Gift Property Form With Decimals

Description

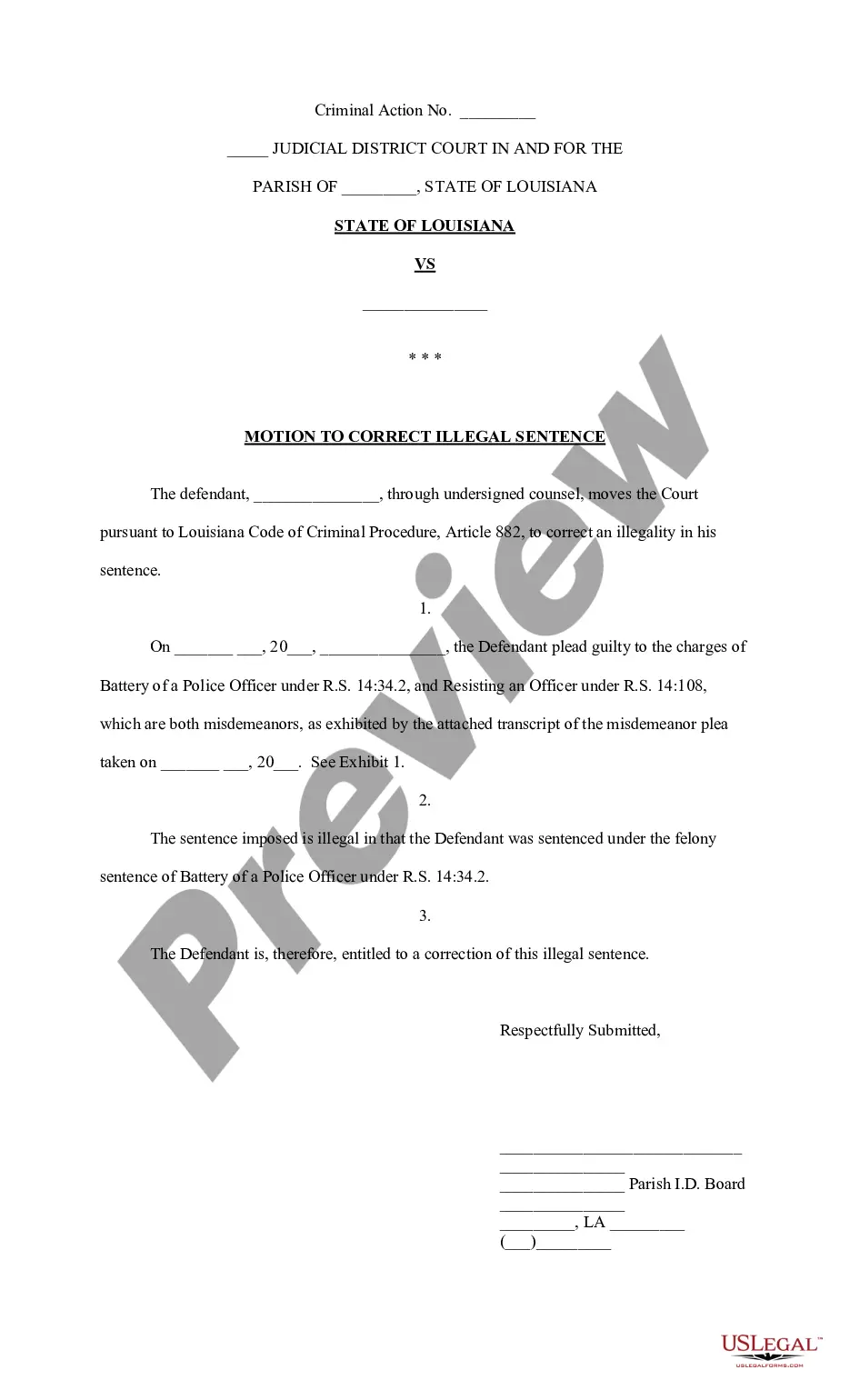

How to fill out Gift Of Entire Interest In Literary Property?

