Confidential Declaration Of Domestic Partnership Form Dp-1a

Description

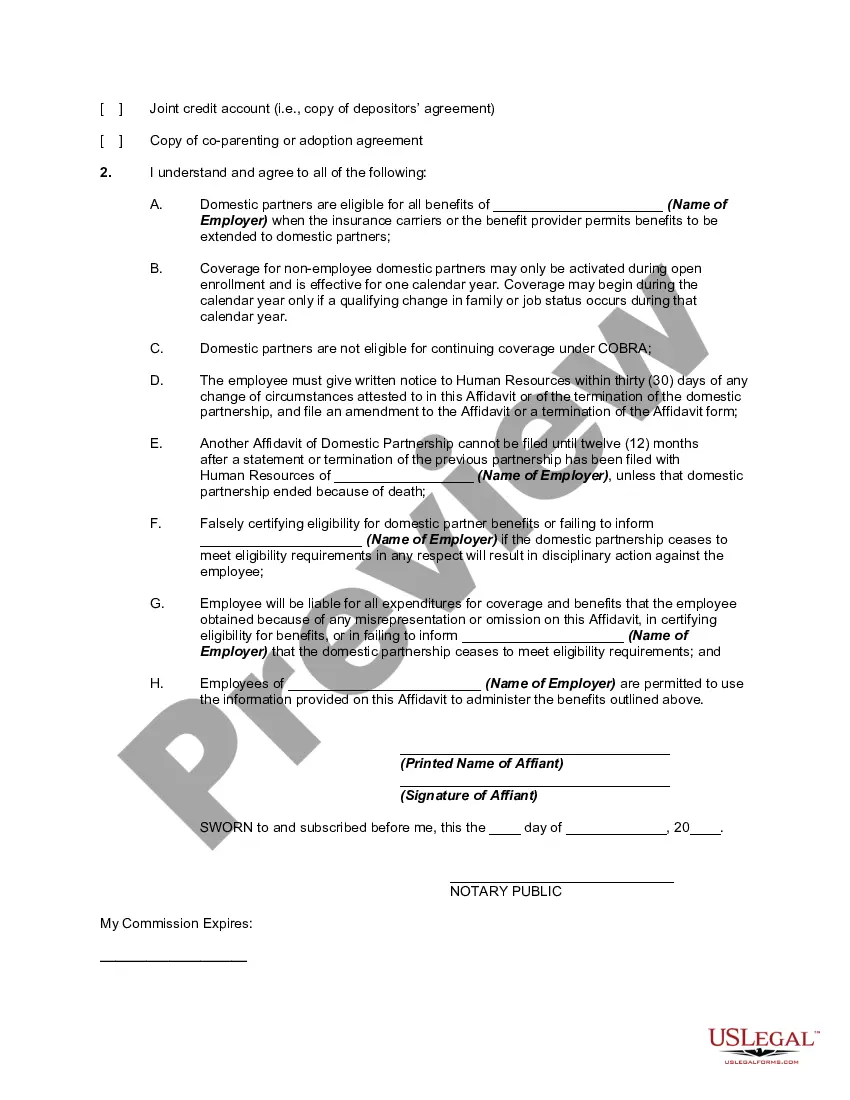

How to fill out Affidavit Of Domestic Partnership For Employer In Order To Receive Benefits?

Acquiring legal documents that comply with federal and state laws is essential, and the web provides various choices.

However, why spend time looking for the accurately composed Confidential Declaration Of Domestic Partnership Form Dp-1a example online when the US Legal Forms digital library already has those templates gathered in one location.

US Legal Forms is the largest online legal repository with more than 85,000 customizable templates prepared by lawyers for any commercial and personal need.

Examine the template using the Preview feature or through the text description to ensure it fits your needs. Search for another sample using the search tool at the top of the page if necessary. Hit Buy Now once you find the appropriate form and choose a subscription plan. Create an account or sign in and process your payment via PayPal or a credit card. Select the format for your Confidential Declaration Of Domestic Partnership Form Dp-1a and download it. All paperwork you find through US Legal Forms is reusable. To re-download and fill out previously acquired forms, navigate to the My documents section in your account. Enjoy the most comprehensive and user-friendly legal document service!

- They are simple to navigate with all documents organized by state and intended use.

- Our experts stay updated with legal changes, ensuring you can always trust your documents are current and compliant when acquiring a Confidential Declaration Of Domestic Partnership Form Dp-1a from our platform.

- Getting a Confidential Declaration Of Domestic Partnership Form Dp-1a is straightforward and fast for both existing and new users.

- If you possess an account with an active subscription, Log In and save the template you need in your desired format.

- If you are a first-time visitor to our site, follow the steps below.

Form popularity

FAQ

Ending a domestic partnership in California requires filing a termination request through the appropriate channels. You should complete the necessary forms, including the Confidential declaration of domestic partnership form dp-1a, and submit them to the county clerk. It's important to follow these steps carefully to ensure all legal matters are handled correctly. If you need guidance, uslegalforms can help you navigate the termination process smoothly.

Title 33 - Corporations, Partnerships and Associations. Chapter 44 - UNIFORM LIMITED LIABILITY COMPANY ACT OF 1996. Section 33-44-1002 - Application for certificate of authority. (8) whether the members of the company are to be liable for its debts and obligations under a provision similar to Section 33-44-303(c).

Bylaws? The incorporators or board of directors must adopt the corporation's initial bylaws. The bylaws set out how the business will operate, including what it can and cannot do. A corporation can put what they wish in the bylaws so long as it doesn't conflict with the law or the business' articles.

(a) Except as otherwise provided in subsection (b), all members of a limited liability company may enter into an operating agreement, which need not be in writing, to regulate the affairs of the company and the conduct of its business, and to govern relations among the members, managers, and company.

SECTION 33-44-409. General standards of member's and manager's conduct. (a) The only fiduciary duties a member owes to a member-managed company and its other members are the duty of loyalty and the duty of care imposed by subsections (b) and (c).

A South Carolina LLC operating agreement is a legal document that establishes how a company will conduct its affairs and run its operations. The agreement also includes financial information related to the company such as ownership interest, initial loans, capital contributions, and any other records.

But while it's not legally required in South Carolina to conduct business, we strongly recommend having an Operating Agreement for your LLC. (It doesn't matter whether you have one or more Members in the company, a written Operating Agreement is an essential internal document.)

SECTION 33-1-103. Designation of representation in magistrates' court; unauthorized practice of law. A corporation or partnership, as defined in this section, may designate an employee or principal of the corporation or partnership to represent it in magistrates' court.

Section 33-44-805 - Articles of termination (a) At any time after dissolution and winding up, a limited liability company may terminate its existence by filing with the Secretary of State articles of termination stating: (1) the name of the company; (2) the date of the dissolution; and (3) that the company's business ...