Business Trust With Example

Description

Form popularity

FAQ

Putting your business in a trust can provide a layer of protection for your assets and simplify the transfer of ownership. This not only safeguards personal and business assets from legal claims but also ensures continuity of operations. A business trust with example helps structure ownership efficiently, attracting investors while protecting personal liabilities.

One example of trust is a revocable living trust, where the creator retains control over the assets during their lifetime. This type of trust allows for a smooth transition of assets to heirs without going through probate. Similarly, a business trust with example can function effectively, benefiting multiple parties while avoiding lengthy legal proceedings.

A business trust is a legal arrangement where a trustee holds and manages assets for the benefit of the trust's beneficiaries. Business trusts streamline operations, allowing multiple investors to share in profits without direct ownership. By establishing a business trust with example, you can protect personal assets while efficiently managing a business.

A simple trust is set up to distribute all of its income to beneficiaries annually, without accumulating any profits. For example, a family trust that pays out dividends from rental properties directly to beneficiaries exemplifies a simple trust. This concept can extend to a business trust with example, where profits are regularly distributed to investors.

A trust in a will enables the distribution of assets according to specific instructions after a person's death. For instance, a testamentary trust can provide for children until they reach adulthood, managed by a trustee. This structure can also reflect a business trust with example, where business ownership or profits are directed as per the will’s instructions.

An example of trust is a family trust, where a trustee manages assets on behalf of family members. This arrangement allows for efficient management of assets while ensuring that the beneficiaries receive their intended inheritance. Similarly, a business trust with example operates where assets are held for a group of investors or beneficiaries, often facilitating business operations without direct ownership.

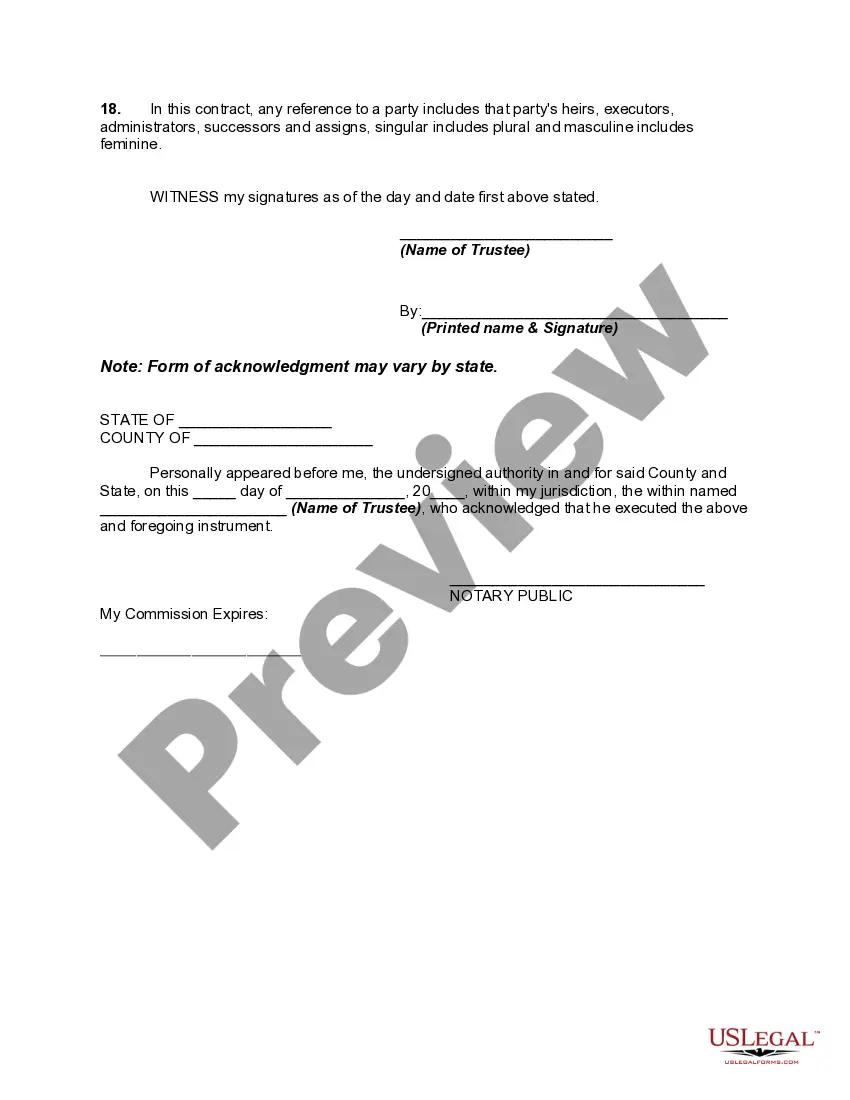

To form a business trust, you start by drafting a trust agreement that outlines the terms and conditions. It's essential to define the roles of the trustee and beneficiaries clearly. After that, you’ll need to fund the trust and file any necessary documentation with your state. Using a platform like US Legal Forms can streamline this process, providing you with templates and guidance to establish your business trust effectively.

One key disadvantage of a business trust with an example is the potential for limited control. When you set up a business trust, you entrust the management of assets to a trustee. This can lead to conflicts if the trustee's decisions do not align with your business goals. Moreover, some business trusts may face higher taxes, impacting overall profitability.

Placing your business in a trust can offer tax benefits and safeguard your assets from creditors. By using a business trust with example, you can ensure smooth transitions for ownership and management. This strategy not only protects your investments but also provides clarity for beneficiaries. Evaluating your options with the assistance of a qualified service, like Us Legal Forms, can help you make an informed decision.

Business trusts come in various forms, including common law trusts, statutory trusts, and Massachusetts business trusts. Each type serves distinct purposes, such as facilitating investment or protecting assets. For instance, a business trust with example can help manage and distribute profits among stakeholders efficiently. Understanding these varieties can guide you in choosing the best structure for your needs.