Release Insurance Information Withholding

Description

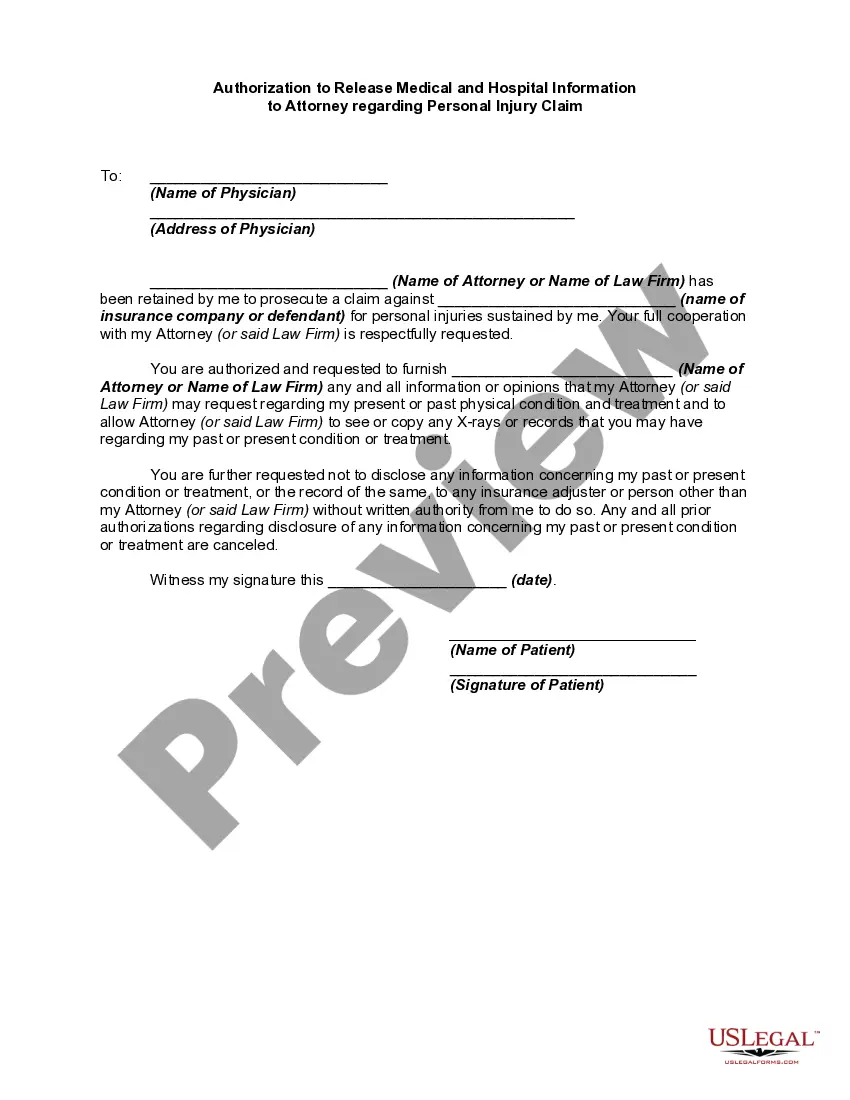

