Discharge Garnishment For Us

Description

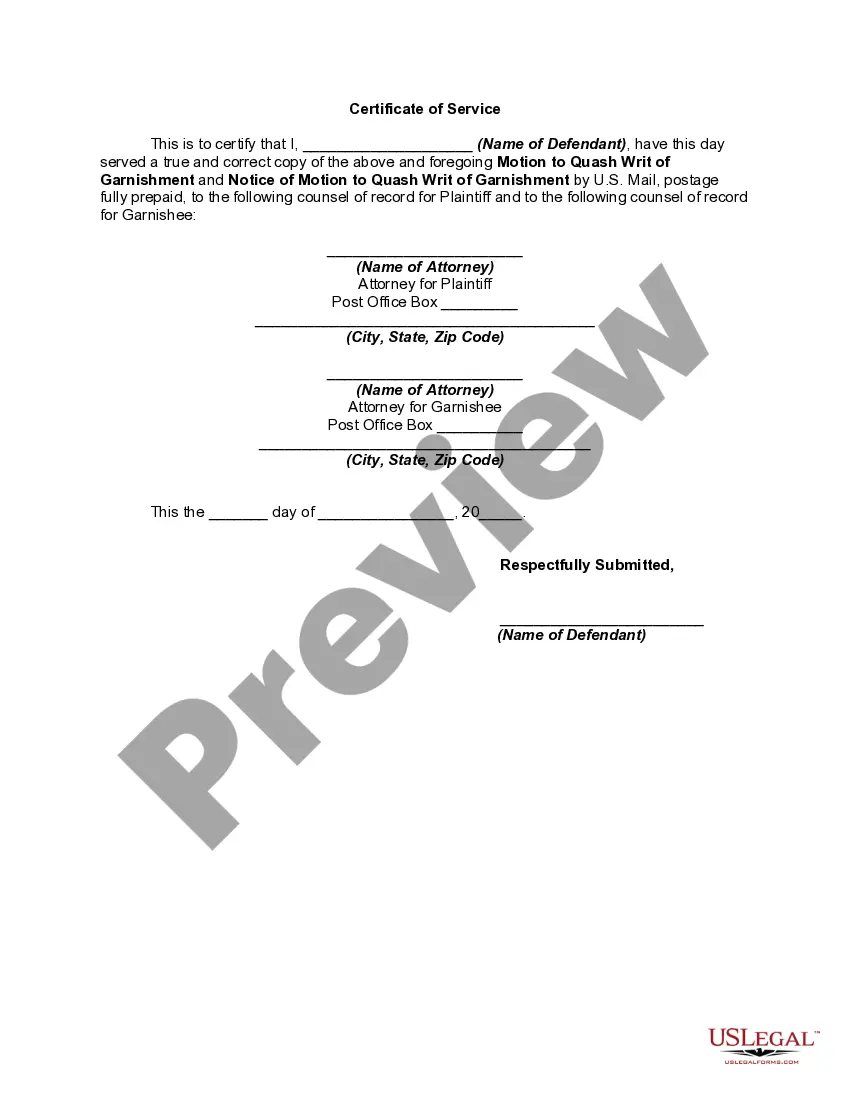

How to fill out Motion Of Defendant To Discharge Or Quash Writ Of Garnishment For Failure To Serve Copy Of Writ On Defendant And Notice Of Motion?

- If you are a returning user, log into your account on the US Legal Forms website and locate the form template you need. Ensure your subscription is active; if not, renew it according to your current plan.

- For first-time users, start by exploring the available forms. Check the Preview mode and form description to confirm that you select the correct one that meets your needs and jurisdiction's requirements.

- Should you need to search for another template, utilize the Search tab to find the right form. If you find the appropriate document, proceed to the next step.

- Make your purchase by selecting the 'Buy Now' button and choosing a subscription plan that works best for you. You'll need to register an account for full access.

- Complete your transaction by entering your payment information via credit card or PayPal account for the subscription.

- Finally, download your completed form to your device. You can also access it anytime from the 'My Forms' section in your profile.

US Legal Forms provides a robust collection of over 85,000 easily fillable and editable legal forms at a competitive cost. This extensive library ensures you find the right documents with the guidance of premium experts when needed.

Take control of your legal documents today. Start using US Legal Forms for all your legal needs and experience the convenience of their vast resources.

Form popularity

FAQ

To complete a challenge to garnishment form, gather all relevant case information, including the amount being garnished and the creditor’s details. Ensure you state your reasons for challenging the garnishment clearly. US Legal Forms can provide customizable templates that can guide you in compiling the necessary information accurately.

Writing a hardship letter for wage garnishment requires explaining your current financial struggles clearly. Be honest about your situation, detailing how the garnishment negatively impacts your ability to meet basic needs. Using a structured template, like those offered by US Legal Forms, can assist you in clearly presenting your case.

In your letter to stop a garnishment, clearly state your intent and explain your reasons concisely. Include any evidence that supports your claim, such as a recent job loss or medical expenses. This proactive approach can help you regain control of your income and reduce financial strain.

To fill out a wage garnishment exemption form, begin by gathering your financial information, including income and expenses. Provide accurate details regarding your financial hardship and specify the exemptions you qualify for under the law. Using services like US Legal Forms can ensure you complete the form correctly and efficiently.

Filling out a challenge to a garnishment form involves providing key information regarding your case. Ensure you include details like your name, the creditor's name, and the reason for your challenge. Platforms like US Legal Forms offer templates that can simplify this process, guiding you step-by-step.

To negotiate a wage garnishment, first contact your creditor directly. Present your financial situation honestly and propose a realistic repayment plan. Often, creditors prefer to receive some payment rather than pursue extensive legal action. Utilizing resources like US Legal Forms can help you prepare for this negotiation.

You may face multiple garnishments at once, but the total amount deducted from your paycheck is subject to legal limits. Generally, a single creditor is prioritized, but additional creditors can file for garnishments if the first is not fully satisfied. Managing these situations effectively is crucial. Learning how to discharge garnishment for us can safeguard your income and provide relief.

In Arizona, various types of creditors can garnish wages, including credit card companies, medical providers, and government entities. To initiate wage garnishment, these creditors obtain a court order against you. It is vital to understand your rights and the process involved. Discharging garnishment for us can offer a pathway to regain financial peace.

The maximum amount that can be garnished from your paycheck is determined by specific laws. Federal law permits garnishment up to 25% of your disposable earnings. Some states have stricter guidelines that could limit the amount further. Familiarizing yourself with the discharge garnishment for us process can protect your income from excessive deductions.

The maximum amount that can be garnished from a paycheck depends on federal and state laws. Generally, federal law allows creditors to garnish up to 25% of your disposable income. However, state laws may vary and can offer more protection. Knowing how to discharge garnishment for us can help you navigate these rules effectively.