Administrator Estate Deceased Withholding Tax

Description

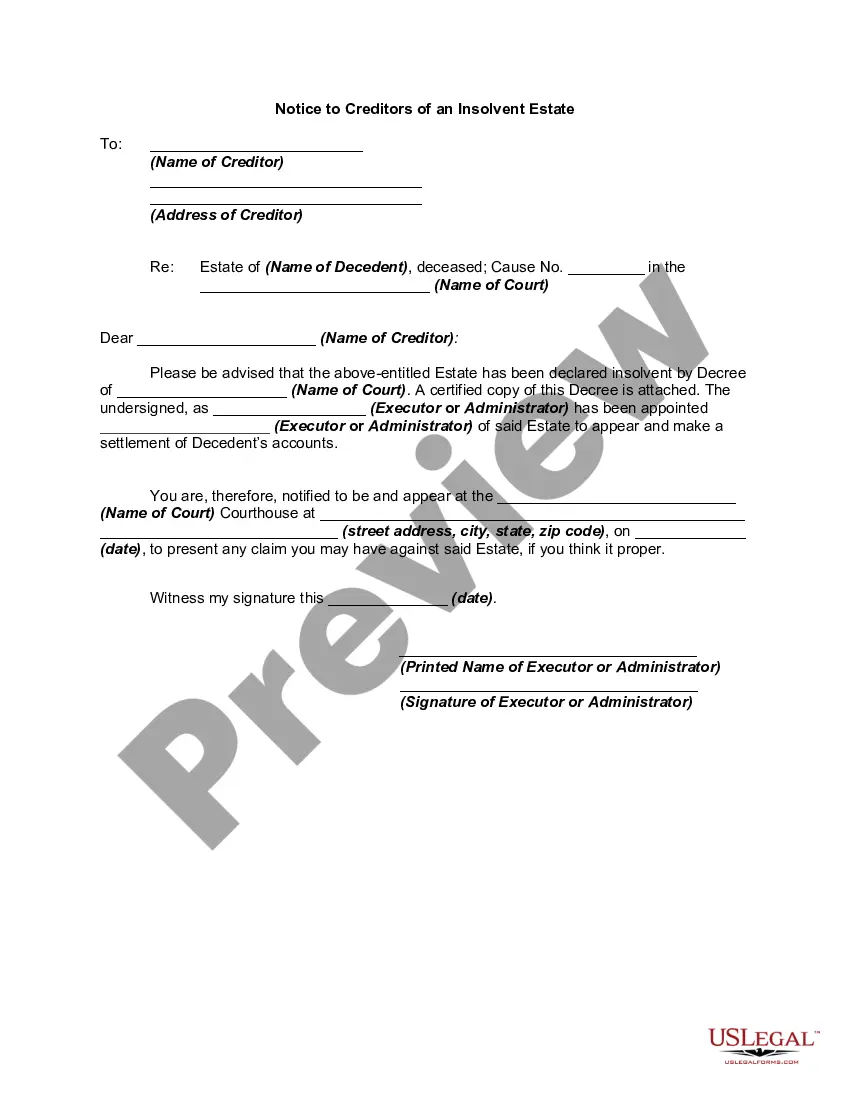

How to fill out Notice To Creditors Of An Insolvent Estate?

Handling legal paperwork and procedures might be a time-consuming addition to the day. Administrator Estate Deceased Withholding Tax and forms like it typically need you to look for them and understand the best way to complete them effectively. Therefore, if you are taking care of economic, legal, or individual matters, using a comprehensive and practical web catalogue of forms on hand will significantly help.

US Legal Forms is the number one web platform of legal templates, featuring more than 85,000 state-specific forms and a variety of tools that will help you complete your paperwork quickly. Discover the catalogue of appropriate documents available to you with just one click.