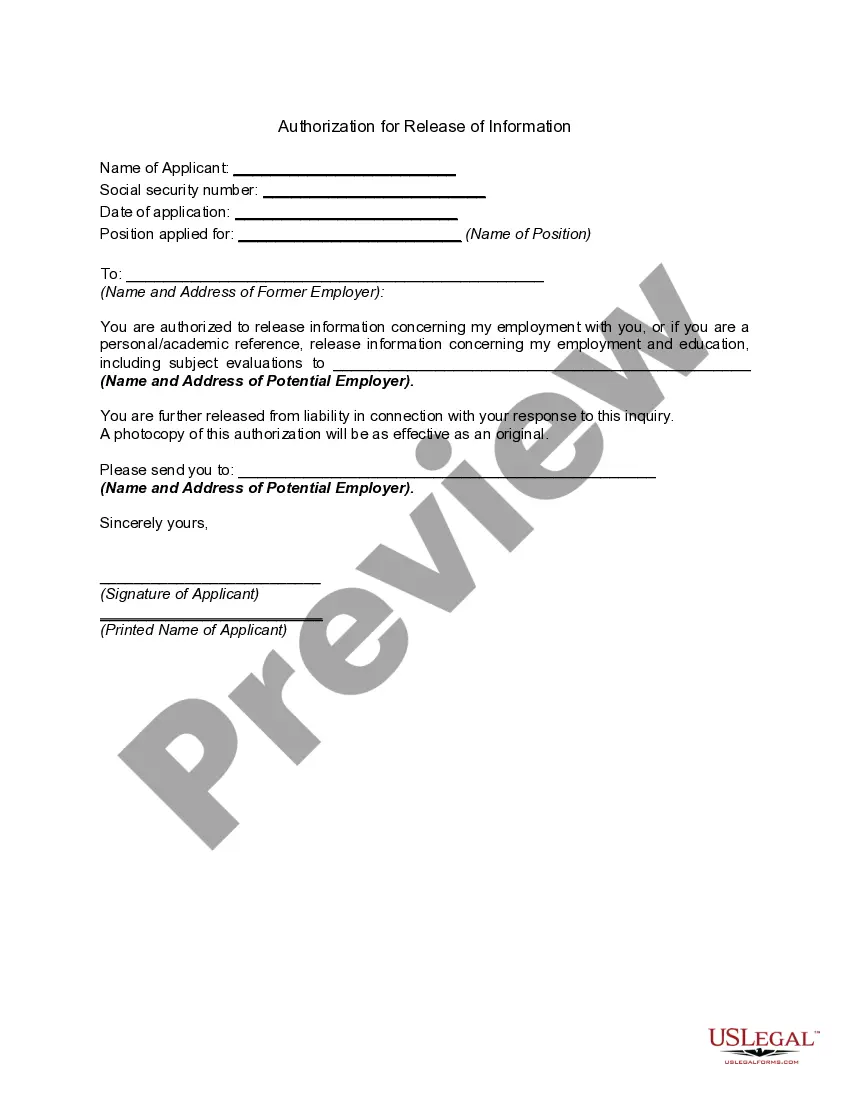

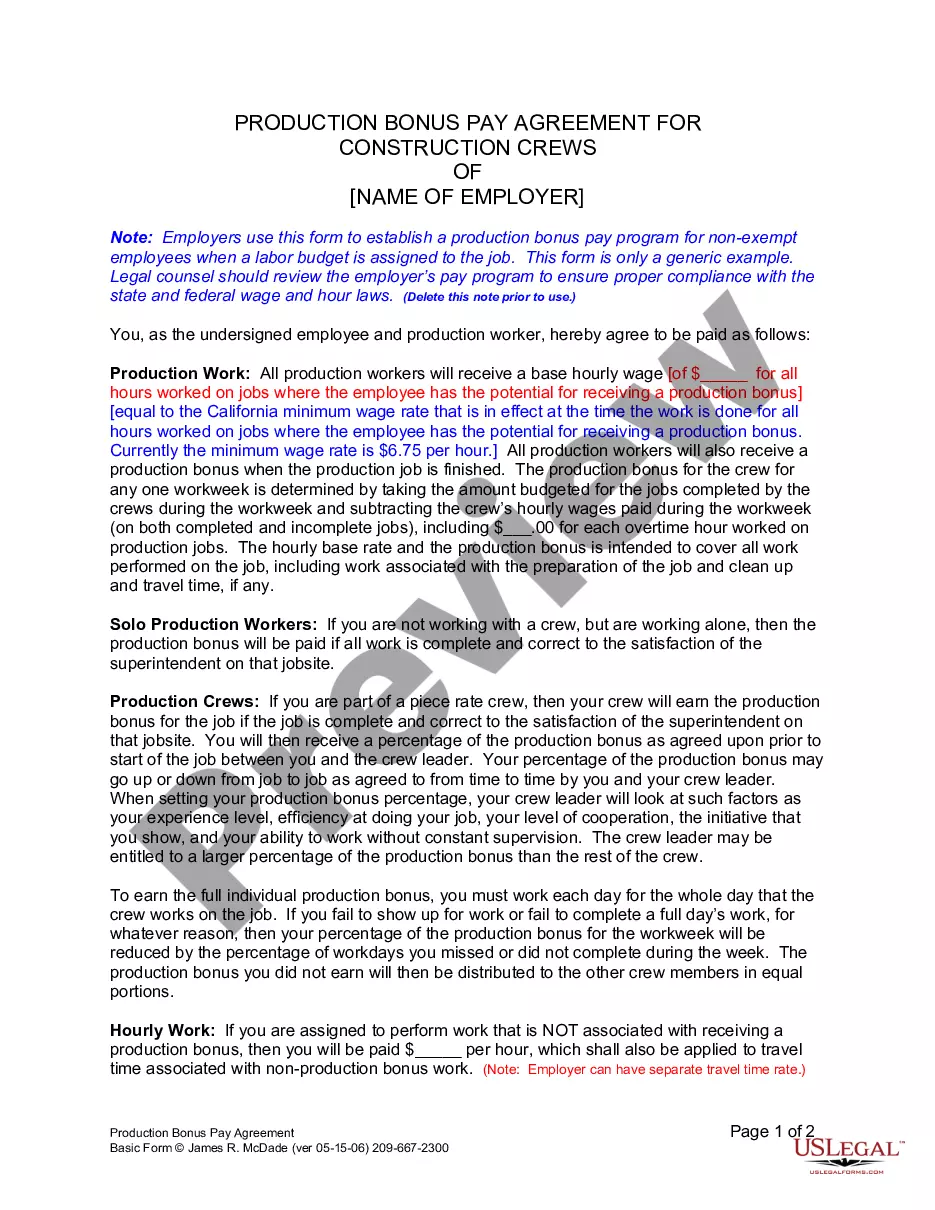

How to fill out Authorization For Release Of Insurance Information With Regard To Pending Litigation?

