Aumento Alquiler Formula

Description

How to fill out Sample Letter For Notification Of Rent Increase From Landlord To Tenant?

Managing legal documents can be daunting, even for the most skilled professionals.

When you’re looking for an Aumento Alquiler Formula and don’t have the time to devote to finding the correct and updated version, the process can be stressful.

US Legal Forms meets all your needs, from personal matters to business paperwork, all in one location.

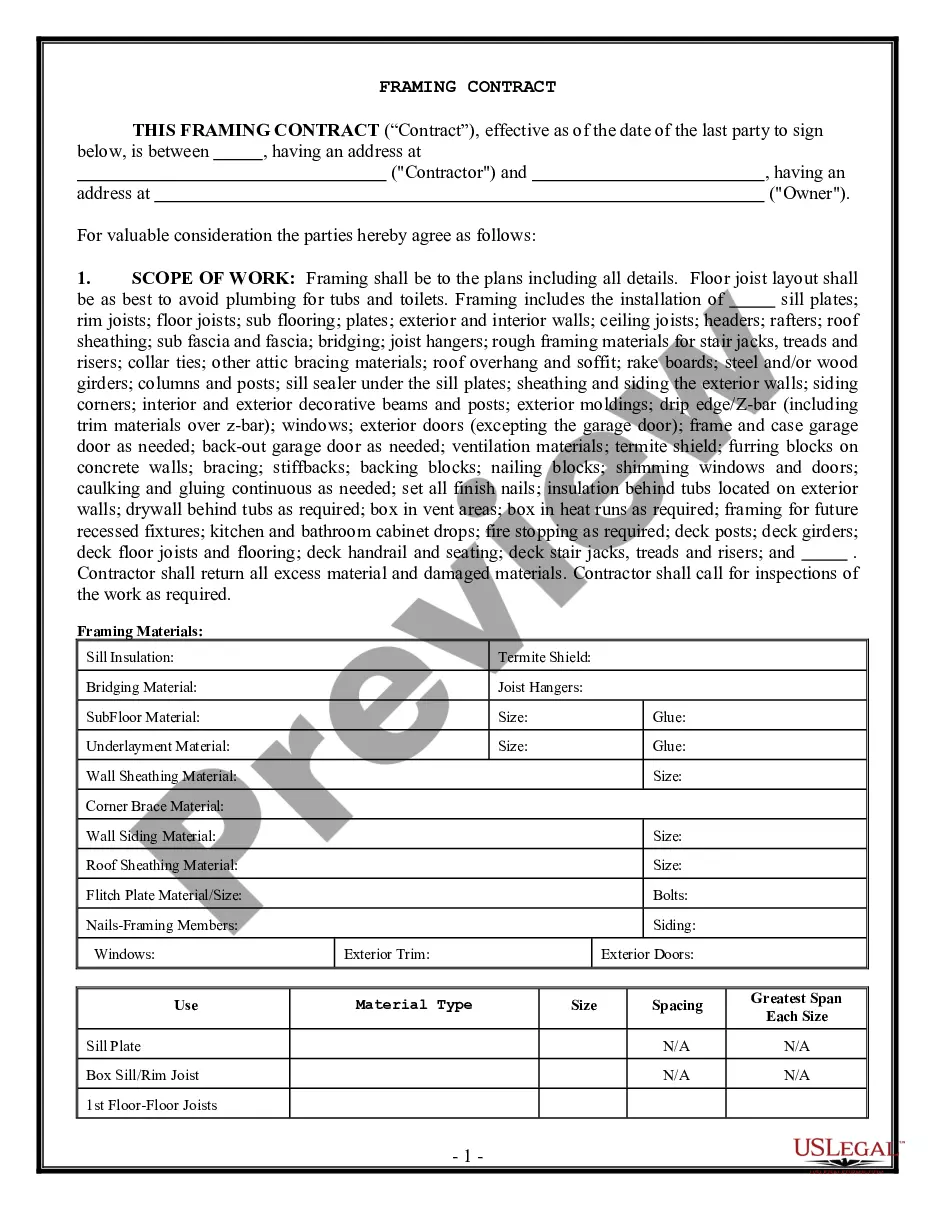

Employ sophisticated tools to fill out and manage your Aumento Alquiler Formula.

