Domestic Partner Affidavit With Ad And D

Description

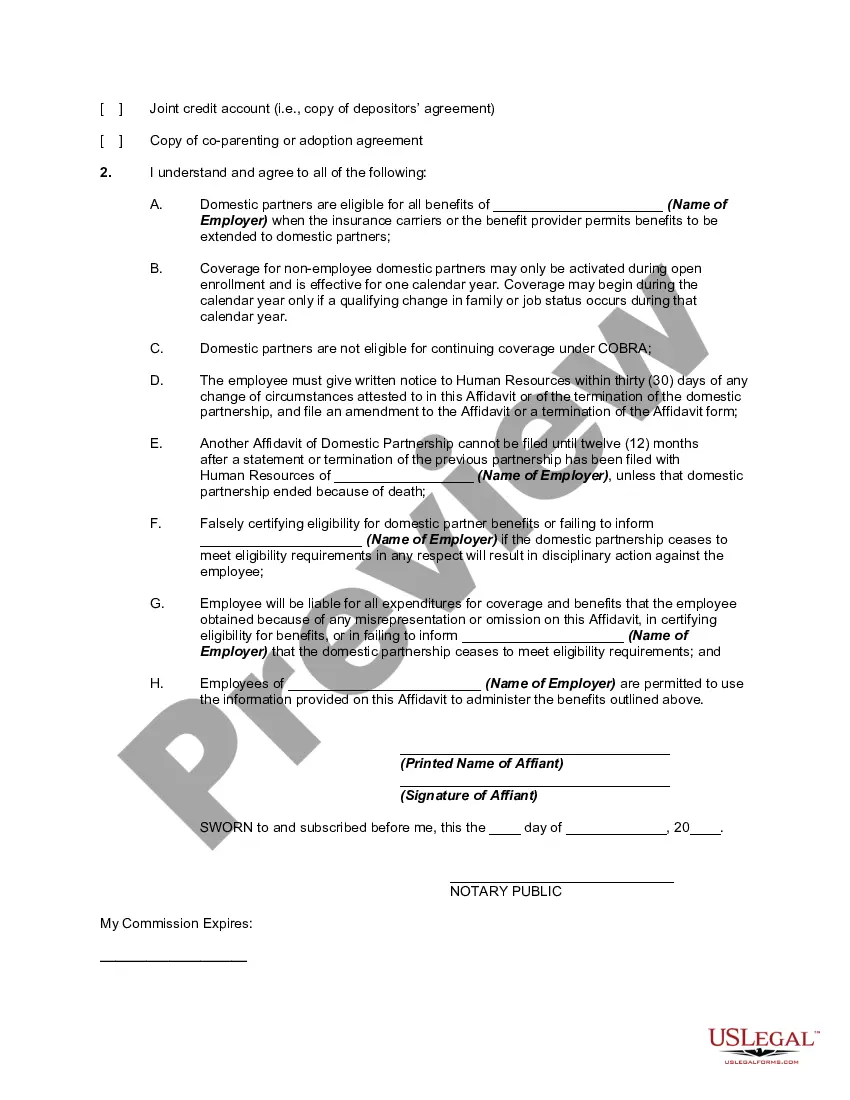

How to fill out Affidavit Of Domestic Partnership For Employer In Order To Receive Benefits?

Individuals frequently link legal documentation to something intricate that only an expert can manage.

In some respect, this is accurate, as creating a Domestic Partner Affidavit With Ad And D demands significant expertise regarding the subject matter, inclusive of state and county regulations.

However, with US Legal Forms, everything has become easier: pre-prepared legal documents for any personal and business circumstance tailored to state laws are gathered in a single online repository and are now accessible to everyone.

All templates in our repository are reusable: once acquired, they remain saved in your account. You can retrieve them anytime via the My documents tab. Discover all the advantages of using the US Legal Forms platform. Subscribe today!

- US Legal Forms provides over 85k current documents categorized by state and industry of application, so finding a Domestic Partner Affidavit With Ad And D or any other specific template only requires a few minutes.

- Users who have previously registered with an active subscription must Log In to their account and select Download to retrieve the form.

- New users on the platform must first establish an account and subscribe before they can save any legal documentation.

- Here is the detailed guide on how to obtain the Domestic Partner Affidavit With Ad And D.

- Examine the page content thoroughly to confirm it meets your needs.

- Review the form description or confirm it using the Preview option.

- If the previous sample does not meet your requirements, find another sample using the Search bar above.

- When you find the suitable Domestic Partner Affidavit With Ad And D, click Buy Now.

- Select a subscription option that aligns with your needs and budget.

- Create an account or Log In to continue to the payment page.

- Complete your subscription payment using PayPal or with your credit card.

- Choose the format for your document and click Download.

- Print your document or upload it to an online editor for faster completion.

Form popularity

FAQ

One simple way to do the calculation is to determine the difference between your company's cost of an employee-only monthly premium and the cost of an employee-plus-one monthly premium. Multiply that number by 12 and you will get your total.

Federal law treats benefits for spouses, children and certain dependents the same way. However, a domestic partner is not considered a spouse under federal law.

This plan covers your spouse or domestic partner for 60% of your coverage amount. If eligible children are covered, then your spouse or domestic partner is covered for 50% of your amount and each child for 20%.

The imputed income reflecting the additional employee and LANL-subsidized (employer) medical costs will show on your payslip as Imputed Inc DP. Your federal and state tax withholding will be increased to reflect this higher income and will therefore impact your paycheck.

Imputed income is defined as the value of the domestic partner coverage minus the after-tax amount contributed toward the coverage.