Sample Miller Trust For The Disabled

Description

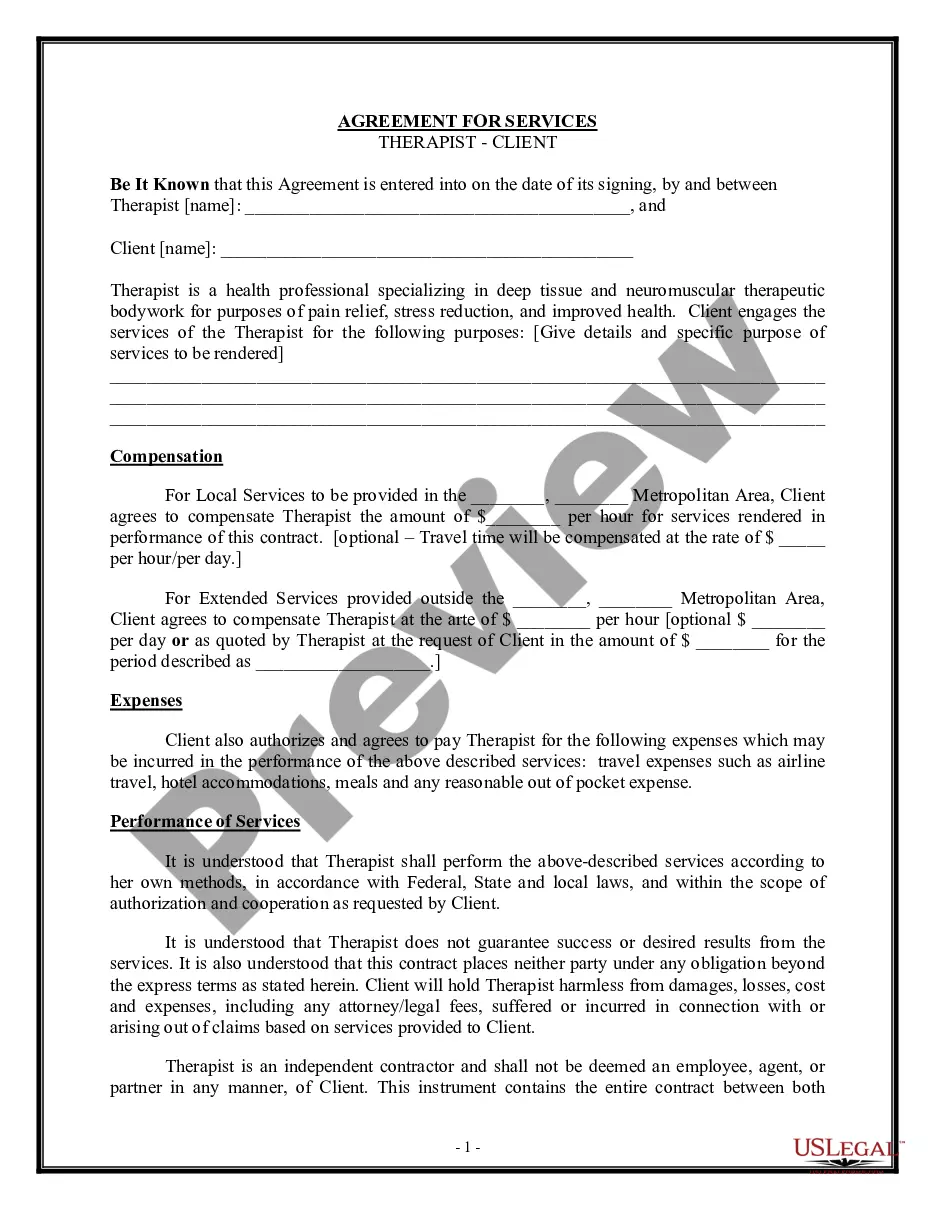

How to fill out Qualified Income Miller Trust?

- If you’re familiar with US Legal Forms, log in to your account. Ensure your subscription is active before downloading the template you need.

- If you're new to our service, start by reviewing the form description and preview mode to choose the right sample miller trust that aligns with your local requirements.

- In the case of discrepancies, utilize the Search feature to find the correct template. Once located, proceed to the purchase step.

- Click the Buy Now button and select your preferred subscription plan. You will need to create an account to access our extensive library.

- Complete your transaction by inputting your payment details via credit card or PayPal.

- Lastly, download the finalized template to your device. You can always revisit your document in the My Forms section of your account.

With US Legal Forms, users benefit from a robust collection of over 85,000 editable legal documents, superior to many competitors. Our platform not only provides extensive resources but also connects users to premium legal experts for assistance.

Experience the ease of securing your sample miller trust for the disabled today with US Legal Forms. Start your journey toward hassle-free legal documentation!

Form popularity

FAQ

The best trust for a disabled person often depends on their unique circumstances and needs. A Sample Miller Trust for the disabled could be ideal for individuals with excess income, allowing them to qualify for Medicaid while providing necessary funds for their care. On the other hand, a special needs trust may be more suitable for those who need ongoing support without affecting their eligibility for other benefits. Consulting with a legal expert can help guide you toward the best solution.

There are several types of trusts available for disabled individuals, including special needs trusts, Miller trusts, and pooled trusts. Each of these serves specific purposes, like enhancing the quality of life without jeopardizing government benefits. For example, a Sample Miller Trust for the disabled ensures that income can be retained while still qualifying for vital assistance programs. Understanding these options allows families to make informed decisions about the best fit for their loved ones.

Creating a Miller trust involves several steps that ensure the trust complies with state regulations. First, you need to gather necessary documentation, including income records and information about the disabled individual’s needs. Next, you will work with a legal professional to draft the trust document, specifying how funds will be used. The Sample Miller Trust for the disabled can be a valuable template to guide you through this process, ensuring that you cover all essential aspects.

One of the main disadvantages of a special needs trust, including a Sample Miller Trust for the disabled, is the complexity involved in setting it up and managing it. Additionally, funds in this type of trust may limit the beneficiary's eligibility for government assistance programs. Furthermore, there can be costs associated with ongoing management and compliance, which may be burdensome for some families. Understanding these limitations is crucial when planning for your loved one's future.

After death, a Miller trust in Indiana must meet specific requirements to ensure compliance and proper distribution of assets. For instance, the trust must be irrevocable and comply with state regulations regarding eligibility for Medicaid benefits. Furthermore, it's essential that the trust's assets are managed according to the established guidelines for the disabled, ensuring that beneficiaries receive their entitled support. Using a Sample miller trust for the disabled can simplify the process and provide clarity on how to administer these trusts effectively.

Setting up a trust fund for a disabled person involves several key steps. First, you will need to determine the type of trust that best suits the individual's needs, such as a Sample Miller Trust for the disabled, which can help maintain eligibility for government benefits. Next, consult with a legal expert who specializes in trusts to ensure compliance with local laws and requirements. Lastly, consider utilizing online platforms like US Legal Forms to access templates and resources that streamline the process, ensuring that the trust is established effectively and efficiently.

Setting up a trust for a disabled person can be a straightforward process when you follow the right steps. First, you need to decide on the type of trust, such as a Sample Miller Trust for the disabled, which can help maintain eligibility for government assistance. Next, you will want to select a trustee who will manage the trust assets in the best interest of the disabled individual. Finally, consider using platforms like USLegalForms that provide templates and guidance to ensure your trust is correctly established.