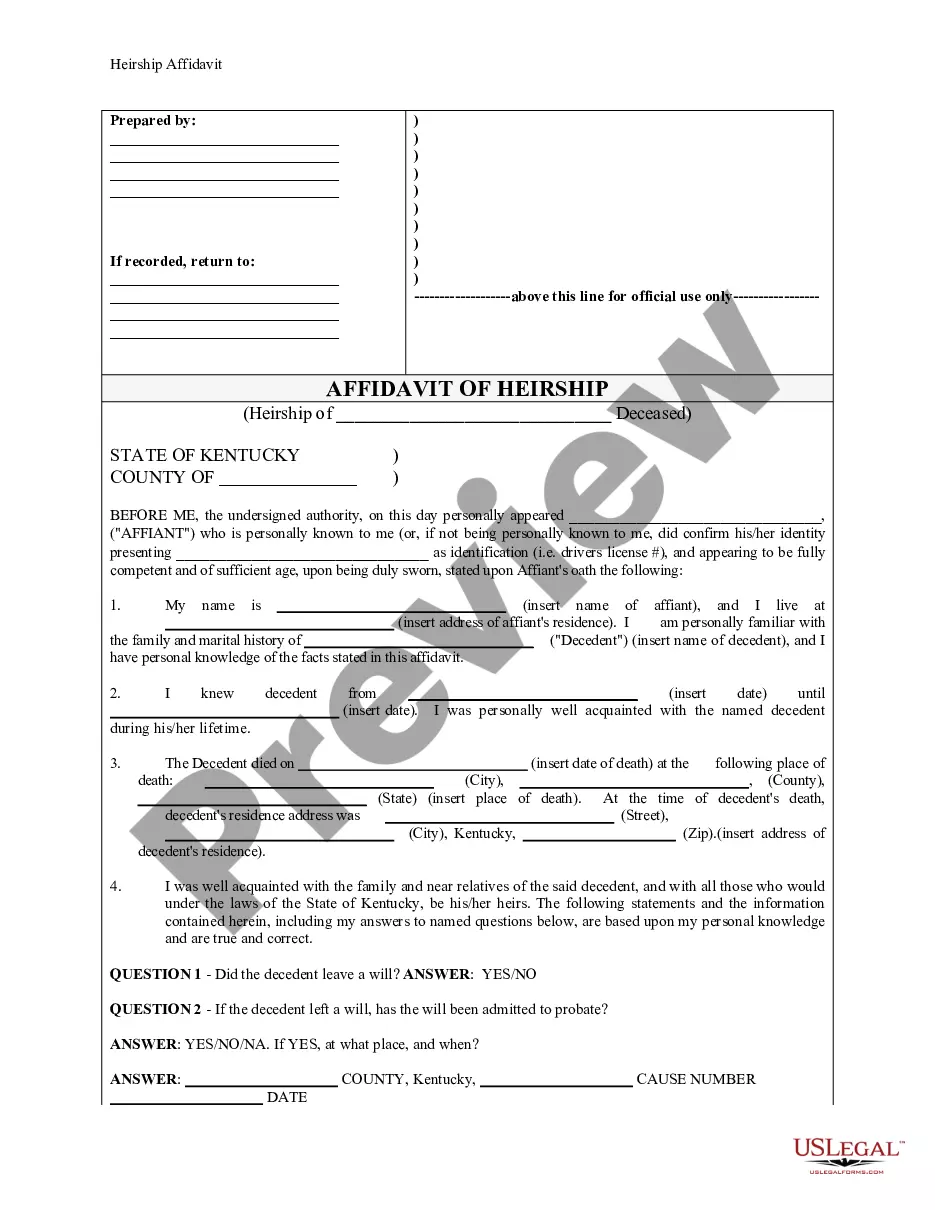

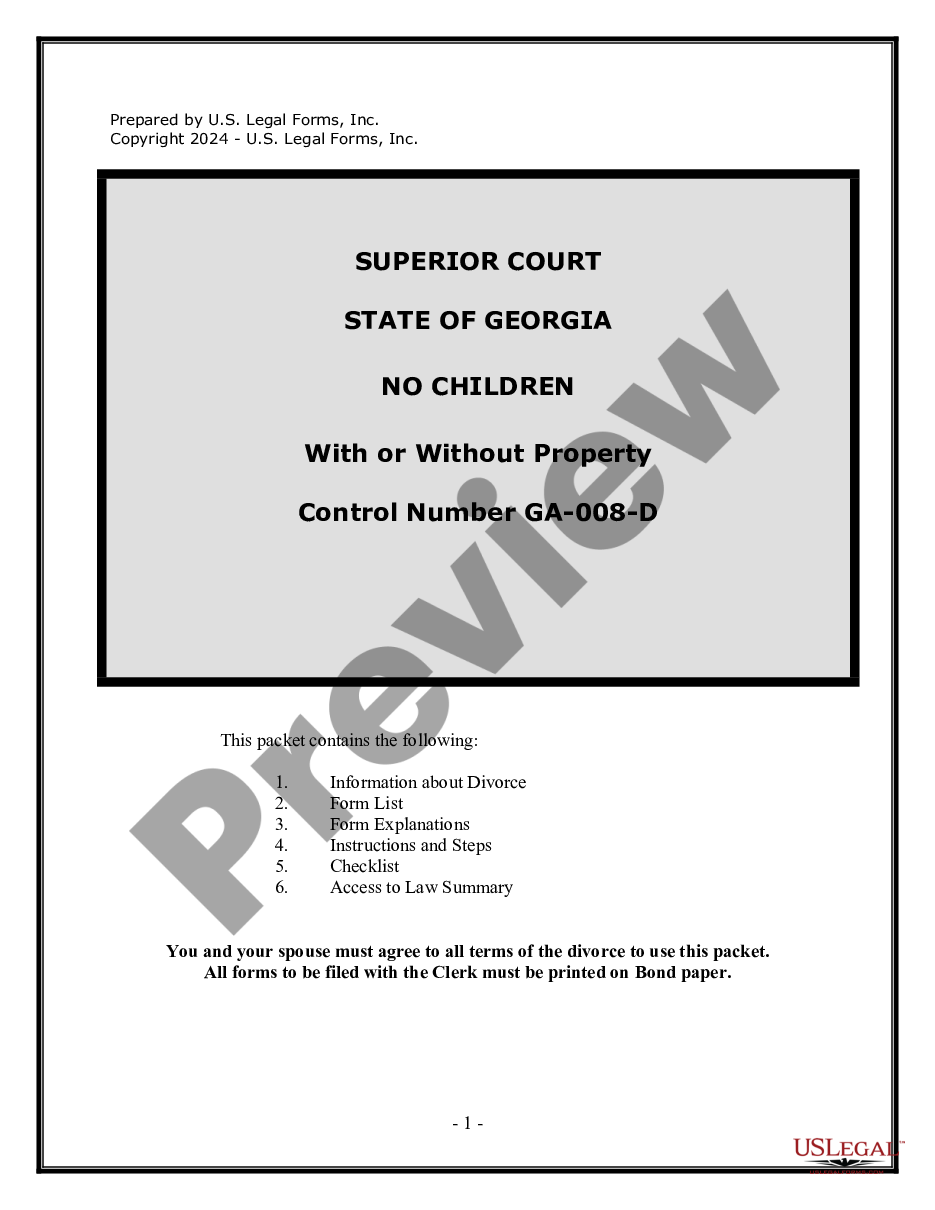

Here are the actions to follow after deeming the form you want: Confirm this is the correct form by previewing it and reviewing its description.

- Tap into a valuable collection of articles, guides, and manuals pertinent to your circumstances and needs.

- Conserve time and effort in locating the necessary documents, and utilize US Legal Forms’ superior search and Review feature to locate Aumento Alquiler Formula and obtain it.

- If you're a subscriber, Log Into your US Legal Forms account, search for the form, and acquire it.

- Visit the My documents tab to discover the documents you’ve already saved and to organize your folders as necessary.

- If this is your initial experience with US Legal Forms, create an account and gain unlimited access to all the benefits of the library.

- Utilize a comprehensive online form directory for anyone aiming to handle these matters effectively.

- US Legal Forms is a recognized leader in online legal forms, boasting over 85,000 state-specific legal templates accessible to you at any time.

- Access localized legal and business documents specific to your state or county.

Form popularity

FAQ

Deeds and most other documents kept by the Land Records Department are available through mdlandrec.net. This website is free to use but you must create an account using your name and email address. Search for your deed by first selecting the county where the property is located.

