Agreement Payment Taxes Withheld

Description

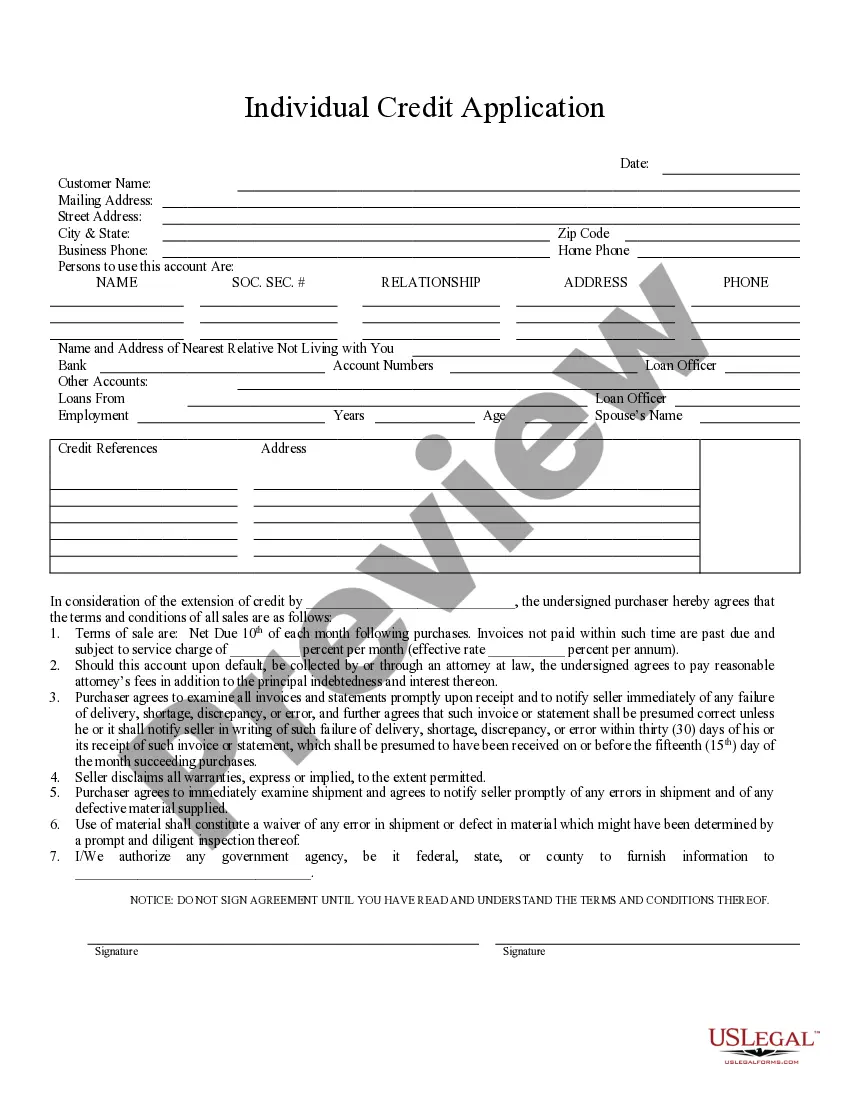

How to fill out Agreement For Direct Payment Of Taxes, Assessments, And/or Insurance And Waiver Of Escrow To Be Held By Lender?

Legal paperwork organization may be perplexing, even for the most proficient experts.

When searching for a Payment Agreement Regarding Withheld Taxes and lacking the time to dedicate to locating the correct and updated version, the procedures can be overwhelming.

US Legal Forms addresses any requirements you might have, ranging from personal to business documents, all in one centralized location.

Employ cutting-edge tools to complete and manage your Payment Agreement Regarding Withheld Taxes.

Here are the steps to follow after accessing the form you require: Confirm it is the correct form by previewing it and reviewing its details. Ensure the sample is accepted in your state or county. Click Buy Now when you're prepared. Choose a monthly subscription plan. Select the file format you need, and Download, complete, eSign, print, and send your documents. Experience the US Legal Forms online catalog, supported by 25 years of experience and reliability. Transform your daily document management into a straightforward and user-friendly process today.

- Access a database of articles, tutorials, and guides related to your situation and needs.

- Save time and energy searching for the documents you need, and utilize US Legal Forms' advanced search and Review tool to locate Payment Agreement Regarding Withheld Taxes and obtain it.

- If you possess a membership, Log In to your US Legal Forms account, look for the form, and obtain it.

- Check your My documents tab to view the documents you previously downloaded and manage your folders as desired.

- If it's your first experience with US Legal Forms, create a free account to have unlimited access to all the platform's benefits.

- A robust online form repository could be transformative for anyone aiming to manage these scenarios effectively.

- US Legal Forms stands as a leader in online legal documentation, boasting over 85,000 state-specific legal forms accessible at any time.

- With US Legal Forms, you can access state or county-specific legal and business documents.

Form popularity

FAQ

You must make your request in writing and attach evidence to support your application. Complete the application form online (it can be saved to your computer). When you have completed the application, you can lodge it online by logging into Online services for business.

More In Pay For employees, withholding is the amount of federal income tax withheld from your paycheck. The amount of income tax your employer withholds from your regular pay depends on two things: The amount you earn. The information you give your employer on Form W?4.

To get a refund of excess or incorrectly withheld Part XIII tax, a non-resident has to fill out Form NR7-R, Application for Refund of Part XIII Tax Withheld. The CRA has to receive this form no later than two years from the end of the calendar year in which the tax was sent to the CRA .

FICA contributions are shared between the employee and the employer. 6.2% of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 6.2%. However, the 6.2% that you pay only applies to income up to the Social Security tax cap, which for 2022 is $147,000 ($160,200 for 2023).

Completing the NR4 Summary Year end or tax year-end. ... Line 1 - Non-resident account number. ... Name and address of payer or agent. ... Line 88 - Total number of NR4 slips filed. ... Lines 18 and 22 - Amounts reported on NR4 slips. ... Lines 26 and 28 - Amounts reported on forms NR601 or NR602. ... Line 30 - Total.