Promissory Note Sample For Rental Payment Format

Description

How to fill out Promissory Note For Past Due Rent?

Acquiring legal document examples that adhere to federal and local regulations is crucial, and the web provides numerous choices to select from.

However, what’s the purpose of wasting time looking for the appropriate Promissory Note Sample For Rental Payment Format online if the US Legal Forms digital library already has such templates compiled in one location.

US Legal Forms is the premier online legal repository with over 85,000 editable templates created by attorneys for any business and personal circumstance.

Examine the template using the Preview feature or through the text description to confirm it meets your requirements.

- They are easy to navigate with all documents categorized by state and intended use.

- Our specialists stay updated with legislative modifications, ensuring your documents are current and compliant when acquiring a Promissory Note Sample For Rental Payment Format from our site.

- Obtaining a Promissory Note Sample For Rental Payment Format is straightforward and fast for both existing and new users.

- If you already possess an account with an active subscription, Log In and retrieve the document sample you need in the desired format.

- If you are new to our platform, follow the steps below.

Form popularity

FAQ

A promissory note does not necessarily have to be notarized to be considered legal, but notarization can add an extra layer of authenticity. It is important to ensure that both parties fully understand the terms and conditions outlined in the note. Some lenders may prefer notarization to prevent disputes in the future. Always check local laws to understand specific requirements.

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

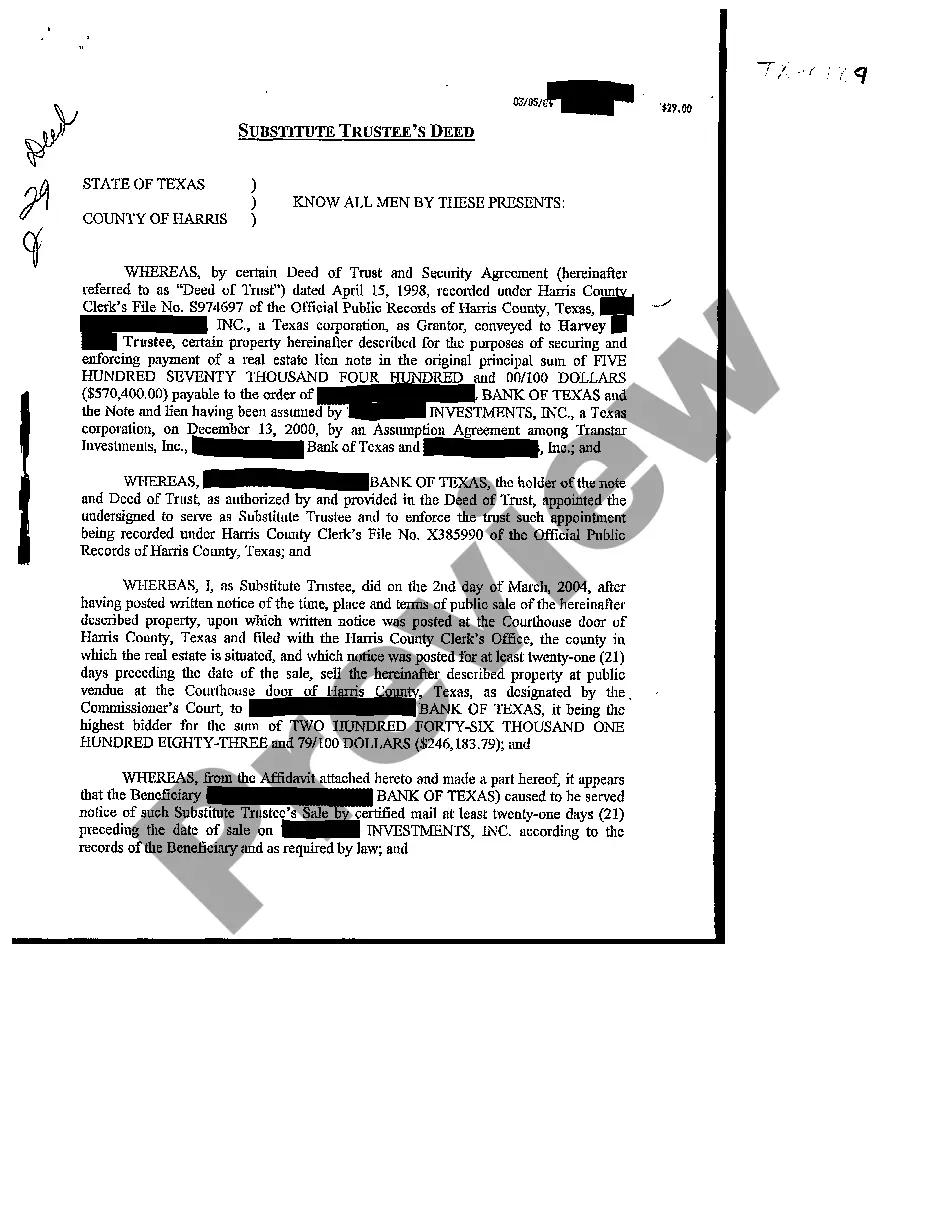

This Promissory Note provides a way for the Tenant to pay past due rent without having to also pay attorney fees or additional fees. It documents the entire amount of rent owed, provides a plan for monthly payments (including annual interest), and a maturity date by which all unpaid rent is due.

Names of all Parties Involved ? Such a document must include the names of the payee, drawee, and holder. Address and Contact Details ? Should include the residential address and phone number of all parties involved. Promissory Note Amount ? It must show the sum that is outstanding and must be repaid as per the note.

At its most basic, a promissory note should include the following things: Date. Name of the lender and borrower. Loan amount. Whether the loan is secured or unsecured. If it's secured with collateral: What is the collateral? ... Payment amount and frequency. Payment due date. Whether the loan has a cosigner, and if so, who.

The concise sample promissory note covers: proper identification of the parties. basic repayment terms ? interest, payment dates, place of payment, etc. optional default and confession of judgment provisions. repayment ledger.