Agreement Trust Nomination Format

Description

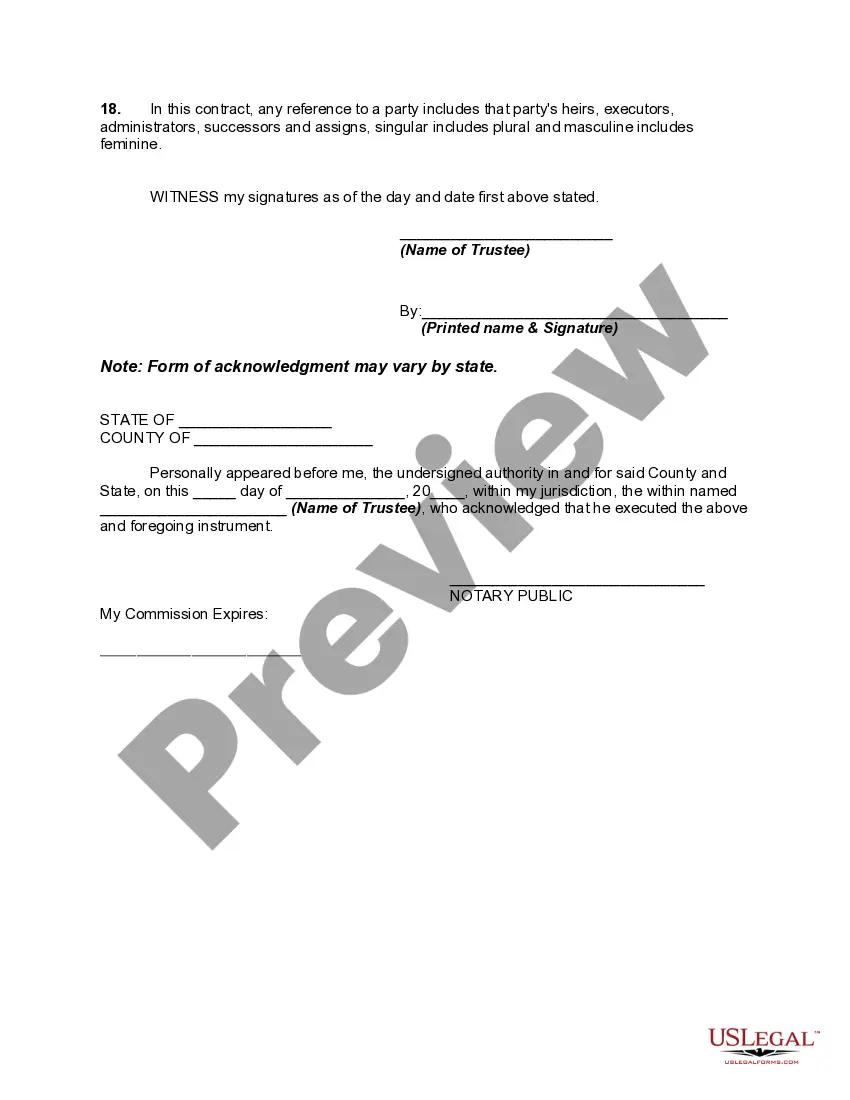

How to fill out Agreement And Declaration Of Real Estate Business Trust - Massachusetts Nominee Realty Trust - Trustees To Act Only As Directed By Beneficiaries?

The Agreement Trust Nomination Format presented on this page is a versatile legal template created by qualified attorneys in accordance with federal and state regulations.

For over 25 years, US Legal Forms has offered individuals, companies, and legal practitioners more than 85,000 confirmed, state-specific forms for any business or personal situation. It’s the quickest, simplest, and most reliable method to acquire the documents you require, as the service ensures the utmost level of data protection and anti-malware safeguards.

Select the format you prefer for your Agreement Trust Nomination Format (PDF, DOCX, RTF) and download the sample to your device.

- Search for the document you require and review it.

- Browse through the sample you searched and preview it or examine the form description to verify it meets your needs. If it doesn’t, use the search bar to locate the correct one. Click Buy Now once you have found the template you need.

- Register and Log In.

- Select the pricing option that fits you and create an account. Use PayPal or a credit card to make an immediate payment. If you already possess an account, Log In and check your subscription to proceed.

- Acquire the editable template.

Form popularity

FAQ

A trust agreement template is a pre-formatted document that outlines the terms and conditions of a trust. It provides a clear structure for designating beneficiaries, managing assets, and stating the trustee's responsibilities. Utilizing an agreement trust nomination format within this template can streamline the creation of your trust, making it easier to customize according to your specific needs. You can find reliable templates on platforms like uslegalforms, which offer user-friendly solutions for your legal document needs.

A nominee trust serves to hold and manage assets on behalf of the beneficiaries. It provides privacy, as the trust's name appears in public records rather than the individual owners. By using an agreement trust nomination format, you can simplify the process of transferring assets and establish clear management guidelines. This arrangement also helps in estate planning, ensuring that your wishes are carried out efficiently.

A nominee trust agreement is a legal document that allows one person, the nominee, to hold property or assets on behalf of another party. This arrangement is often used to manage assets while keeping the beneficial owner’s identity confidential. Understanding the agreement trust nomination format is vital, as it outlines the responsibilities and rights of the involved parties, ensuring clarity and legal compliance. For more guidance, USLegalForms offers comprehensive resources to help you create and understand these agreements.

Yes, many platforms allow you to submit a nomination form online, streamlining the process for your convenience. With the agreement trust nomination format, you can easily complete and submit your forms digitally. USLegalForms provides a user-friendly interface that simplifies this process, ensuring that your submission is both secure and efficient.

To obtain a copy of a trust agreement, you typically need to contact the trustee or the attorney who created the trust. They can provide you with the necessary documents, including the agreement trust nomination format. If you are unsure of how to proceed, consider using a service like USLegalForms, which offers resources and templates to help you navigate the process more effectively.

The nominee trust is not a trust - it is an agency arrangement in which the "trustees" are agents for undisclosed principals. A true trust is an arrangement under which a "grantor" or "donor" transfers property to a trustee to use for the benefit of one or more beneficiaries.

To leave property to your living trust, name your trust as beneficiary for that property, using the trustee's name and the name of the trust. For example: John Doe as trustee of the John Doe Living Trust, dated January 1, 20xx.

They have rights and entitlements, such as receiving trust assets. These assets might be money, property, or investments. Beneficiaries rely on the trustee, who manages these assets, to act in their best interest. It's a bit like a partnership, where the trustee has a duty to protect the beneficiaries' interests.

A nominee trust is a legal arrangement whereby a person, termed the settlor, appoints another person, termed the "nominee" or "trustee", to be the owner of the legal title to some property.

A trust agreement is a legal document containing, terms, conditions and provisions that allows the trustor to transfer the ownership of assets to the trustee to be held for the trustor's beneficiaries. The trustees will manage the property and assets on behalf of the beneficiary.