A Miller Trust With Indiana

Description

How to fill out Qualified Income Miller Trust?

It’s clear that you cannot instantly become a legal professional, nor can you learn how to swiftly prepare A Miller Trust With Indiana without possessing a particular set of capabilities.

Drafting legal documents is a lengthy endeavor that necessitates specific training and competencies. So why not entrust the preparation of the A Miller Trust With Indiana to the experts.

With US Legal Forms, one of the most extensive legal document repositories, you can access everything from courtroom documents to templates for internal business communication.

You can regain access to your documents from the My documents section at any time. If you’re an existing client, you can easily Log In and find and download the template from the same section.

Regardless of the intent of your documents—be it financial, legal, or personal—our platform has everything you need. Give US Legal Forms a try now!

- Locate the form you require by utilizing the search bar at the upper section of the page.

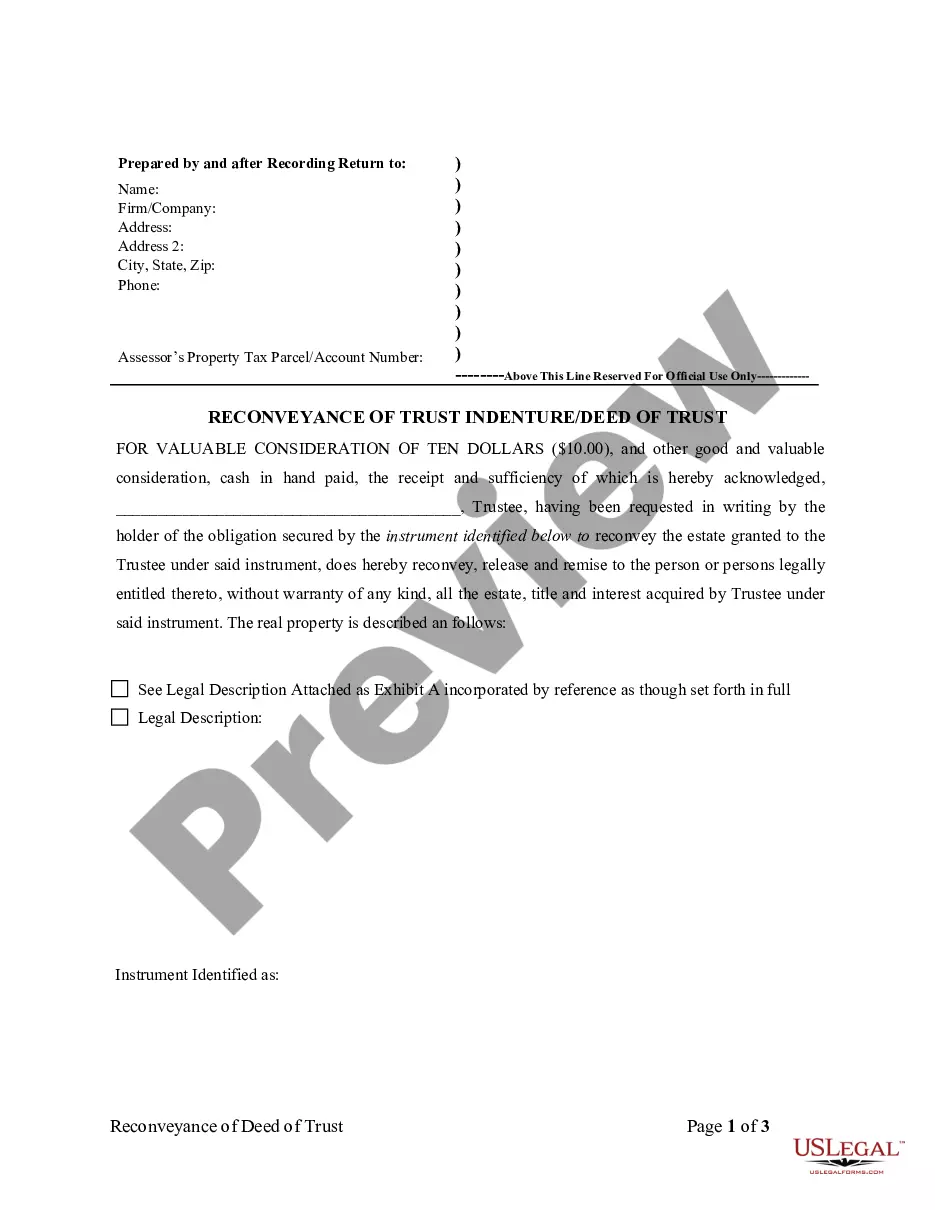

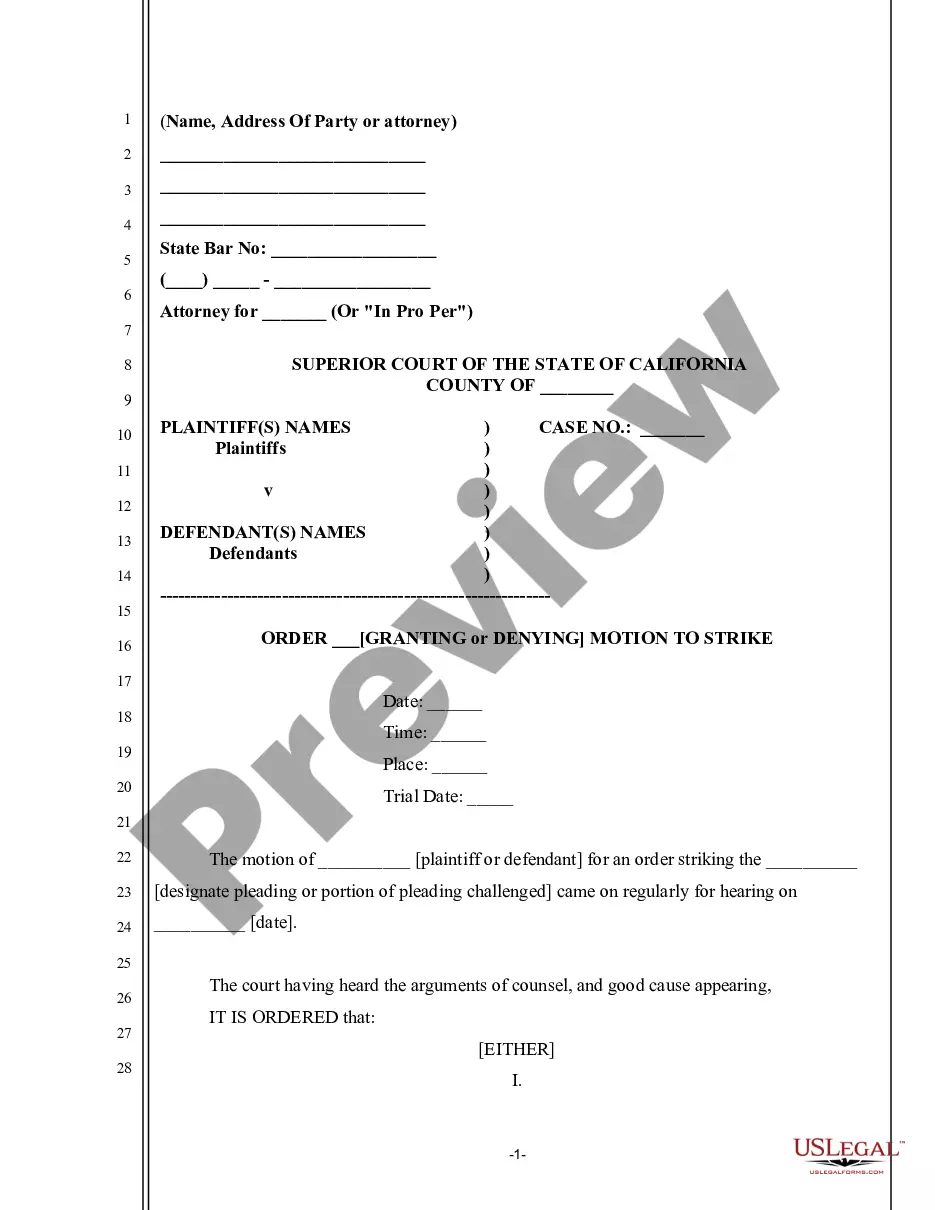

- Preview it (if this feature is available) and review the accompanying description to determine if A Miller Trust With Indiana fits your needs.

- Restart your search if you require a different form.

- Create a free account and select a subscription plan to acquire the form.

- Click Buy now. Once the transaction is completed, you can obtain the A Miller Trust With Indiana, complete it, print it, and send it or send it by mail to the relevant individuals or organizations.

Form popularity

FAQ

You might need a Miller trust to manage assets while ensuring you qualify for Medicaid benefits in Indiana. This type of trust can help you protect your assets, allowing you to receive necessary care without financial strain. By creating a Miller trust with Indiana, you can achieve greater financial stability and peace of mind during your later years.