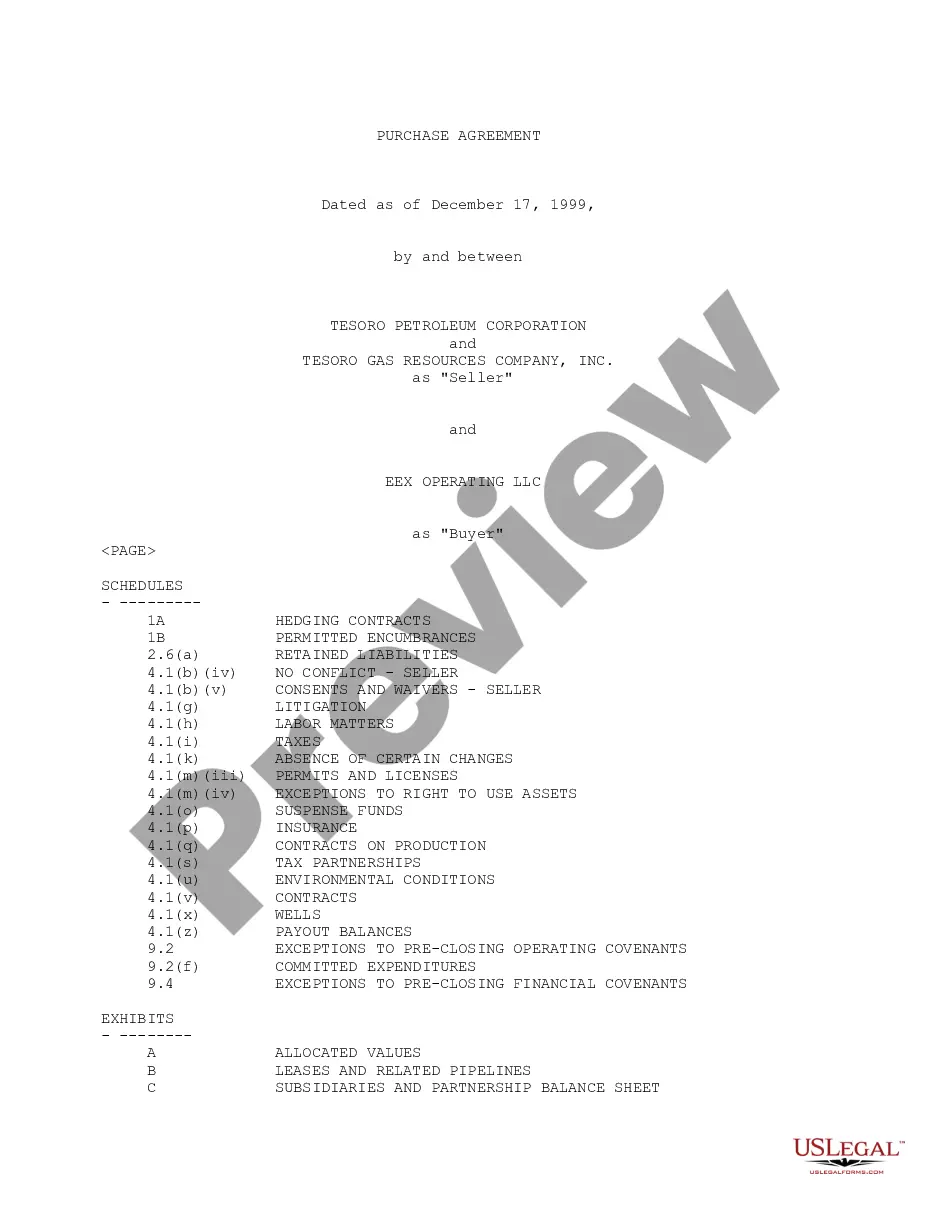

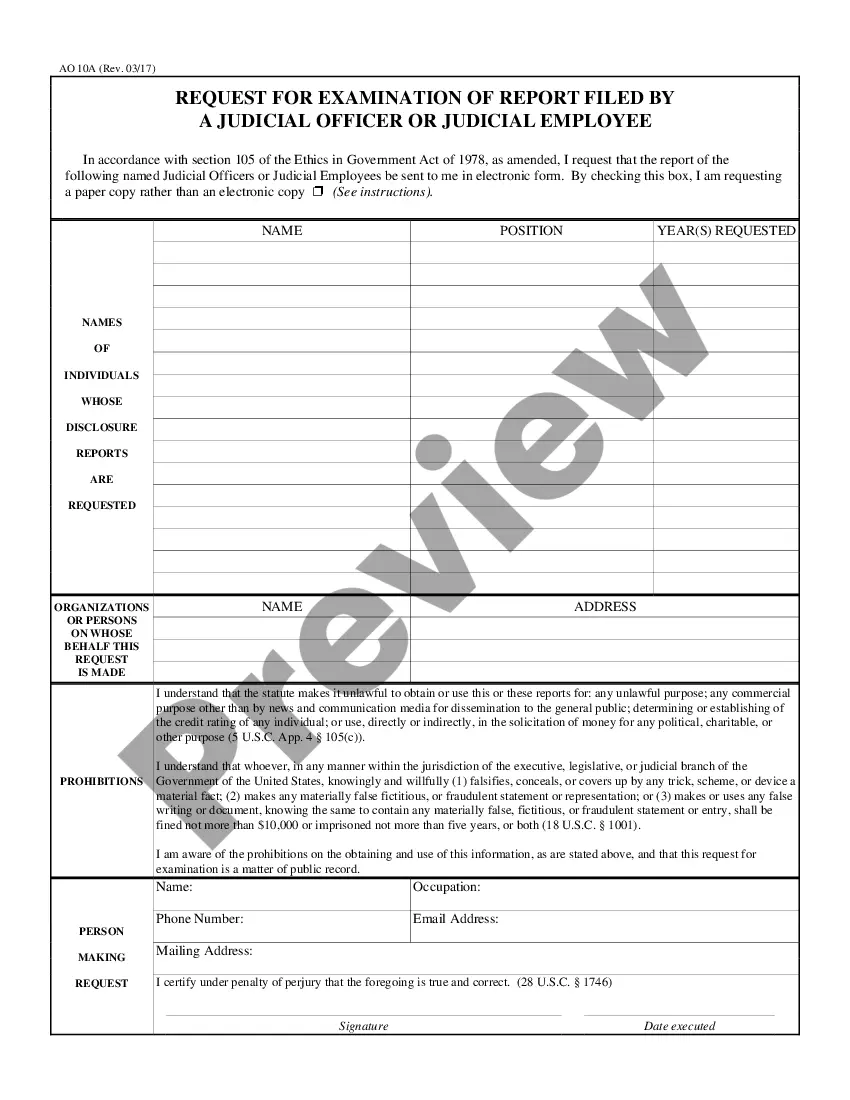

Legal papers management might be overpowering, even for experienced specialists. When you are looking for a Release Insurance Information Withholding and do not get the a chance to commit looking for the correct and up-to-date version, the procedures could be stressful. A strong web form library could be a gamechanger for anyone who wants to take care of these situations successfully. US Legal Forms is a market leader in web legal forms, with more than 85,000 state-specific legal forms accessible to you at any moment.

With US Legal Forms, you may:

- Gain access to state- or county-specific legal and organization forms. US Legal Forms handles any requirements you might have, from personal to business paperwork, in one place.

- Utilize advanced resources to accomplish and deal with your Release Insurance Information Withholding

- Gain access to a resource base of articles, tutorials and handbooks and resources relevant to your situation and requirements

Help save effort and time looking for the paperwork you need, and utilize US Legal Forms’ advanced search and Review tool to find Release Insurance Information Withholding and acquire it. In case you have a monthly subscription, log in to your US Legal Forms account, look for the form, and acquire it. Review your My Forms tab to see the paperwork you previously downloaded as well as to deal with your folders as you can see fit.

If it is the first time with US Legal Forms, make a free account and have limitless access to all benefits of the platform. Listed below are the steps to take after getting the form you want:

- Validate this is the proper form by previewing it and reading through its information.

