Create A Petition Online With Google Docs

Description

How to fill out Petition To Probate Lost Will?

Utilizing legal document examples that adhere to federal and local statutes is crucial, and the internet provides numerous choices to select from.

However, what’s the benefit of squandering time searching for the appropriate Create A Petition Online With Google Docs template online when the US Legal Forms digital library already has such samples consolidated in one location.

US Legal Forms is the premier online legal repository with over 85,000 editable templates created by attorneys for any business or personal scenario. They are easy to navigate with all documents organized by state and intended use.

All documents you access through US Legal Forms are reusable. To redownload and fill out previously bought forms, navigate to the My documents section in your profile. Take advantage of the most comprehensive and user-friendly legal document service!

- Our experts stay informed with regulatory changes, ensuring your documents are current and compliant when acquiring a Create A Petition Online With Google Docs from our site.

- Obtaining a Create A Petition Online With Google Docs is quick and straightforward for both existing and new users.

- If you already possess an account with a valid subscription, Log In and download the document template you need in the desired format.

- If you are a newcomer to our site, follow the instructions below.

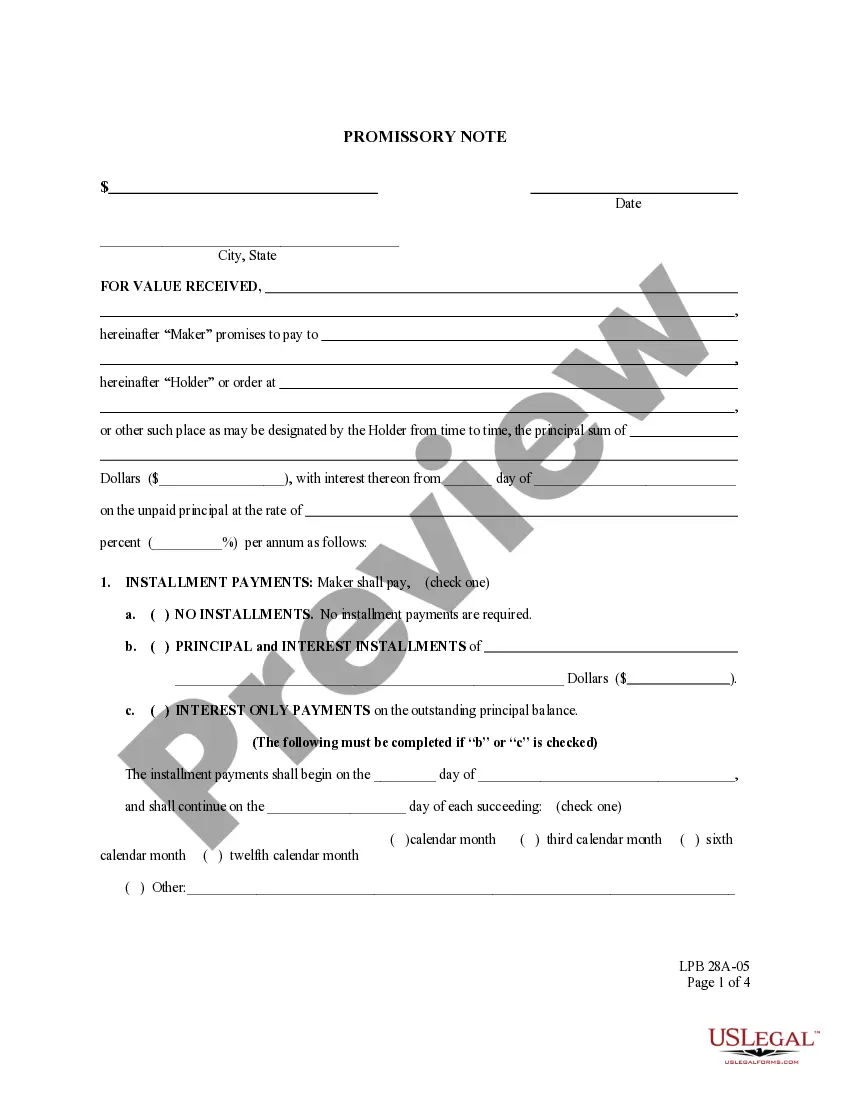

- Examine the template using the Preview feature or through the text outline to ensure it meets your requirements.

Form popularity

FAQ

To create an online registration form using Google Docs, start with a blank document and list the fields necessary for registration, such as names, email addresses, and contact numbers. Structure the document with clear instructions and organized sections to enhance understanding. You can share the form with your audience via link to facilitate easy sign-ups.

How to File and Pay Sales Tax in Maryland File online ? Visit the Maryland Department of Revenue's Comptroller's Office. ... File by mail ? You can use Form 202 and file and pay through the mail, though you must file and pay online if your tax liability in the previous year was $1,000,000 or more.

You can file Form 1040-X, Amended U.S. Individual Income Tax Return electronically with tax filing software to amend tax year 2020 or later Forms 1040 and 1040-SR, and tax year 2021 or later Forms 1040-NR. If amending a prior year return originally filed on paper, then the amended return must also be filed on paper.

Form 511 is used by an Electing PTE to file an income tax return for a specific tax year or period and to remit Electing PTE tax paid with respect to all members' distributive or pro rata shares of income.

The Maryland Form 510 A Pass-Through Entity Income Tax Return must be filed electronically if the pass-through entity has generated a business tax credit from Form 500CR or a Heritage Structure Rehabilitation Tax Credit from Form 502S to pass on to its members.

You must file your Maryland Amended Form 502X electronically to claim, or change information related to, business income tax credits from Form 500CR. Changes made as part of an amended return are subject to audit for up to three years from the date that the amended return is filed.

You can download tax forms using the links listed below. Request forms by e-mail. You can also e-mail your forms request to us at taxforms@marylandtaxes.gov. Visit our offices.

If you are sending a Form 502 or Form 505 (with a payment) through the US Postal Service, send it to: Comptroller of Maryland, Payment Processing, PO Box 8888, Annapolis, MD 21401-8888.

How to File a Maryland Tax Amendment. If you need to change or amend an accepted Maryland State Income Tax Return for the current or previous Tax Year, you need to complete Form 502X (residents) or Form 505X (nonresidents and part-year residents) and 505NR (nonresident income tax calculation).