It’s common knowledge that becoming a legal expert isn’t achievable overnight, nor can you swiftly learn to prepare the Gift Property Form With Decimals without a specialized background.

Compiling legal papers is a lengthy procedure that necessitates specific training and expertise. So why not entrust the preparation of the Gift Property Form With Decimals to the experts.

With US Legal Forms, one of the most comprehensive legal document archives, you can discover everything from court forms to templates for internal communication.

You can access your documents again from the My documents tab at any time.

If you’re an existing customer, you can simply Log In, find, and download the template from the same tab.

- Find the form you require using the search bar at the top of the page.

- Preview it (if this feature is available) and review the accompanying description to see if the Gift Property Form With Decimals suits your needs.

- Restart your search if you need another form.

- Create a free account and select a subscription plan to purchase the form.

- Click Buy now. Once the payment is finalized, you can obtain the Gift Property Form With Decimals, complete it, print it, and send or mail it to the appropriate individuals or organizations.

Form popularity

FAQ

Not every estate is required to file a form 706, also known as the United States Estate (and Generation-Skipping Transfer) Tax Return. Generally, an estate must file this form if its gross value exceeds the federal exemption threshold. However, if you're gifting property, it is often easier to manage through a Gift property form with decimals, which can accurately address fractional interests. Utilizing platforms like uslegalforms can simplify this process and help ensure compliance with tax regulations.

The tax basis of property received as a gift is generally the same as the donor's basis, which means you will take the original value of the property. If the property's market value falls below the donor's basis, the basis for a gain or loss upon its sale may vary. It's important to accurately fill out a Gift property form with decimals to reflect this information correctly. Uslegalforms offers comprehensive resources to ensure you understand your tax obligations related to gifted property.

To document a gift for tax purposes, you need to complete a Gift property form with decimals. This form requires you to include details about the donor and recipient, along with the property's fair market value. Keep a copy of this form for your records, as it helps in accurately reporting any potential gift taxes. Utilizing platforms like uslegalforms can simplify this process by providing templates that are easy to fill out.

Line 12 on Form 709 pertains to the total taxable gifts for the year. Here, you include the total value of all gifts given, minus any exclusions and deductions. This form requires precise information, and using the gift property form with decimals aids in accurately detailing your transactions. Properly filling out this line helps in correctly assessing your gift tax obligations.

To calculate gift tax, start by determining the value of the gift you are giving. Subtract any applicable exclusions, such as the annual exclusion limit, from this value. You will then apply the gift tax rates to the remaining amount to find your tax liability. Using the gift property form with decimals helps ensure accurate reporting and calculations, making the process smoother.

To document a gift for tax purposes, you must keep records that show the value, date, and nature of the gift. Using a gift property form with decimals can help establish clarity regarding the gift’s worth. Proper documentation not only simplifies your tax filing but also safeguards against potential audits.

Form 709 is used to report gifts that exceed the annual exclusion limit and applies to gift taxes. It can also address situations involving inheritance when property is transferred. If you’re using a gift property form with decimals, it’s essential to report accurately to avoid complications with the IRS.

The basis of property given as a gift is typically the fair market value at the time of the transfer. This amount is crucial for determining tax consequences, especially when reporting on a gift property form with decimals. Understanding this can help you accurately assess any potential capital gains taxes involved.

Some common tax mistakes include incorrect deductions, failing to properly report income, and misunderstanding the implications of gift taxes. Individuals often miscalculate values on forms, particularly when handling gifts using a gift property form with decimals. Staying informed about tax regulations can help you avoid these pitfalls.

When completing tax returns, it is standard practice to round to the nearest dollar. However, when using a gift property form with decimals, maintain the decimal values for clarity in reporting specific amounts. This practice allows for more precise calculations when assessing your tax liability.