If you wish to change your name or remove a name on your property record, due to marriage, divorce, death of an owner, etc., a new deed must be filed with the local Land Records office where the property is located. You can not change a deed to a property through the Assessment office.

Plats.net is a website by the Maryland State Archives, the Administrative Office of the Courts and Maryland Circuit Court Clerks to make accessible all plats.

Deed Requirements All deeds and other property-related documents must be accompanied by a completed Maryland State Intake Sheet. A deed which changes or transfers ownership of property must be accompanied by a lien certificate. A deed submitted without a lien certificate will not be processed.

Deeds are public information. This means anyone can view and get a copy of a deed. Deeds can be viewed for free online through mdlandrec.net. You must create an account with the Maryland State Archives to view deeds on mdlandrec.net.

Either get your deed online or pick up a copy in person at the circuit court. Deeds and most other documents kept by the Land Records Department are available through mdlandrec.net. This website is free to use but you must create an account using your name and email address.

Transfer Taxes Transfer tax is at the rate of . 5 percent of the actual consideration, unless they are a first-time Maryland home buyer purchasing a principal place of residence, in that case the transfer tax rate is . 25 percent of the actual consideration.

To add a name to a deed in Maryland, you must prepare a new deed that includes both the current owner's name and the new owner's name. The current owner is the grantor, and the new owner is the grantee. The new deed should include a legal description of the property.