Discharge Garnishment With A Fixed Amount

Description

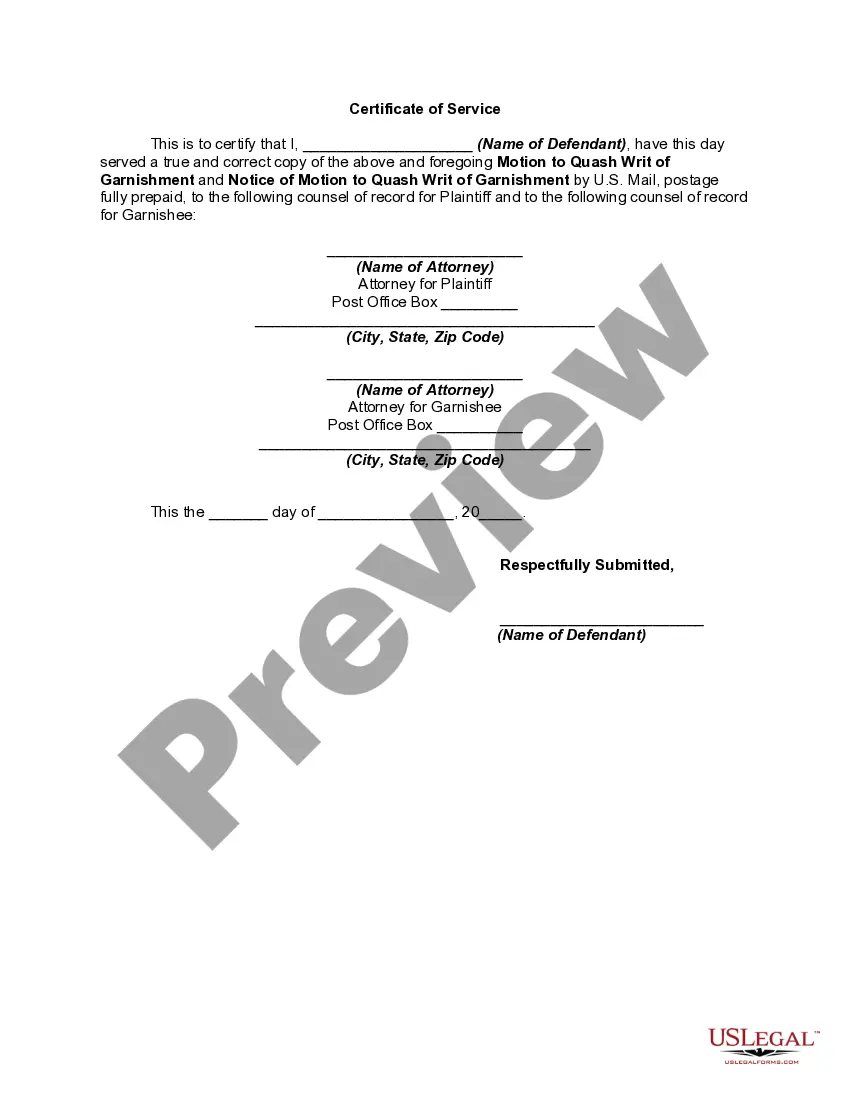

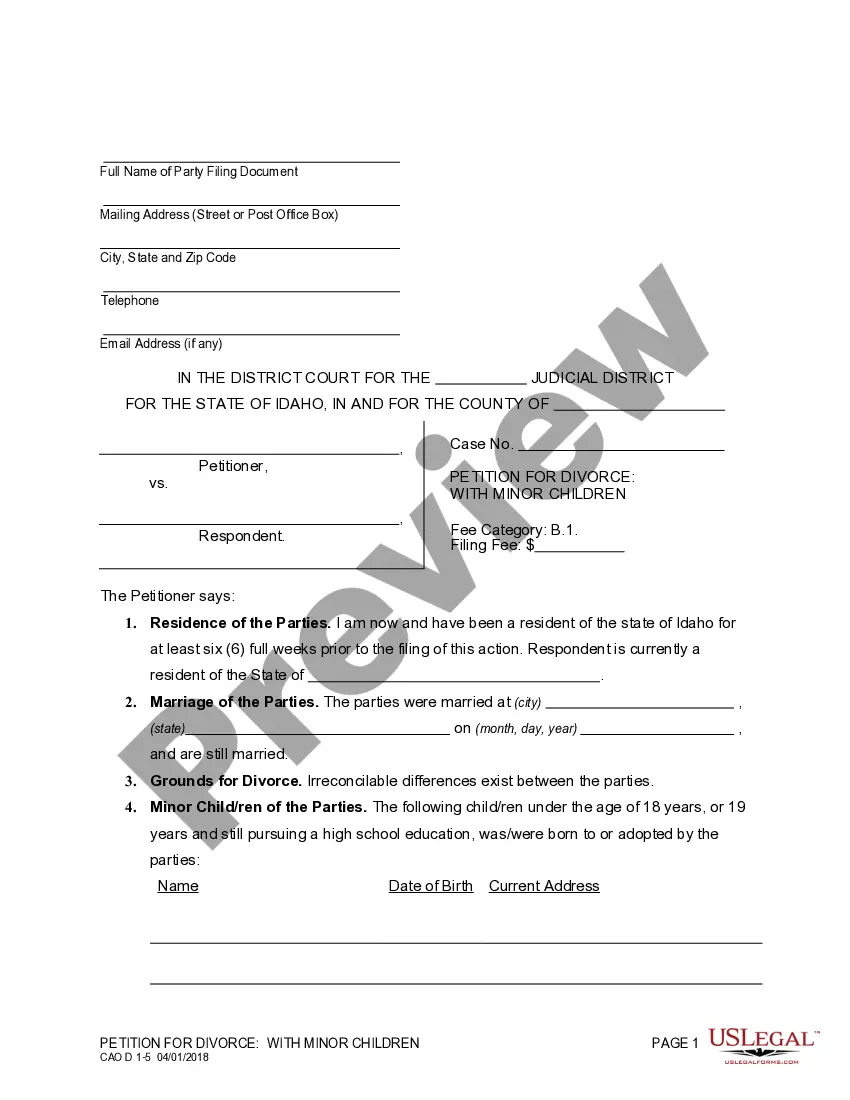

How to fill out Motion Of Defendant To Discharge Or Quash Writ Of Garnishment For Failure To Serve Copy Of Writ On Defendant And Notice Of Motion?

- If you are a returning user, log in to your account and access the necessary form. Confirm your subscription is active; renew it if required.

- For new users, begin by reviewing the form descriptions in Preview mode. Make sure the template matches your requirements and complies with local laws.

- Should you find discrepancies or need another template, utilize the Search tab to locate the correct document.

- To purchase the document, click on the Buy Now button and select the subscription plan that fits your needs. You will need to create an account for access.

- Complete your purchase by entering your payment details via credit card or PayPal.

- After the transaction is confirmed, download the form to your device. You can also access it later in the My documents section of your profile.

By following these steps, you will have efficiently obtained the necessary paperwork to discharge garnishment with a fixed amount. US Legal Forms provides a comprehensive library, ensuring you find the right form for your situation.

Don't hesitate to explore the extensive resources available at US Legal Forms to empower your legal endeavors!

Form popularity

FAQ

The maximum amount that can be garnished varies based on the type of debt. Generally, up to 25% of your disposable income may be taken for most debts, but certain cases can have different limits. If your goal is to discharge garnishment with a fixed amount, consider utilizing resources that my platform provides to help you navigate this process smoothly.

Yes, you have options to discharge garnishment with a fixed amount by filing for bankruptcy or negotiating with your creditor. In some cases, demonstrating financial hardship can result in a reduced payment plan. It's important to seek guidance from legal experts to ensure you fully understand your rights and available options.

The Federal law allows creditors to garnish up to 25% of your disposable earnings for most debts. However, certain types of debts, like child support or taxes, may have different limits. If you want to understand how to discharge garnishment with a fixed amount, consider speaking with a legal professional for personalized advice.

To effectively discharge garnishment with a fixed amount, explore options like negotiating a repayment plan. Communicate with your creditor to reach an agreement that might reduce the amount they garnish. Additionally, you can seek legal advice to assess your situation and find potential exemptions that may apply to your case.

