Vendor Booth Form For 1099

Description

How to fill out Commercial Booth Rental Form - More Than One Booth - Conventions?

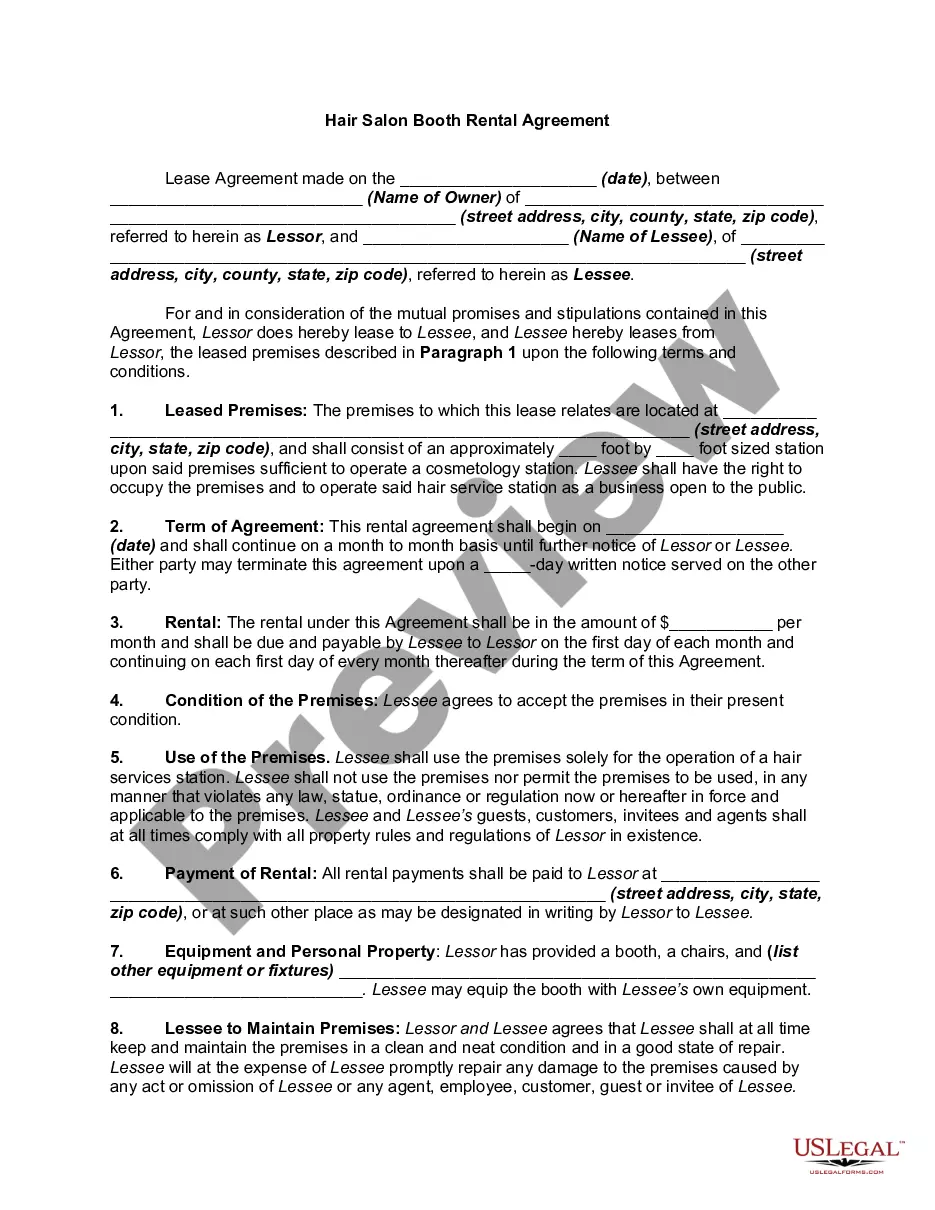

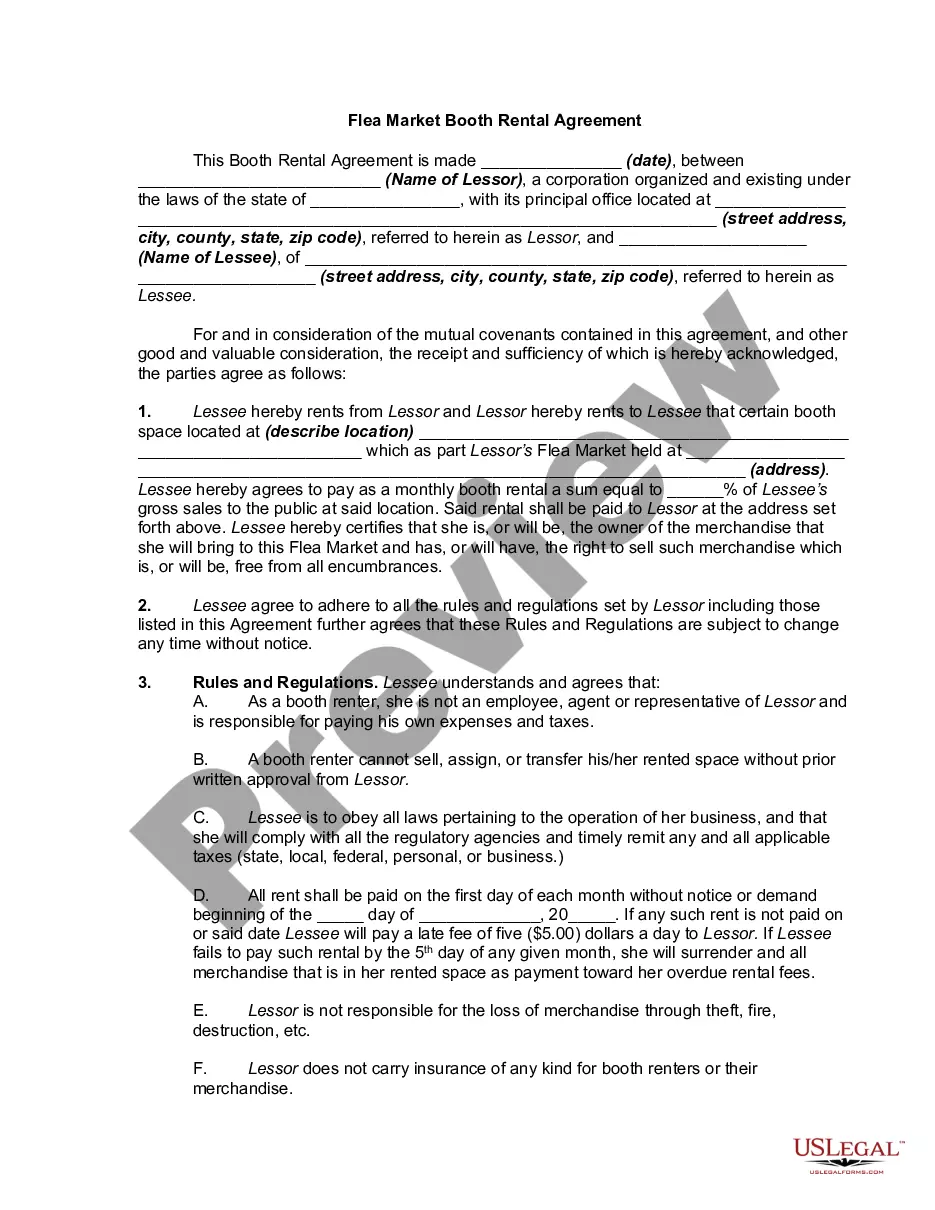

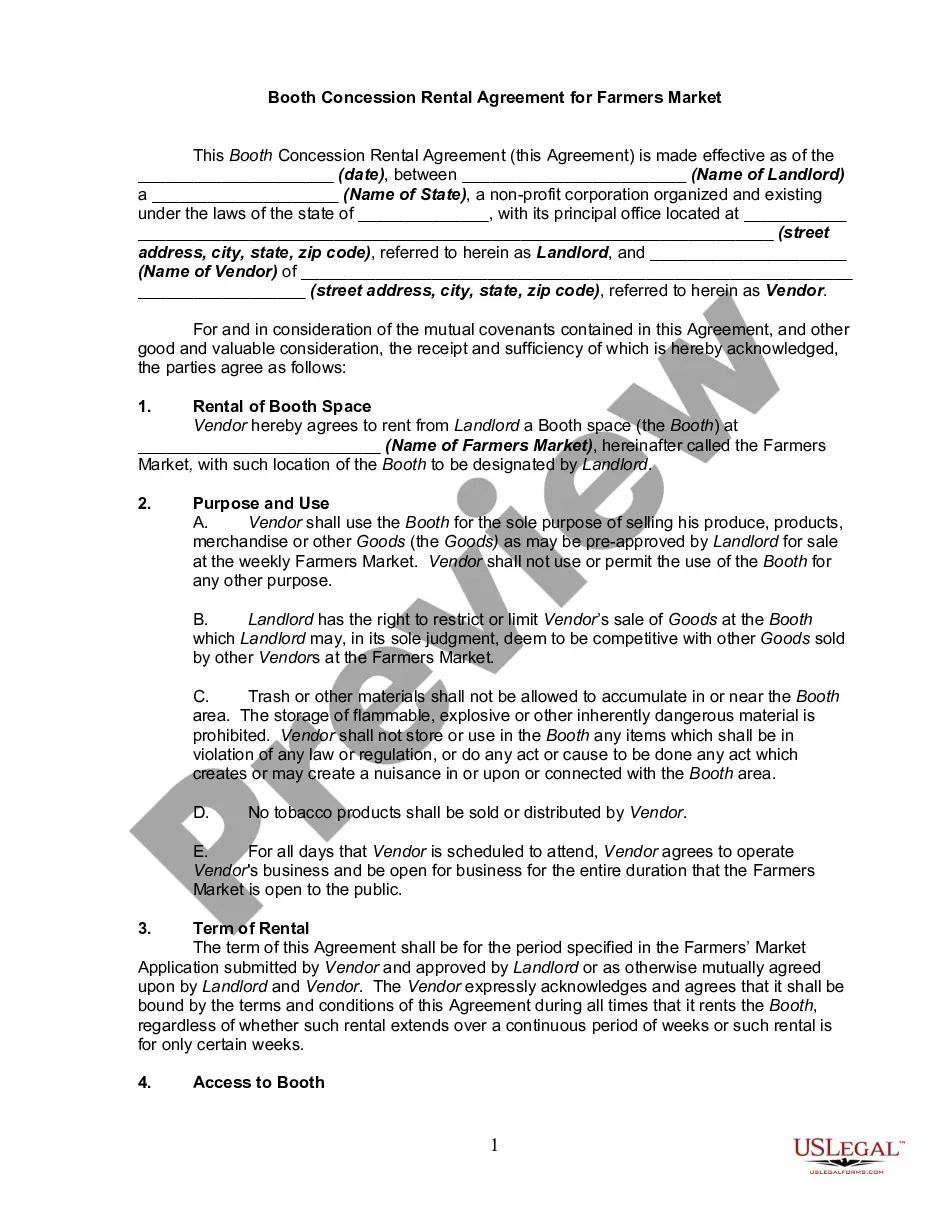

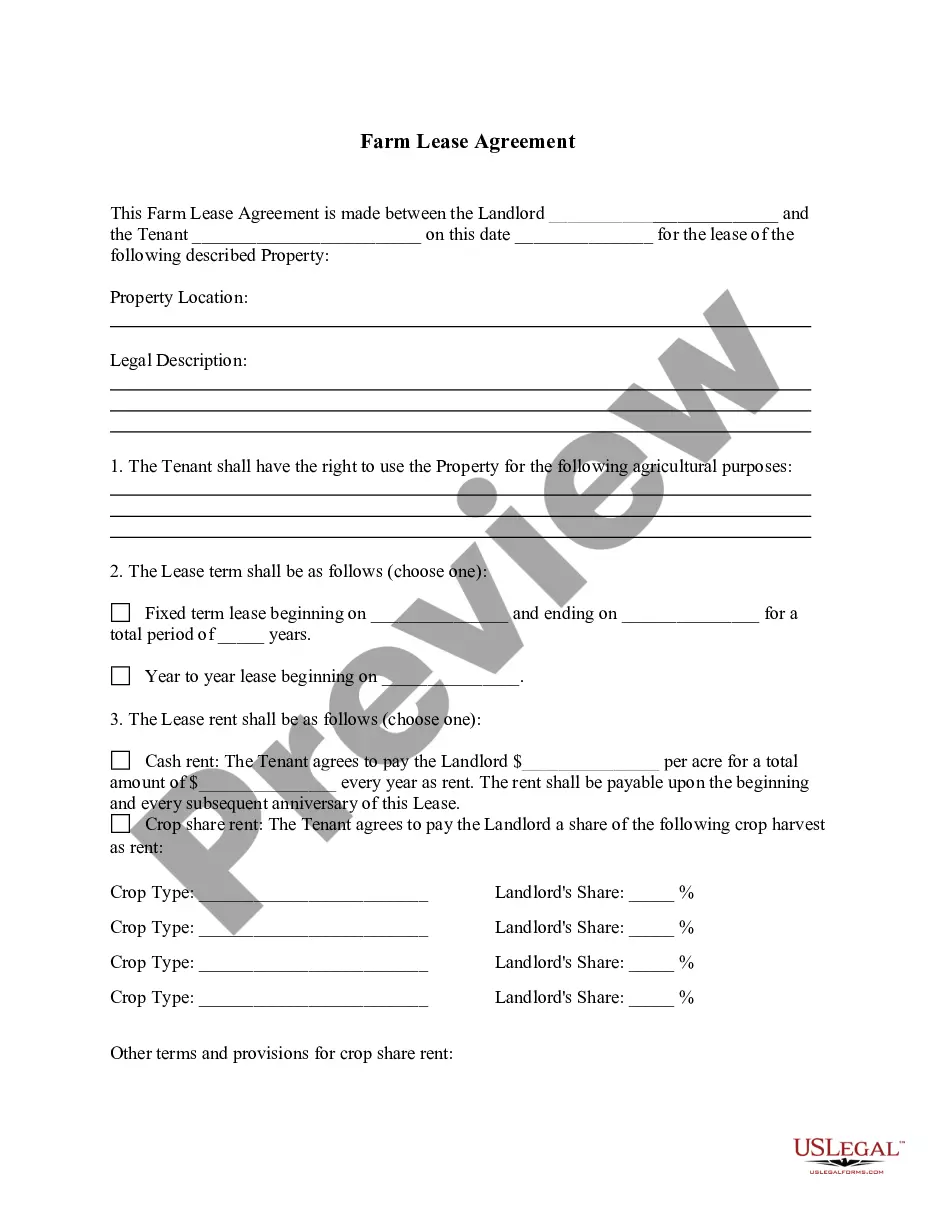

The Vendor Booth Document For 1099 you see on this page is a reusable legal template crafted by expert attorneys in accordance with federal and local regulations.

For over 25 years, US Legal Forms has offered individuals, businesses, and legal experts more than 85,000 validated, state-specific forms for various business and personal situations. It’s the quickest, most straightforward, and most reliable method to acquire the documentation you require, as the service ensures the utmost level of data security and anti-malware protection.

