Agreement Nonprofit Contract For Services

Description

How to fill out Subscription Agreement With Nonprofit Corporation?

It’s clear that you cannot transform into a legal authority instantly, nor can you learn to swiftly compose an Agreement Nonprofit Contract For Services without a distinct set of expertise.

Assembling legal documents is a lengthy endeavor that demands specific education and expertise. So why not entrust the development of the Agreement Nonprofit Contract For Services to the specialists.

With US Legal Forms, one of the most extensive legal template collections, you can access everything from court documents to templates for internal communication.

If you need any other form, restart your search.

Create a free account and choose a subscription plan to purchase the form. Click Buy now. After the payment is processed, you can acquire the Agreement Nonprofit Contract For Services, complete it, print it, and send or mail it to the appropriate individuals or organizations.

- We recognize how vital compliance and observance of federal and local regulations are.

- That’s why, on our site, all templates are location-specific and current.

- Here’s how to begin with our platform and obtain the form you require in just minutes.

- Find the document you need using the search bar at the top of the page.

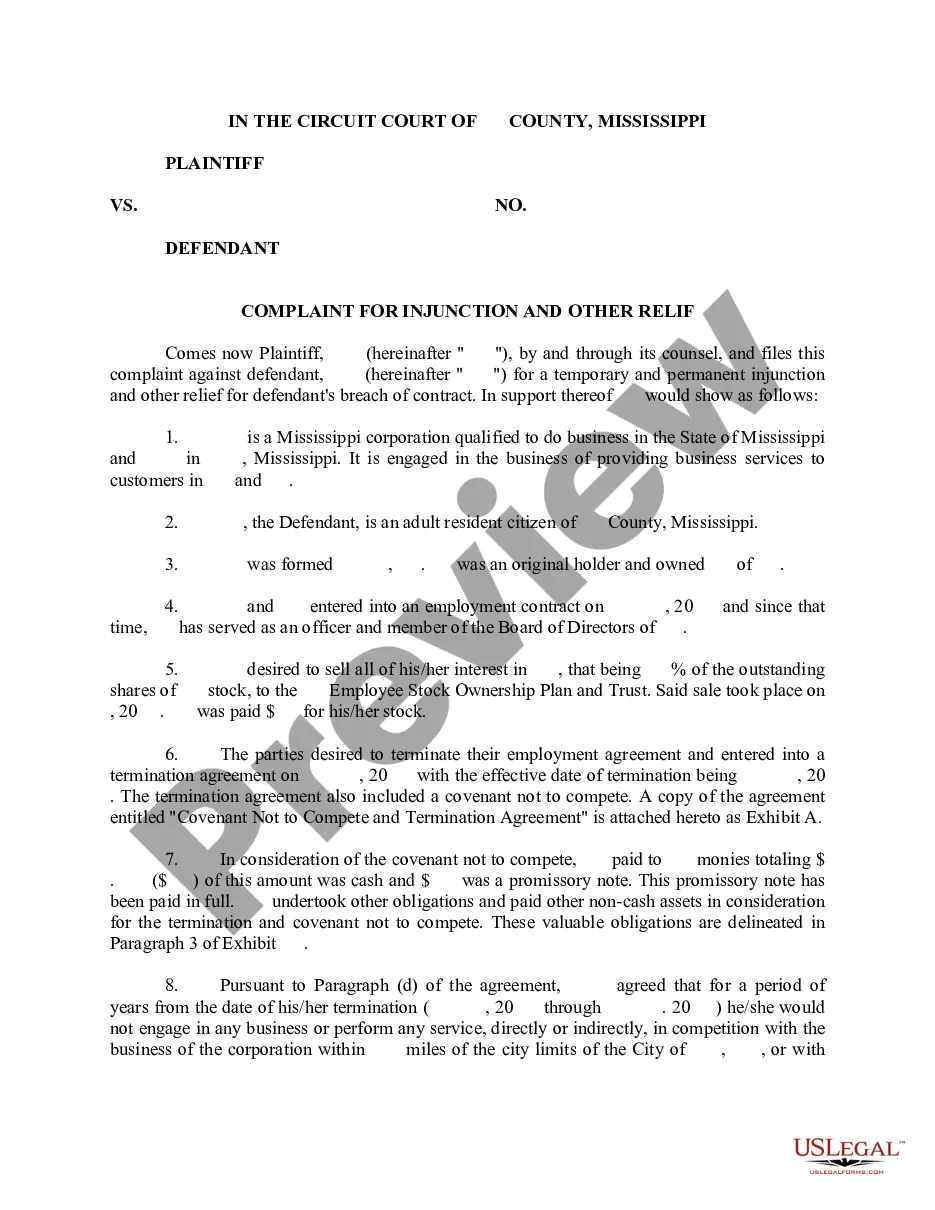

- Preview it (if this option is available) and read the accompanying description to ascertain if the Agreement Nonprofit Contract For Services is what you’re looking for.

Form popularity

FAQ

A contract agreement is a broad term that encompasses any legally binding arrangement between parties, while a service agreement specifically outlines the terms under which one party provides services to another. Service agreements often include details such as scope, deadlines, and payment terms. When drafting an agreement nonprofit contract for services, it is crucial to clarify the expectations and responsibilities of all parties involved to ensure successful collaboration.

The 33 1/3 rule for nonprofits is similar to the 33% rule, indicating that organizations should limit their administrative expenses to one-third of their total budget. This principle promotes efficient use of resources, ensuring that most funds support programs that align with the nonprofit's mission. Incorporating this rule in your agreement nonprofit contract for services can strengthen your organization’s financial practices.

The 33 percent rule for nonprofits emphasizes that no more than 33% of an organization’s revenue should be allocated to administrative costs. This guideline encourages nonprofits to prioritize their mission and the services they provide. When forming an agreement nonprofit contract for services, consider this rule to enhance your organization's financial health and sustainability.

The IRS rules for non-profit organizations dictate that these entities must operate for charitable purposes and avoid private benefit. They must also adhere to specific guidelines regarding financial reporting and fundraising. When creating an agreement nonprofit contract for services, it is essential to comply with these IRS regulations to maintain tax-exempt status and foster trust with stakeholders.

The 33% rule for nonprofits suggests that organizations should not spend more than one-third, or 33%, of their total revenue on administrative expenses. This guideline helps ensure that a significant portion of funds is allocated to programs and services that benefit the community. Understanding this rule is crucial when drafting an agreement nonprofit contract for services, as it promotes transparency and accountability.

How do I write a Service Agreement? State how long the services are needed. ... Include the state where the work is taking place. ... Describe the service being provided. ... Provide the contractor's and client's information. ... Outline the compensation. ... State the agreement's terms. ... Include any additional clauses.

Service Contracts are agreements between a customer or client and a person or company who will be providing services. For example, a Service Contract might be used to define a work-agreement between a contractor and a homeowner. Or, a contract could be used between a business and a freelance web designer.

A service agreement sets the stage for successful collaboration by clearly outlining the terms, roles, and responsibilities of the other party. It defines critical elements such as the scope of services, payment terms, and confidentiality to safeguard the interests of both service providers and clients.

Those seven elements are: Identification (Defining all the parties involved) Offer (The agreement) Acceptance (Agreement mirrored by other parties) Mutual consent (Signatory consent of all parties) Consideration (The value exchanged for the offer) Capacity (Legal/mental competence of all parties)

What to include in your contract. Description of services. Lay out exactly what professional services you and your company will receive. ... Payment terms. Describe when and how the contractor will be compensated. ... Ownership rights. ... Confidentiality clause. ... Indemnification clause. ... Amendment. ... Termination. ... Dispute resolution.