Escrow Taxes On New Construction

Description

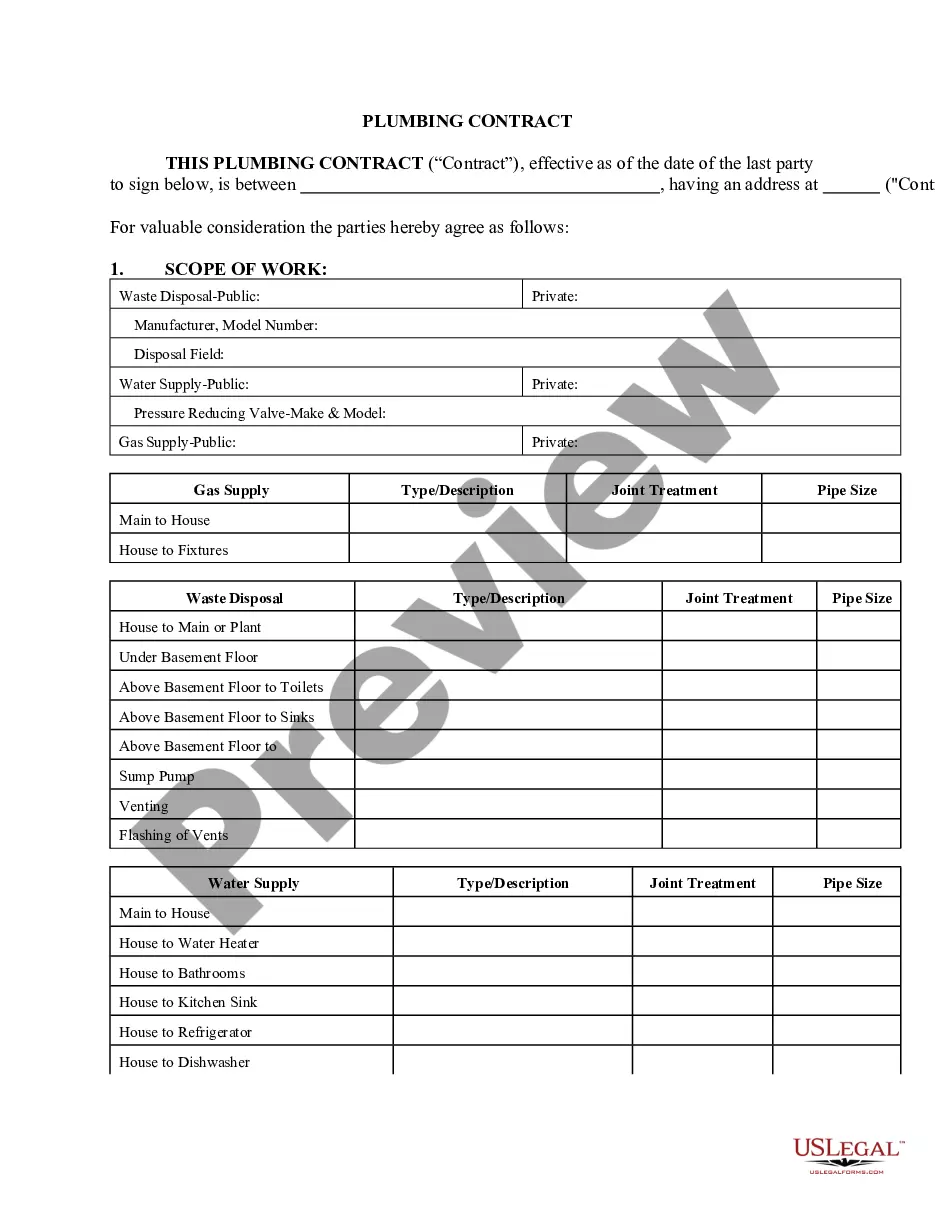

How to fill out Agreement For Direct Payment Of Taxes, Assessments, And/or Insurance And Waiver Of Escrow To Be Held By Lender?

Accessing legal templates that comply with federal and local regulations is essential, and the internet provides many choices to choose from.

However, what’s the benefit in spending time searching for the suitable Escrow Taxes On New Construction example online if the US Legal Forms online library already houses such templates in one location.

US Legal Forms is the largest online legal repository with over 85,000 fillable templates created by lawyers for any business and personal situation.

Review the template using the Preview feature or through the text description to ensure it fits your requirements.

- They are easy to navigate with all documents categorized by state and intended use.

- Our experts keep up with legal updates, ensuring your paperwork is always current and compliant when obtaining an Escrow Taxes On New Construction from our site.

- Getting an Escrow Taxes On New Construction is fast and straightforward for both existing and new users.

- If you already have an account with an active subscription, Log In and save the document sample you need in the correct format.

- If you are a newcomer to our site, follow the steps below.

Form popularity

FAQ

Property taxes on new construction can vary significantly, depending on local regulations and the assessed value of the property. In some cases, new constructions may benefit from temporary tax abatements or exemptions, which can result in lower payments initially. However, as the property is completed and assessed, taxes may rise to reflect the property's full value. It's advisable to consult with local tax authorities or use resources like US Legal Forms to understand the specific implications of escrow taxes on new construction in your area.

To set up a construction escrow account, start by selecting a trusted escrow agent or financial institution that specializes in handling escrow taxes on new construction. Next, gather all required documents and funds needed for the escrow account. You will then work with the escrow agent to establish the terms, including payment schedules and distribution of funds to contractors. Finally, ensure that you review and sign all agreements to protect your interests throughout the construction process.

Estimating taxes on new construction involves researching local tax rates and assessing the value of your new home. You can typically find this information through your local tax assessor's office or online resources. Additionally, consider using tools or calculators that can provide estimates based on similar properties. For further assistance, US Legal Forms offers guides that can help you estimate your escrow taxes on new construction accurately.

Escrow on new construction involves an arrangement where funds are held by a third party until certain conditions are met. Typically, your lender will establish an escrow account to manage payments for property taxes and insurance during the construction phase. This process ensures that funds are available when needed, providing peace of mind as your new home is built. You can learn more about managing escrow through US Legal Forms, which offers valuable insights.

How does an escrow account work? To set up your mortgage escrow account, the lender will calculate your annual tax and insurance payments, divide the amount by 12 and add the result to your monthly mortgage statement.

Generally, the buyer's or seller's real estate agent will open the escrow. As soon as you complete the purchase agreement, the agent will place the buyer's initial deposit, if any, into the escrow account at a title company or into the real estate broker's account.

This is a great question because there is a lot of onus placed on the buyer, even with an escrow account. While your loan servicer is the one responsible for handling your property tax and insurance payments, mistakes are made, and you are the one who will be held liable for the full, on-time payment.

?An escrow shortage can occur when the amount included in your monthly payment that is allocated to pay for your property taxes and homeowner's insurance doesn't cover (or isn't projected to cover) the actual cost of the taxes or insurance when the bill for those amounts comes due,? says Baker.

The assessment of first-year property taxes for new construction homes can be calculated based on either sale price or what is known as the cost approach. The latter is a combination of the replacement value of the house and the value of the land. This can result in a lower appraisal.