US Legal Forms gives you state- and county-specific forms available at any moment for downloading. Shield your papers managing operations by using a high quality services that allows you to put together any form within a few minutes without additional or hidden cost. Just log in in your account, identify Administrator Estate Deceased Withholding Tax and download it immediately within the My Forms tab. You may also gain access to previously saved forms.

Is it your first time making use of US Legal Forms? Sign up and set up an account in a few minutes and you’ll have access to the form catalogue and Administrator Estate Deceased Withholding Tax. Then, adhere to the steps below to complete your form:

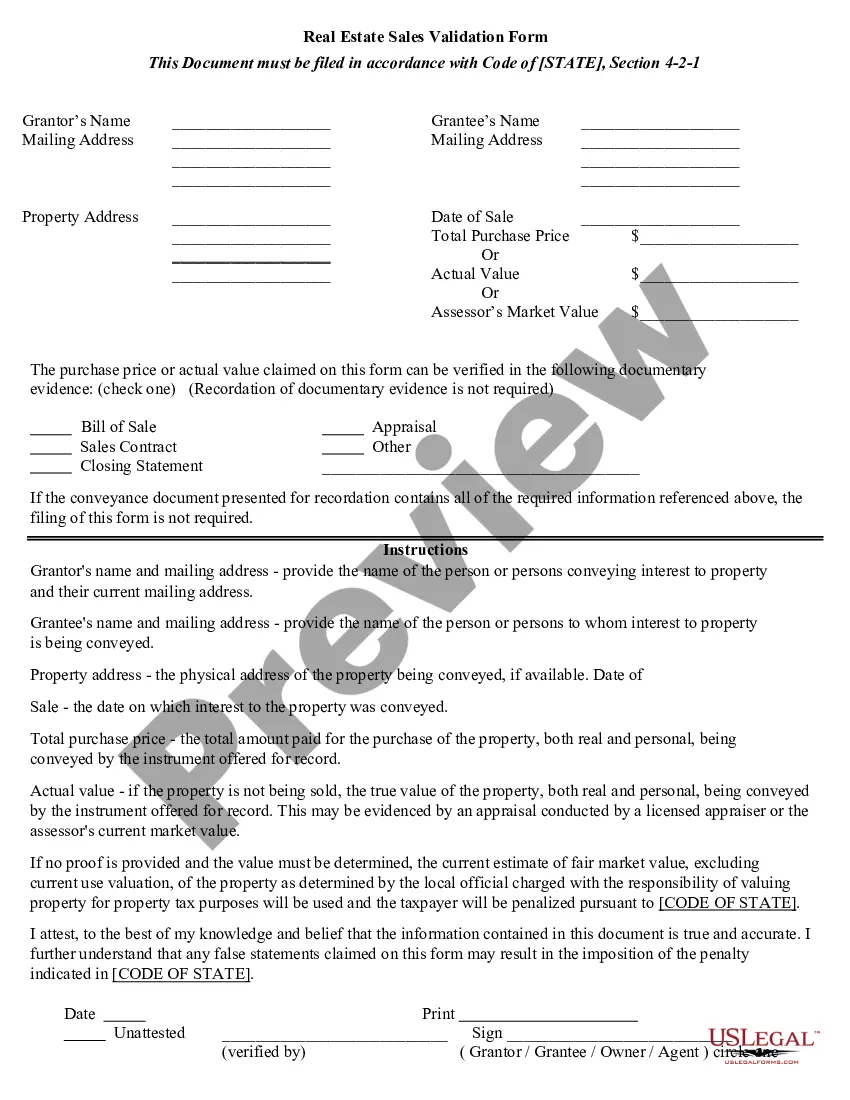

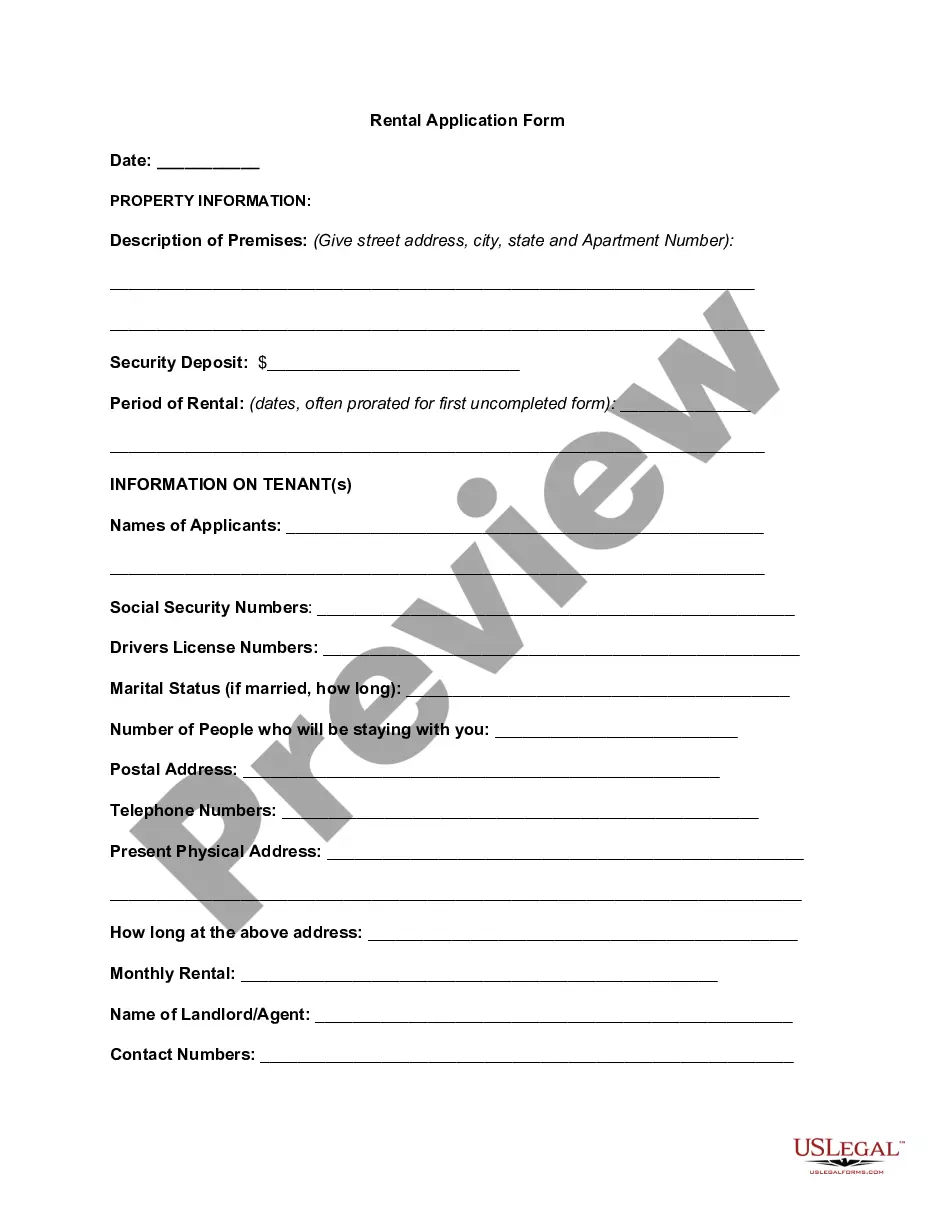

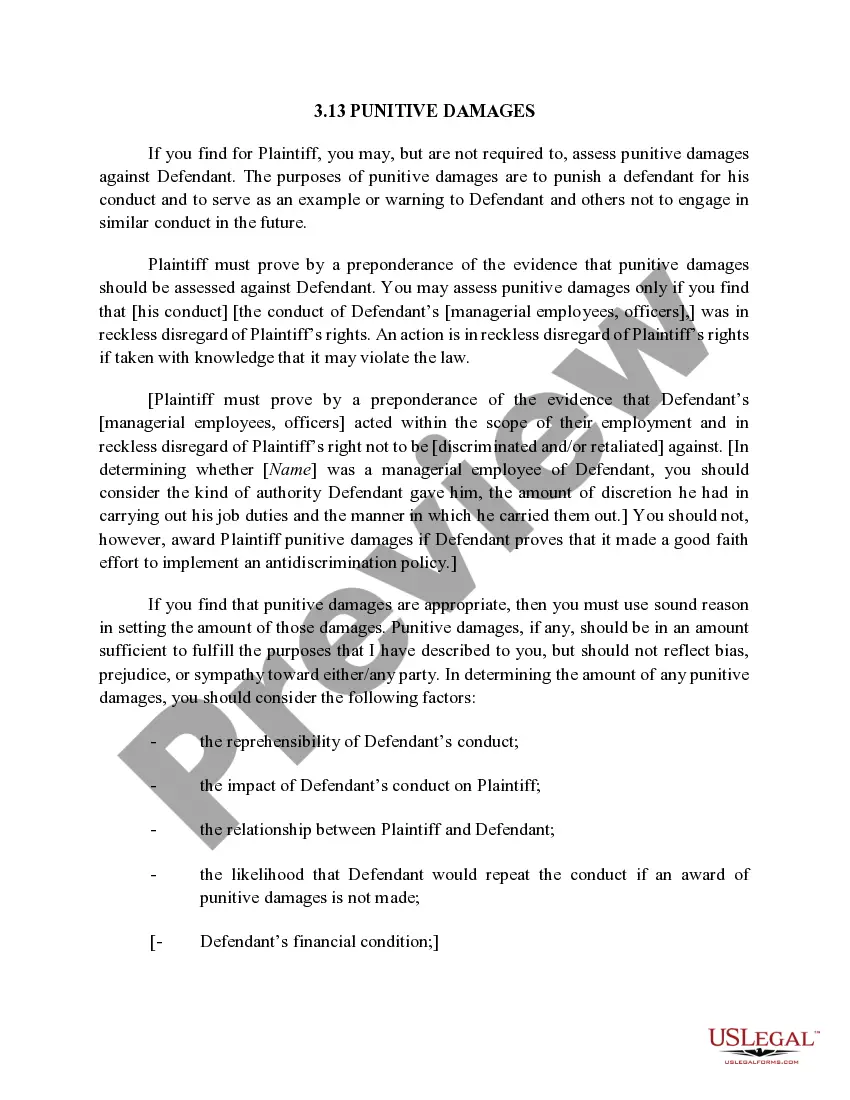

- Ensure you have discovered the right form using the Preview feature and reading the form description.

- Pick Buy Now when all set, and select the subscription plan that fits your needs.

- Choose Download then complete, sign, and print out the form.

US Legal Forms has 25 years of expertise helping consumers deal with their legal paperwork. Discover the form you need today and improve any process without breaking a sweat.

Form popularity

FAQ

If paper-filed, write ?Deceased,? the taxpayer's name, and the taxpayer's date of death across the top of the final return. If e-filed, follow the directions provided by the tax software and be sure to indicate the taxpayer is deceased and the date of death.

The administrator, executor, or beneficiary must: File a final tax return. File any past due returns. Pay any tax due.

If payment was after the year of death, the employer should not report it on Form W-2, and should not withhold Social Security and Medicare taxes. Whether the payment was made in the year of death or after the year of death, the employer also must report the payment to the estate or beneficiary on Form 1099-MISC.

In general, file and prepare the final individual income tax return of a deceased person the same way you would if the person were alive. Report all income up to the date of death and claim all eligible credits and deductions.

The personal representative of an estate is an executor, administrator, or anyone else in charge of the decedent's property. The personal representative is responsible for filing any final individual income tax return(s) and the estate tax return of the decedent when due.