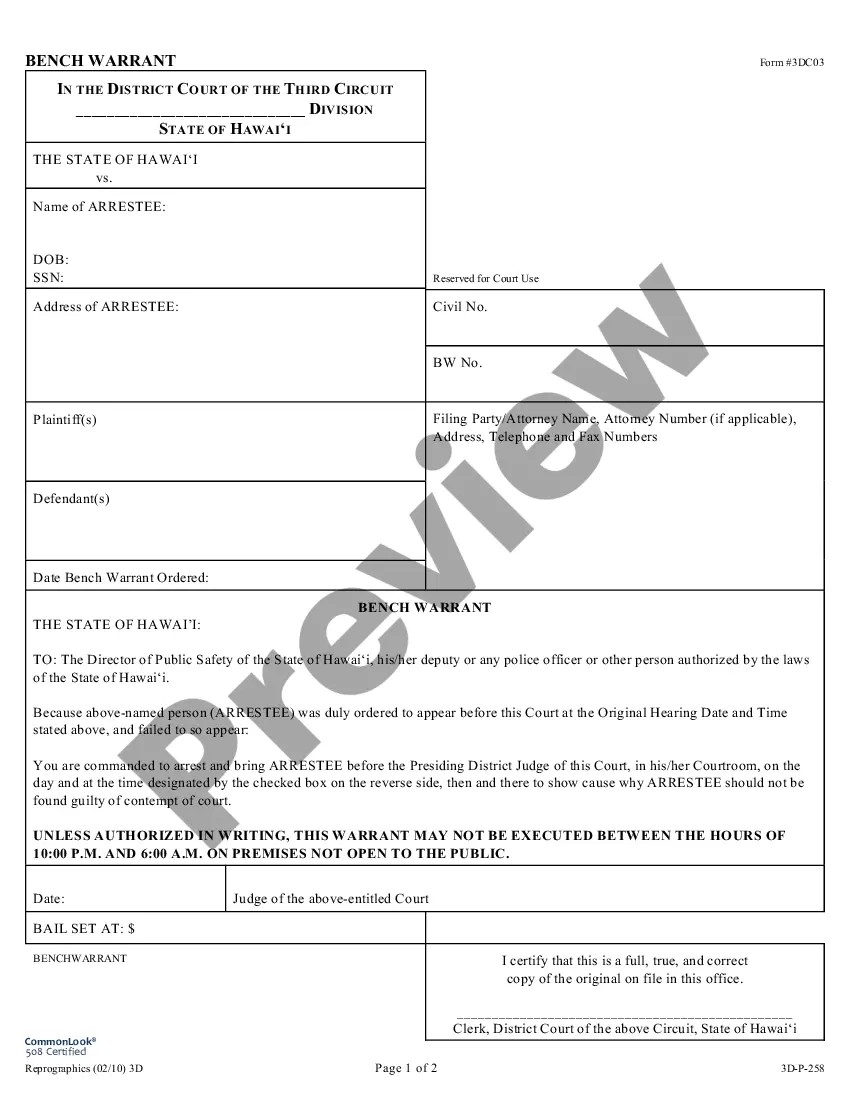

Inheritance declaration form format refers to a standardized document used to declare the transfer of assets, properties, or valuables from an individual's estate to their beneficiaries after their demise. It acts as an essential legal record that outlines and confirms the rightful distribution of the deceased person's possessions according to their will or applicable laws. The format of an inheritance declaration form usually includes key details, such as the deceased person's full name, date of birth, date of passing, and relevant identification numbers. It also specifies the names and addresses of the beneficiaries, who are entitled to inherit the assets and their respective share in the inheritance. Additionally, the form outlines the nature of assets being transferred, like properties, bank accounts, investments, jewelry, or any other valuable possessions. Different types of inheritance declaration forms may exist depending on jurisdiction or personal circumstances. Here are a few examples: 1. Last Will and Testament Form: This type of inheritance declaration form enables individuals to specify their wishes regarding the distribution of assets upon their death. It includes provisions for naming beneficiaries, appointing an executor, and may include other instructions related to guardianship of minors or charitable donations. 2. Intestate Succession Form: When an individual passes away without leaving a valid will, an intestate succession form is used to determine the distribution of assets according to the laws of intestacy. This form ensures that the assets are allocated among the statutory heirs as per the governing jurisdiction's regulations. 3. Trust Declaration Form: In cases where the deceased person has established a trust arrangement, a trust declaration form is utilized to declare the beneficiaries and trustees involved, along with the terms and conditions governing the trust's administration and distribution. 4. Renunciation Form: This type of form allows a beneficiary mentioned in a will or intestate succession to renounce their rights to inherit the assets. Renunciation forms are typically used in situations where the beneficiary wishes to voluntarily surrender their share or redirect the inheritance to someone else. It is important to consult legal professionals or relevant authorities to ensure accurate completion of the inheritance declaration form based on the specific requirements of the jurisdiction and individual circumstances involved.

Inheritance Declaration Form Format

Description

How to fill out Inheritance Declaration Form Format?

Whether for corporate reasons or for individual matters, everyone must manage legal issues at some stage in their lives.

Filling out legal documents demands meticulous care, beginning with selecting the appropriate form example. For instance, if you choose an incorrect version of an Inheritance Declaration Form Template, it will be rejected when submitted.