- Ensure that the sample is accepted in your state or county.

- Choose Buy Now once you are ready.

- Choose a monthly subscription plan.

- Pick the format you want, and Download, complete, sign, print and send out your papers.

Take advantage of the US Legal Forms web library, supported with 25 years of expertise and reliability. Change your day-to-day papers managing in a smooth and user-friendly process today.

Form popularity

FAQ

Claiming 1 reduces the amount of taxes that are withheld from weekly paychecks, so you get more money now with a smaller refund. Claiming 0 allowances may be a better option if you'd rather receive a larger lump sum of money in the form of your tax refund.

Claiming 1 reduces the amount of taxes that are withheld from weekly paychecks, so you get more money now with a smaller refund. Claiming 0 allowances may be a better option if you'd rather receive a larger lump sum of money in the form of your tax refund.

By placing a ?0? on line 5, you are indicating that you want the most amount of tax taken out of your pay each pay period. If you wish to claim 1 for yourself instead, then less tax is taken out of your pay each pay period. 2. You can choose to have no taxes taken out of your tax and claim Exemption (see Example 2).

The Form W-4 in Depth Step 1: Provide Your Information. Provide your name, address, filing status, and Social Security number. ... Step 2: Indicate Multiple Jobs or a Working Spouse. ... Step 3: Add Dependents. ... Step 4: Add Other Adjustments. ... Step 5: Sign and Date Form W-4.

The W-4 Form is the IRS document you complete for your employer to determine how much should be withheld from your paycheck for federal income taxes and sent to the IRS.