require a dependable service to swiftly find and retrieve the Example Of Nonprofit Bylaws.

- If you’re familiar with our services and have already registered an account, simply Log In to your account, find the template, and download it, or re-download it anytime in the My documents section.

- If you don’t have an account? No issue. It requires minimal time to sign up and browse the catalog.

Form popularity

FAQ

You can find the bylaws of a nonprofit organization by searching online databases, state regulatory agency websites, or directly contacting the organization. Many non-profits provide their bylaws on their official websites for public access. If you seek a reliable example of nonprofit bylaws, US Legal Forms offers templates that can help you understand typical structures and requirements. Exploring these resources can lead you to the specific information you need.

The bylaws for a nonprofit organization are typically drafted by the founding members or the board of directors. It is also common for legal professionals to assist in writing these documents to ensure they meet state requirements. An example of nonprofit bylaws may include guidelines tailored to the specific needs of the organization. Working with platforms like US Legal Forms can simplify the process of drafting bylaws that comply with legal standards.

Nonprofit bylaws are usually considered public records. This designation allows the public to review the governance structure that guides the organization. As you look for an example of nonprofit bylaws, you may find these documents available online or through state regulatory agencies. Transparency is a crucial aspect of non-profit operations, promoting accountability to stakeholders.

Yes, company bylaws are public information in most states. This means that anyone can request to view them, allowing transparency in how non-profit organizations operate. When searching for an example of nonprofit bylaws, you can often find these documents filed with your state's Secretary of State. Access to this information fosters public trust and accountability.

Bylaws in a non-profit organization serve as the internal governing rules. They outline how the organization operates, including roles of officers, membership requirements, and meeting procedures. An example of nonprofit bylaws includes provisions for board elections, term lengths, and conflict resolution. Having clear bylaws is essential for maintaining good governance and ensuring compliance with state laws.

The proper way to write bylaws involves clarity, simplicity, and a logical structure. Start with an introduction that states the organization’s purpose, then outline the board’s powers and member roles. Use bullet points or numbered lists to enhance readability. For effective examples of nonprofit bylaws, exploring user-friendly templates on platforms like US Legal Forms can be very helpful.

To write bylaws for a nonprofit, begin by outlining the fundamental elements that govern your organization, such as board structures and membership rights. Utilize clear language and a straightforward format, ensuring that every member understands their rights and responsibilities. It’s beneficial to review examples of nonprofit bylaws for inspiration. For professional assistance and templates, consider resources like US Legal Forms.

When drafting bylaws, avoid including overly specific provisions that may limit flexibility, such as particular names or events. Additionally, do not include operational details that can change frequently, like specific annual budgets or individual employee roles. Keeping bylaws focused on governance rather than day-to-day operations allows more adaptability. For clarity, examples of nonprofit bylaws can guide you on what to omit.

Nonprofit bylaws should provide clear guidelines on various operational aspects, including member roles, board structure, and meeting procedures. Essential components often include the purpose of the organization, membership criteria, and how to handle conflicts of interest. By including these elements, nonprofits ensure smooth operations. For a thorough example of nonprofit bylaws, consider checking templates on platforms like US Legal Forms.

The 33% rule for nonprofits suggests that at least one-third of the board members should not be related to one another. This guideline helps ensure a balanced and diverse governing body, promoting fair decision-making. By adhering to this rule, organizations can create a more effective governance structure. For examples of nonprofit bylaws, you can refer to templates that clarify this rule.