With a comprehensive US Legal Forms collection available, you no longer need to waste time searching for the suitable template online. Utilize the library’s user-friendly navigation to find the right template for any situation.

- Obtain the template you require using the search bar or catalog browsing.

- Review the form’s description to ensure it fits your needs, state, and locality.

- Click on the form’s preview to review it.

- If it is the incorrect document, return to the search function to find the Inheritance Declaration Form Template you require.

- Download the template if it aligns with your specifications.

- If you already possess a US Legal Forms account, simply click Log in to retrieve previously saved documents in My documents.

- If you don't have an account yet, you can download the form by clicking Buy now.

- Select the appropriate pricing option.

- Complete the profile registration form.

- Choose your payment method: use a credit card or PayPal account.

- Select the document format you desire and download the Inheritance Declaration Form Template.

- After it is saved, you can fill out the form using editing software or print it and complete it manually.

Form popularity

FAQ

You must electronically file this Appearance and Answer using EDMS at unless you obtain from the court an exemption from electronic filing requirements.

NOTE: A Notice of Appearance is filed by an attorney/representative to indicate his or her appearance in the appeal. NOTE: Once a Notice of Appearance has been filed, the filer may receive automatic email notifications whenever a filing is made on the appeal.

What are the steps in a Contempt of Court action? We file an application for a contempt citation, including the facts supporting the application, with the Clerk of Court, and serve it on the person ordered to pay support. The court holds a hearing to decide whether the violation of the support order is willful.

Iowa Legal Aid provides free legal advice and representation on civil matters to low-income Iowans.

In Iowa, you have to file an action against the other party to seek enforcement of the existing court decree order. The enforcement action is formally known as an Application for Rule to Show Cause, commonly referred to as a contempt filing. This filing brings the opposing party's bad acts to the court's attention.

If the defendant fails to answer and the clerk of court determines proper notice was given to the defendant, the clerk of court or a judge may enter a default judgment against the defendant if the plaintiff's damages are clearly identified.

Respondent must file an Answer within 20 days after receiving the Petition and Original Notice, or the court may enter a judgment against Respondent giving Petitioner what he or she asked for in the Petition. Use this Answer form 115 if you received Petition form 101, otherwise use form 116.

A defendant's or respondent's answer must be electronically filed with the court. The papers (original notice and petition) that were served on the defendant or respondent tell how long the defendant or respondent has to file an answer. For information on calculating answer deadlines, see Iowa Code section 4.1(34).