Select the format you desire for your Vendor Booth Document For 1099 (PDF, DOCX, RTF) and save the sample on your device. Complete and sign the paperwork. Print the template to fill it out manually. Alternatively, make use of an online multi-functional PDF editor to quickly and accurately fill out and sign your form with a legally-binding electronic signature.

- Search for the document you require and review it.

- Browse through the sample you looked for and preview it or check the form description to confirm it meets your requirements. If not, utilize the search feature to find the correct one. Click Buy Now when you locate the template you want.

- Register and sign in.

- Choose the pricing plan that works for you and create an account. Use PayPal or a credit card to make a swift payment. If you already have an account, Log In and verify your subscription to proceed.

- Obtain the editable template.

Form popularity

FAQ

Best Practices for Handwritten W2s and 1099s When handwriting any tax form, always use legible block letters. ... Black ink is required for handwriting tax forms. ... When writing a dollar amount, always include the decimal point even if the decimal point conveys zero. ... For dollar amounts, do not include the dollar sign.

When a business pays an independent contractor for services performed in the course of that business, the service recipient must file Form 1099 MISC if the payment is $600 or more for the year, unless the service provider is a Corporation.

1099 Explained: Step by step, line by line Payer information box. Located in the top left corner of the form, this is where you enter your company information. ... Payer TIN. ... Recipient's TIN. ... Recipient's name and address. ... FATCA filing requirement. ... Account number. ... Box 1: Non-Employee Compensation. ... Box 2: (Blank)

The Importance of W9 Vendor Forms Trades or businesses need to get W9 Forms from U.S. vendors to prepare information returns like Form 1099-NEC and 1099-MISC required by the IRS to report calendar year amounts paid to them of $600 or more or amounts of backup withholding of federal income taxes.