Custodial Parent Under With Joint Custody

Description

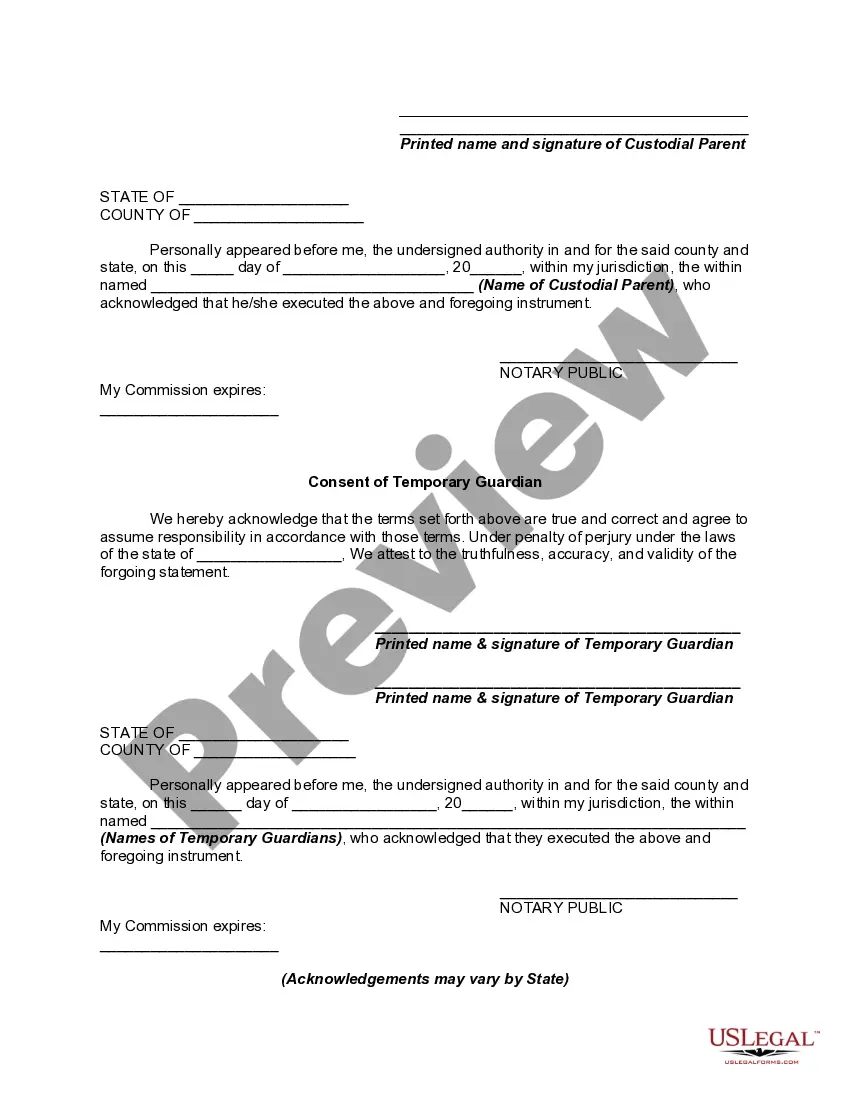

How to fill out Temporary Guardianship Agreement With Detailed Authorization Regarding The Acquiring Of Medical Care For Minor Children - Including Consent Of Temporary Guardians?

Creating legal documents from the ground up can sometimes be daunting.

Certain situations may require extensive research and considerable financial investment.

If you seek a simpler and more economical method for producing Custodial Parent Under With Joint Custody or any other documents without unnecessary obstacles, US Legal Forms is always available to assist you.

Our online repository of over 85,000 current legal forms covers nearly every facet of your financial, legal, and personal affairs.

However, before you jump directly to downloading Custodial Parent Under With Joint Custody, consider these tips: Review the document preview and descriptions to ensure you have located the correct document. Confirm that the template you choose meets the requirements of your state and county. Select the most suitable subscription plan to acquire the Custodial Parent Under With Joint Custody. Download the form and then fill it out, certify it, and print it. US Legal Forms boasts an impeccable reputation and over 25 years of experience. Join us now and make form completion an effortless and streamlined process!

- With just a few actions, you can swiftly access state- and county-compliant formats meticulously crafted for you by our legal experts.

- Utilize our platform whenever you need trustworthy and dependable services to conveniently locate and download the Custodial Parent Under With Joint Custody.

- If you’re familiar with our website and have previously created an account, simply Log In to your account, find the form and download it or re-download it anytime in the My documents section.

- Not registered yet? No problem. Establishing an account and browsing the catalog takes just a few minutes.

Form popularity

FAQ

A significant mistake in a custody battle is failing to prioritize your child's needs above personal conflicts. Allowing emotions to hinder communication can lead to poor decisions. Stay focused on co-parenting strategies that ensure a smooth experience, especially as a custodial parent under with joint custody.

The custodial parent is the parent with whom the child lived for the greater number of nights during the year. The other parent is the noncustodial parent. In most cases, because of the residency test, the custodial parent claims the child on their tax return.

Stress can come with children having to transfer from one parent's home to the other. This can be one of the main drawbacks of shared custody. The back-and-forth of 50/50 custody might be difficult for some children to get used to. Small children who like stability may find it particularly difficult.

In most cases, the parent with whom the child resides more often?the custodial parent?has the right to claim the child on their taxes. However, there's a twist. Noncustodial parents can also claim the child as a dependent if both parties agree to it in writing.

In Texas, the parent who gets to claim the child on their tax return, or who is in IRS terms the custodial parent, is the one designated as the primary conservator in the divorce decree, or the parent who has possession of the child for the most nights in a year.

Some worry that the court automatically favors mothers over fathers in custody cases. However, this is now simply a myth. Colorado is neither a ?mom state? nor a ?dad state? when deciding on child custody. It's also not an ?automatic 50-50 parenting time state.? Here's how it works.