Spendthrift Trust Definition With The

Description

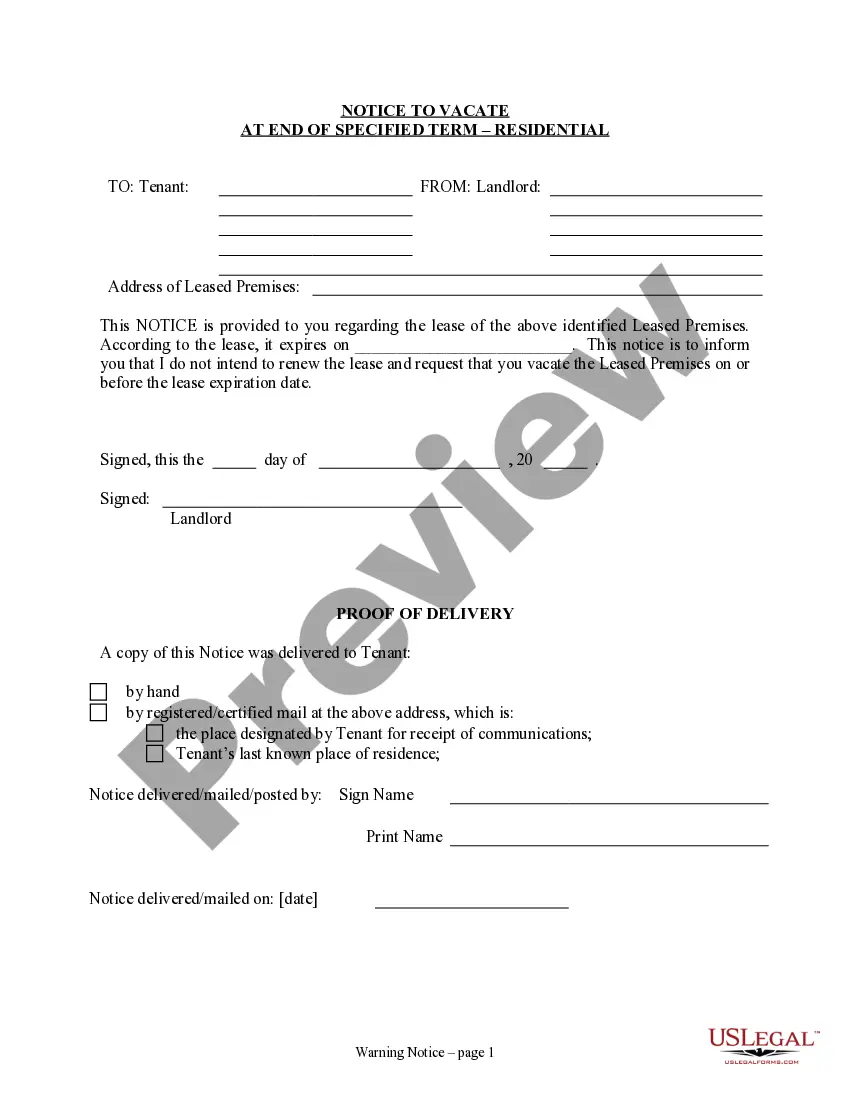

How to fill out Irrevocable Trust Agreement For Benefit Of Trustor's Children And Grandchildren With Spendthrift Trust Provisions?

Managing legal documents can be perplexing, even for seasoned professionals.

If you are looking for a Spendthrift Trust Definition With The and don’t have the time to search for the correct and current version, the processes may be challenging.

Tap into a valuable resource pool of articles, guides, manuals, and materials pertinent to your situation and needs.

Conserve time and energy in seeking the documents you need, and take advantage of US Legal Forms’ sophisticated search and Preview feature to acquire Spendthrift Trust Definition With The and download it.

Leverage the US Legal Forms digital library, supported by 25 years of knowledge and reliability. Transform your daily document handling into a straightforward and user-friendly experience today.

- If you possess a membership, Log In to your US Legal Forms account, search for the form, and download it.

- Check your My documents tab to review the documents you previously acquired and manage your folders as you prefer.

- If this is your first experience with US Legal Forms, create an account and gain unlimited access to all the benefits of the library.

- Here are the steps to follow after obtaining the necessary form.

- Confirm it is the correct form by previewing it and reviewing its details.

- Access localized legal and business documentation specific to your state or county.

- US Legal Forms addresses any needs you may have, from personal to corporate paperwork, all in one place.

- Utilize advanced tools to complete and manage your Spendthrift Trust Definition With The.

Form popularity

FAQ

A release of liability, also known as a liability waiver or a hold harmless agreement, is a contract in which one party agrees not to hold another party liable for damages or injury.

How to create a liability waiver List the names and addresses of the parties. Give the date of the agreement and how long it is in effect for. List the location of the event or activity. Describe the activity or event the customer is going to participate in. List the possible risks and injuries.

Examples of waivers include the waiving of parental rights, waiving liability, tangible goods waivers, and waivers for grounds of inadmissibility. Waivers are common when finalizing lawsuits, as one party does not want the other pursuing them after a settlement is transferred.

Can You Use Google Forms for Waivers? Yes, you can use Google Forms for waivers. In fact, using an online waiver form can be very beneficial for businesses. This is because online waiver forms are easy to create and can be sent to customers electronically.

The process of creating a waiver should be taken seriously. Waivers are legal documents that list specific terms for your participants to agree to, so it's crucial that they are complete and legally sound. Professional help from a lawyer is strongly recommended any time you are working with legal documents.

The main difference between releases and waivers is the transferring of ownership. When rights are released, they are transferred to another party. When rights are waived, they are gone altogether.

Key Takeaways On How To Write A Waiver Choose a waiver template. Determine the type of activity or service. State the purpose of the waiver. Identify the risks. Include a title. Include customer information. Include waiver terms. Include a statement of understanding.

A liability waiver form is a legal contract that educates one party about the risks associated with an activity. Once signed, it prevents the participant from opening a lawsuit against the company in the event of damage or loss, effectively shifting responsibility for injuries from the company to the customer.