Tax Escrow For Closing

Description

How to fill out Agreement For Direct Payment Of Taxes, Assessments, And/or Insurance And Waiver Of Escrow To Be Held By Lender?

Regardless of whether it's for professional reasons or personal matters, individuals must manage legal circumstances at some stage in their lives.

Completing legal documents requires meticulous focus, starting with choosing the correct form template.

Complete the account registration form, choose your payment method: you can utilize a credit card or PayPal account. Select the file format you prefer and download the Tax Escrow For Closing. After downloading, you can fill out the form using editing software or print it to complete manually. With a vast US Legal Forms catalog available, you won't need to waste time searching for the right template online. Utilize the library’s straightforward navigation to find the appropriate form for any situation.

- For example, selecting an incorrect version of the Tax Escrow For Closing will result in rejection upon submission.

- Thus, it's crucial to obtain a trustworthy source for legal forms like US Legal Forms.

- To acquire a Tax Escrow For Closing template, follow these simple instructions.

- Locate the sample you need via the search bar or catalog navigation.

- Review the description of the form to confirm it fits your situation, state, and county.

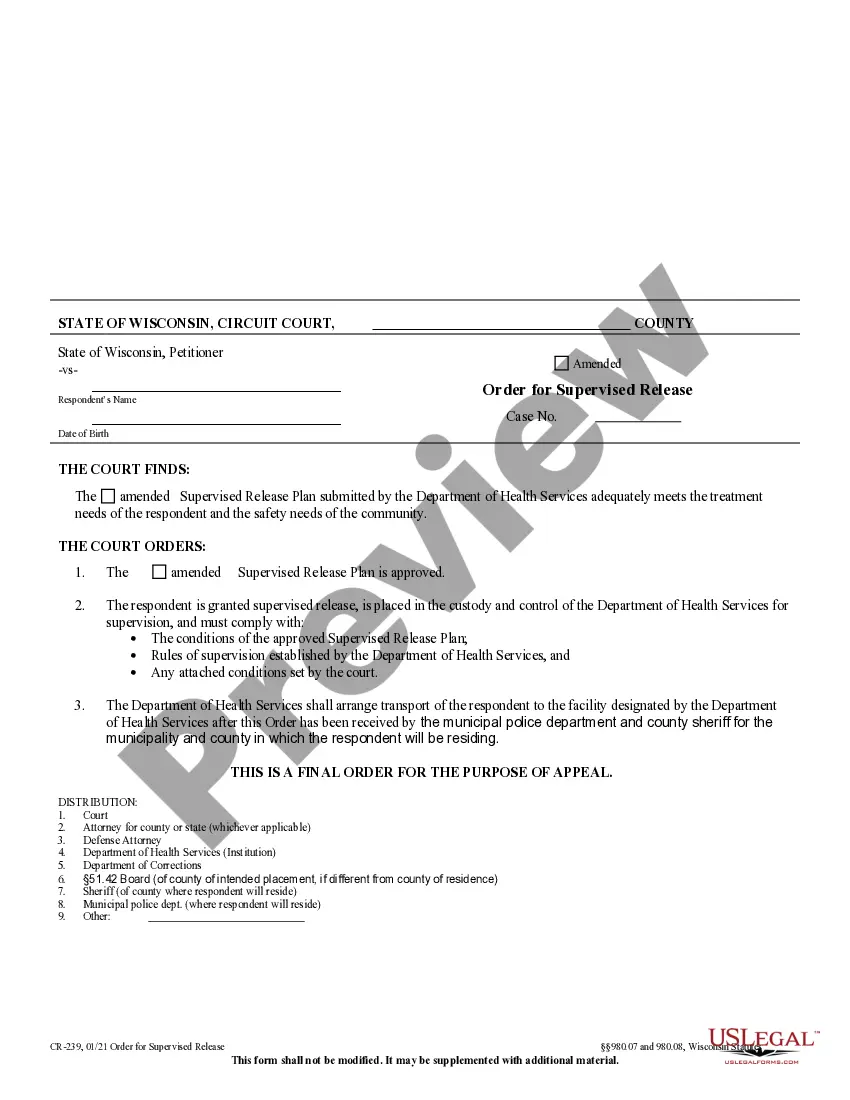

- Click on the preview of the form to view it.

- If it’s not the correct form, return to the search feature to find the Tax Escrow For Closing template you need.

- Obtain the file once it aligns with your requirements.

- If you possess a US Legal Forms account, simply click Log in to access previously stored documents in My documents.

- If you don't have an account yet, you can acquire the form by clicking Buy now.

- Select the suitable pricing option.

Form popularity

FAQ

To claim escrow on taxes, you will need to keep track of any payments made into your escrow account throughout the year. If your escrow account includes property taxes or mortgage interest, you can often deduct these amounts on your tax return. Utilizing tax escrow for closing can help you manage these payments efficiently, ensuring you have the funds available when it's time to file.

S form is typically issued during the closing process if you sold real estate. This form reports the sale of the property and is important for tax purposes. If you have used tax escrow for closing, ensure that all your documentation is in order to avoid any issues with your 1099S. You may want to consult with a tax advisor to confirm your reporting obligations.

An escrow refund generally does not count as taxable income. When you receive a refund from your tax escrow for closing, it is simply a return of your own funds that were previously held. Therefore, you do not need to report it as income on your tax return. However, if you have questions about your specific situation, consulting a tax professional may provide clarity.

To claim your closing costs on taxes, you will need to gather all relevant documents, such as your closing statement and any receipts for expenses. When filing your taxes, report these costs on Schedule A if you itemize deductions. Tax escrow for closing can help ensure that you have the necessary funds set aside for these expenses, making it easier to manage your finances.

The escrow balance for a mortgage refers only to that money set aside to pay for obligations like taxes and insurance that are paid on your behalf by your mortgage servicer. The principal balance refers instead to the amount of the home loan that is still outstanding.

It's automatic Having your mortgage lender or servicer hold your property tax and homeowners insurance payments in escrow ensures that those bills are paid on time, automatically.

What Can You Do With an Escrow Refund Check? Bolster your household emergency fund. Pay down your credit cards. Make an extra payment on your car loan or mortgage.

The escrow account calculations for purchase loans is essentially 12 months of homeowner's insurance, 3 months of additional insurance, and 3 months of property taxes.

How does an escrow account work? To set up your mortgage escrow account, the lender will calculate your annual tax and insurance payments, divide the amount by 12 and add the result to your monthly mortgage statement.