Michigan requires LLCs to include both a resident agent and a registered office in their articles of organization. The agent accepts legal documents, demands or notices on behalf of the LLC and must have a physical address within Michigan to do so.

The articles of organization is a document that officially establishes your LLC by laying out basic information about it. Prepare articles of organization and file them with the Michigan Corporation Division to register your Michigan LLC properly.

Starting a professional limited liability company in Michigan is absolutely free with Inc Authority. You are only required to pay the mandatory state filing fee of $50, and Inc Authority will take care of the rest at no extra charge.

To start an LLC, you need to file the Michigan Articles of Organization. This gets filed with the Michigan Department of Licensing and Regulatory Affairs (LARA). The Michigan Articles of Organization costs $50 if you file online. This is a one-time fee to create your LLC.

Do You Need a Business License in Michigan? While Michigan does not require a single, general business operating license for companies doing business in the state, many businesses must obtain at least one kind of business license or permit from the state before conducting business.

In order to start an LLC in Michigan, you'll need to register your company with the Michigan Department of Licensing and Regulatory Affairs (LARA). LARA sets the requirements and fees for starting an LLC in Michigan and for operating an out-of-state LLC in Michigan.

Michigan LLC Cost. Forming an LLC in Michigan costs $50?the state fee to file the Michigan Articles of Organization. You'll also need to pay a $25 annual report fee every year to keep your LLC active.