Texas Is Forever

Description

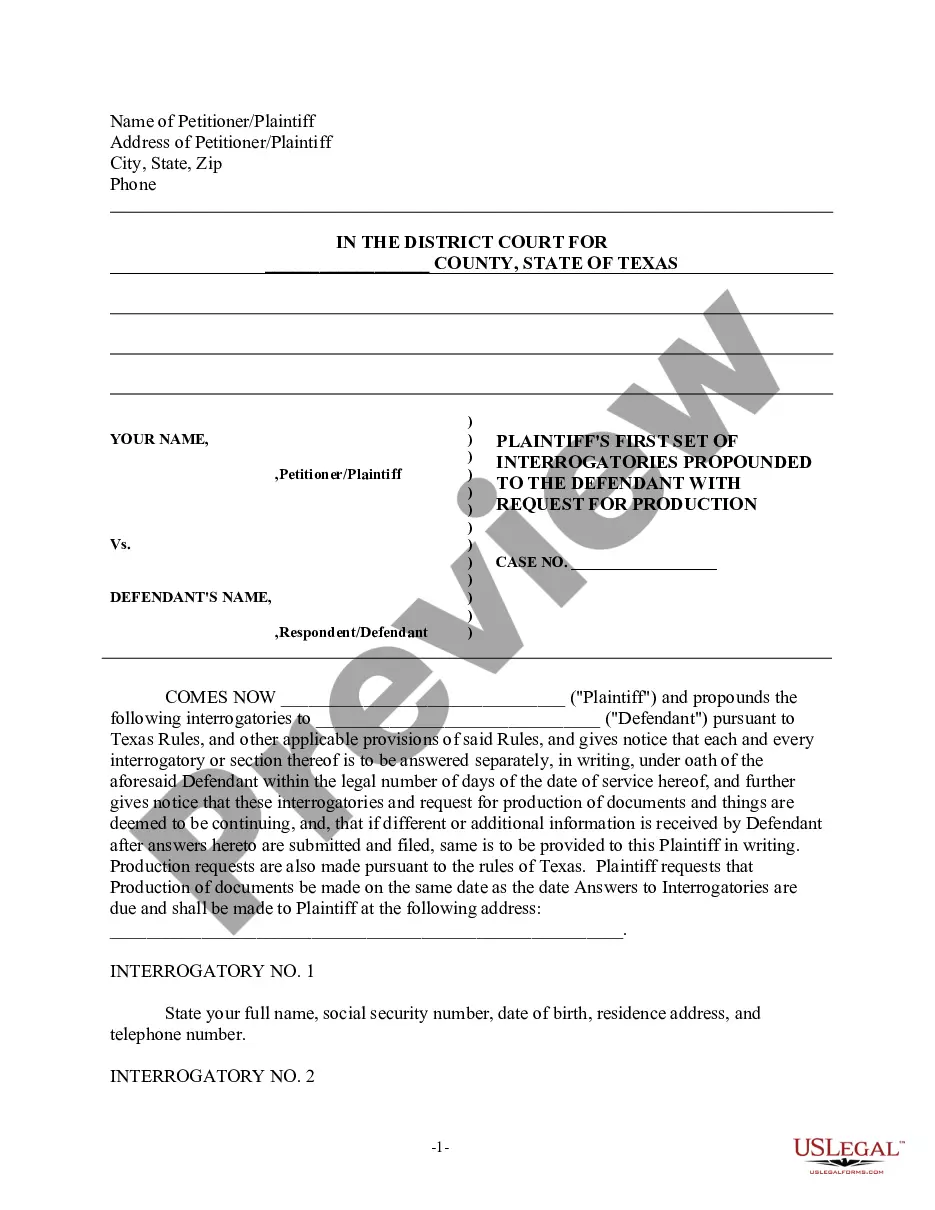

How to fill out Irrevocable Trust Agreement For Benefit Of Trustor's Children And Grandchildren With Spendthrift Trust Provisions?

- Sign in to your US Legal Forms account if you have one. Make sure your subscription is active; otherwise, renew it accordingly.

- If you are new to the service, start by exploring the Preview mode and form description to find the right document that suits your legal needs.

- If you don’t find what you need, use the Search tab to locate additional templates.

- Once you find the correct document, click the Buy Now button and choose a subscription plan that fits your requirements.

- Complete your purchase by entering your payment information through credit card or PayPal.

- Finally, download the legal form directly to your device. You can also access it anytime via the My Forms section of your profile.

US Legal Forms stands out with its extensive collection of over 85,000 legal documents, offering more options than competitors at comparable prices. Additionally, you gain access to premium experts who can assist with form completion, ensuring that your documents are both precise and legally sound.

In conclusion, using US Legal Forms can significantly simplify your legal processes. With Texas is forever in mind, get started on your legal documentation today and experience the ease of navigating your legal needs.

Form popularity

FAQ

Claiming residency in two states involves showing consistent habitation, such as maintaining a home and jobs in both locations. Each state has its criteria for residency, including duration and intent. If you're unsure about the legal nuances, consider using resources, like uslegalforms. Remember, Texas is forever, and understanding your residency status can help in tax matters.

Closing a business in Texas involves several steps, including filing a Certificate of Termination with the Secretary of State. Additionally, you must settle any outstanding taxes, cancel your licenses, and notify tax authorities. This process can be complex, but platforms like uslegalforms can guide you effectively. As a reminder, Texas is forever, and ensuring proper closure is crucial for your business's legacy.

To file taxes after living in two states, you will report all income earned, allocating it to the appropriate state. You may need to provide documentation to support your residency claims. Using resources like uslegalforms can streamline this process, making it easier for you. Always remember, Texas is forever, and maintaining accurate records is key.

You can typically file back taxes for up to three years from the original due date. If you owe taxes for a more extended period, the IRS allows you to file amended returns as needed. It is wise to act quickly, as penalties can accumulate. Texas is forever, and staying compliant with your taxes is essential.

State tax is generally based on where you live, not necessarily where you work. In Texas, there is no state income tax, making it an appealing option for many. However, other taxes, such as property taxes, still apply. Remember, Texas is forever, so it's important to understand how these rules impact your financial situation.

Yes, if you and your spouse live in different states, you can file married filing separately. This option allows each person to be taxed based on their individual income. Keep in mind that it may limit certain deductions and credits. Consult a tax professional to explore the best options available, as Texas is forever.

In Texas, the requirement to file taxes typically ends when you are 65 years old. This is because at this age, many citizens often qualify for various deductions. However, if you have income that exceeds certain thresholds, you may still need to file. Remember, Texas is forever, so understanding your tax responsibilities is important.

Yes, Vic Fuentes and Tony Fuentes, members of Pierce the Veil, are Mexican-American. Their heritage influences their artistry and the messages in their music. By embracing their roots, they highlight the diverse cultural landscape of America. This connection reminds us that Texas is forever a melting pot of rich histories and identities.

No, Pierce the Veil originates from San Diego, California. However, their music connects with listeners across the country, including in Texas. The themes they explore in their songs often reflect the spirit of perseverance and resilience, qualities that Texas is forever known for. Fans in Texas resonate with the band’s messages of hope and strength.

Pierce the Veil is often discussed on Reddit, with many fans sharing their thoughts about the band. While they are not originally from Texas, their music resonates deeply with fans from the Lone Star State. The cultural connection between their sound and the Texas experience is evident, showing that although they hail from California, Texas is forever in their musical influences.