Citizenship For Residency

Description

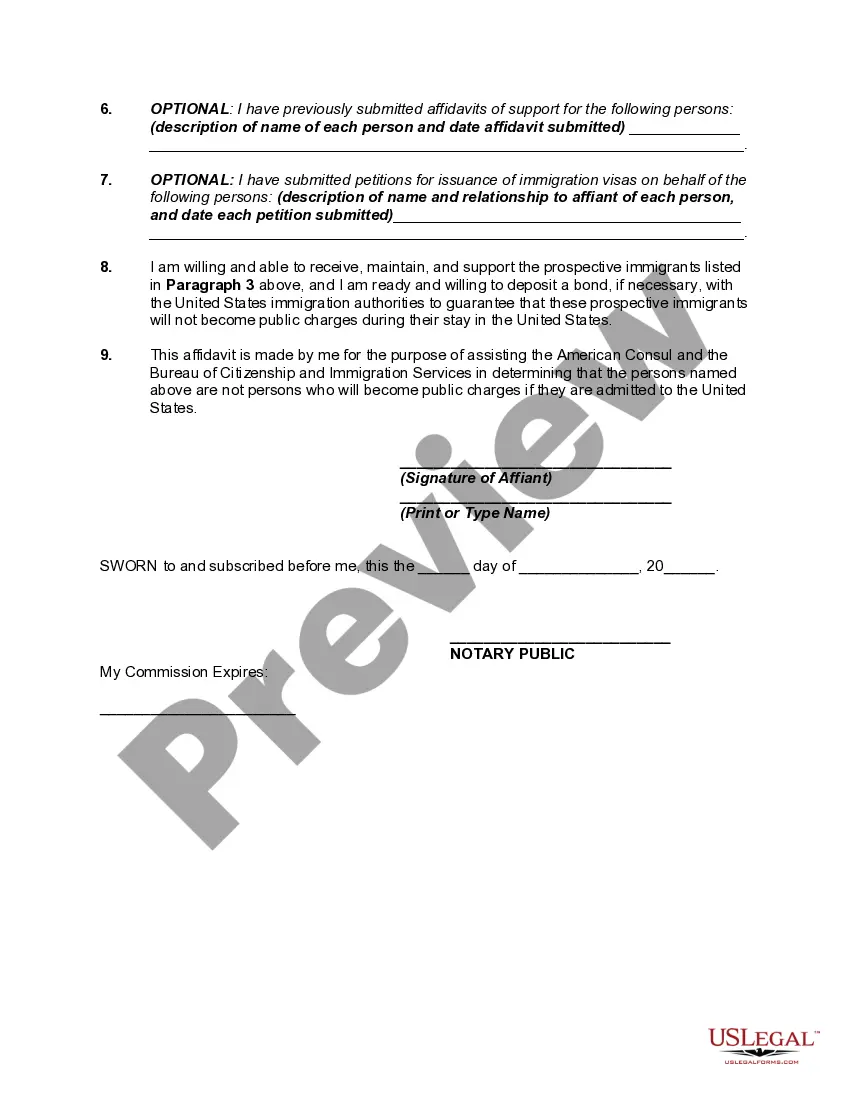

How to fill out Affidavit And Proof Of Citizenship Or Residence Of United States In Support Of Relatives Desiring To Emigrate?

It’s widely known that you cannot instantly become a legal authority, nor can you discover how to swiftly prepare Citizenship For Residency without possessing a specialized skill set.

Assembling legal paperwork is a lengthy undertaking necessitating specific training and expertise. Therefore, why not entrust the creation of the Citizenship For Residency to the professionals.

With US Legal Forms, one of the most extensive legal document repositories, you can locate everything from courtroom documents to templates for in-office correspondence.

You can regain access to your documents from the My documents section at any time. If you’re a returning customer, you can simply Log In, and locate and download the template from the same section.

Regardless of the intention behind your documents—whether they are financial, legal, or personal—our website has you taken care of. Experience US Legal Forms now!

- Identify the document you require by utilizing the search bar located at the top of the page.

- Preview it (if this option is available) and read the accompanying description to determine whether Citizenship For Residency is what you seek.

- Initiate your search again if you require any additional form.

- Create an account for free and select a subscription plan to acquire the template.

- Click Buy now. Once the purchase is completed, you can obtain the Citizenship For Residency, fill it out, print it, and send or mail it to the relevant individuals or organizations.

Form popularity

FAQ

Pennsylvania offers a simplified probate process for small estates, which state law defines as estates that contain no more than $50,000 in assets. That total does not include real estate, certain amounts the family can collect without probate, and amounts used to pay funeral expenses. (20 Pa. Cons.

In Pennsylvania, it is only necessary to probate if the decedent owned assets, whether financial or real estate holdings, solely in their name which did not already have a beneficiary designated. Such assets are called probate assets, and in order to convey ownership of them it is necessary to probate.

How to write a codicil to a will Read through your existing will. Take note of desired alterations. Write the opening statement and last will information. Propose your amendments. Sign the codicil. Secure the document. Consult with estate planning professionals (optional)

The Probate Process in Pennsylvania Inheritance Laws Essentially any estate worth more than $50,000, not including real property like land or a home and other final expenses, must go through the probate court process under Pennsylvania inheritance laws.

4 essential estate planning documents A will distributes assets upon death. A power of attorney manages finances. Advance care directives manage your health. A living trust is an alternative to a last will.

In Pennsylvania, the courts shortcut probate for any estate worth $50,000 or under.

In all but a few narrow exceptions, property that was titled in the deceased's name at the time of death must go through probate. Title to most assets, such as real estate and bank investment accounts, cannot be changed without going through probate.

An official can deem a codicil invalid if it is not correctly witnessed, signed, and notarized before being added to the will. A judge can also overrule a codicil. You can have multiple codicils, each dedicated to a different amendment and contradicting codicils.