In New Jersey, the law limits wage garnishment to a maximum of 10% of your income or the amount that exceeds a specific weekly threshold, whichever is lower. This rule helps protect your essential earnings while allowing creditors to collect debts. Knowing how to discharge garnishment with a fixed amount is important, and platforms like uslegalforms can guide you through this complex process and help you manage your financial obligations.

The IRS can garnish a portion of your paycheck based on your income and filing status, typically up to 25% of your disposable earnings. Also, they consider how much you need to live on, ensuring that you can meet basic expenses. If you find yourself facing this situation, understanding how to discharge garnishment with a fixed amount can provide a way to regain control of your finances.

A release of garnishment means that the court has issued an order that terminates the garnishment process. This release allows you to recover the funds that were previously withheld from your income or assets. Effectively discharging garnishment with a fixed amount ensures you can access and utilize your earnings again. Utilizing resources from uslegalforms can make this process more straightforward, guiding you through each step.

A 'notice to discharge and release garnishee' is a formal communication notifying all parties involved that the garnishment is being lifted. This legal document indicates that the creditor has agreed to release the hold on the garnishee's assets or wages. Successfully discharging garnishment with a fixed amount allows you to regain access to your financial resources. You can navigate this process smoothly with the insights provided by uslegalforms.

'Garnishee discharged' refers to a situation where the individual or entity holding the funds is relieved of the obligation to keep the funds frozen for the creditor. Essentially, it means that the garnishee, often an employer, can stop withholding funds from your paycheck. This process can help you discharge garnishment with a fixed amount and regain control over your earnings. Platforms like uslegalforms can help clarify this process for you.

When you dismiss a garnishment, it means the court has officially ended the garnishment proceedings. This can happen for various reasons, such as proof of payment or changes in your financial situation. Understanding how to discharge garnishment with a fixed amount remains crucial in these instances, as it allows you to move on without the stress of leftover obligations. Using tools from uslegalforms can simplify this paperwork and ensure proper filing.