Accounting Witt

Description

How to fill out Engagement Letter Between Accounting Firm And Client For Tax Return Preparation?

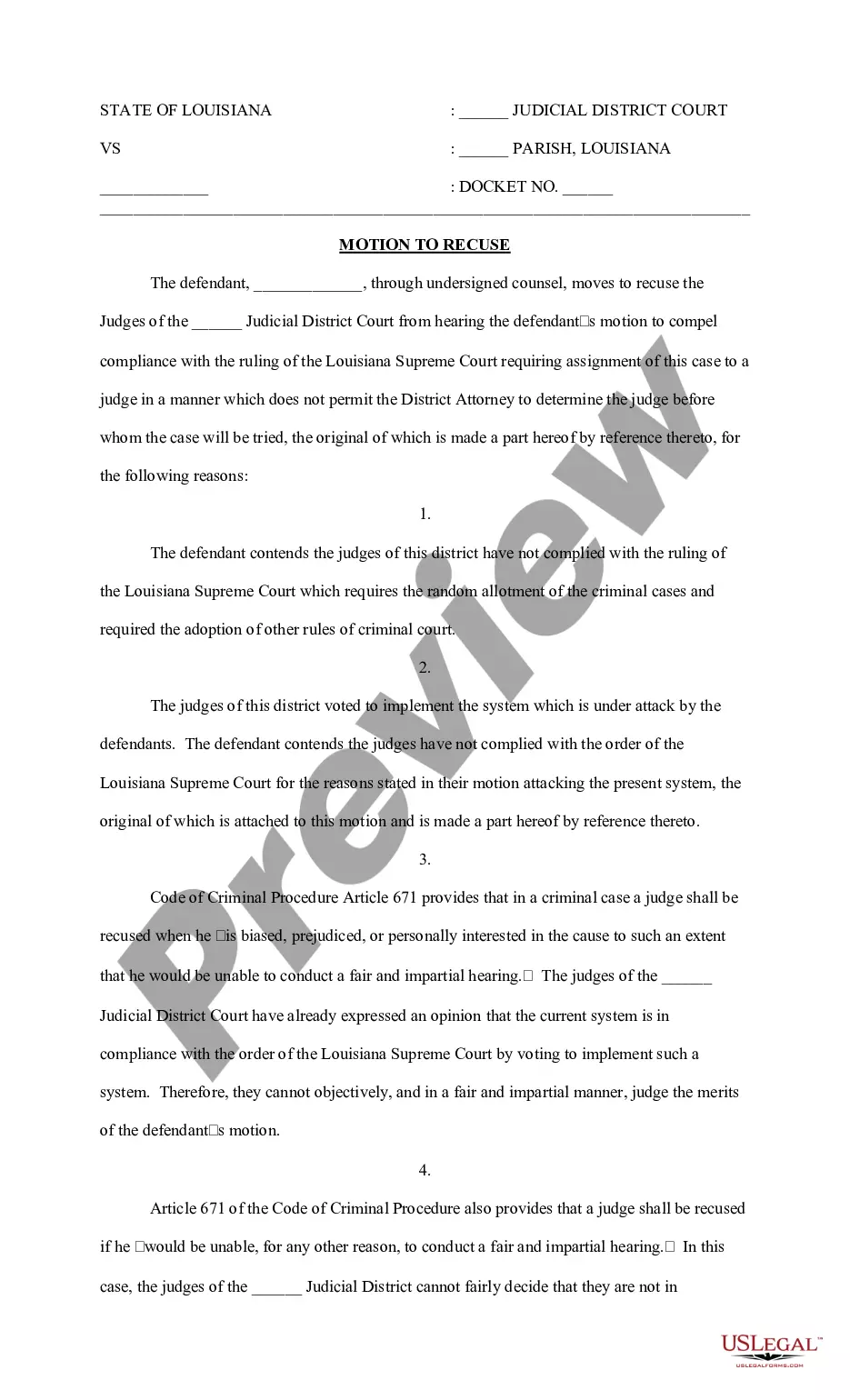

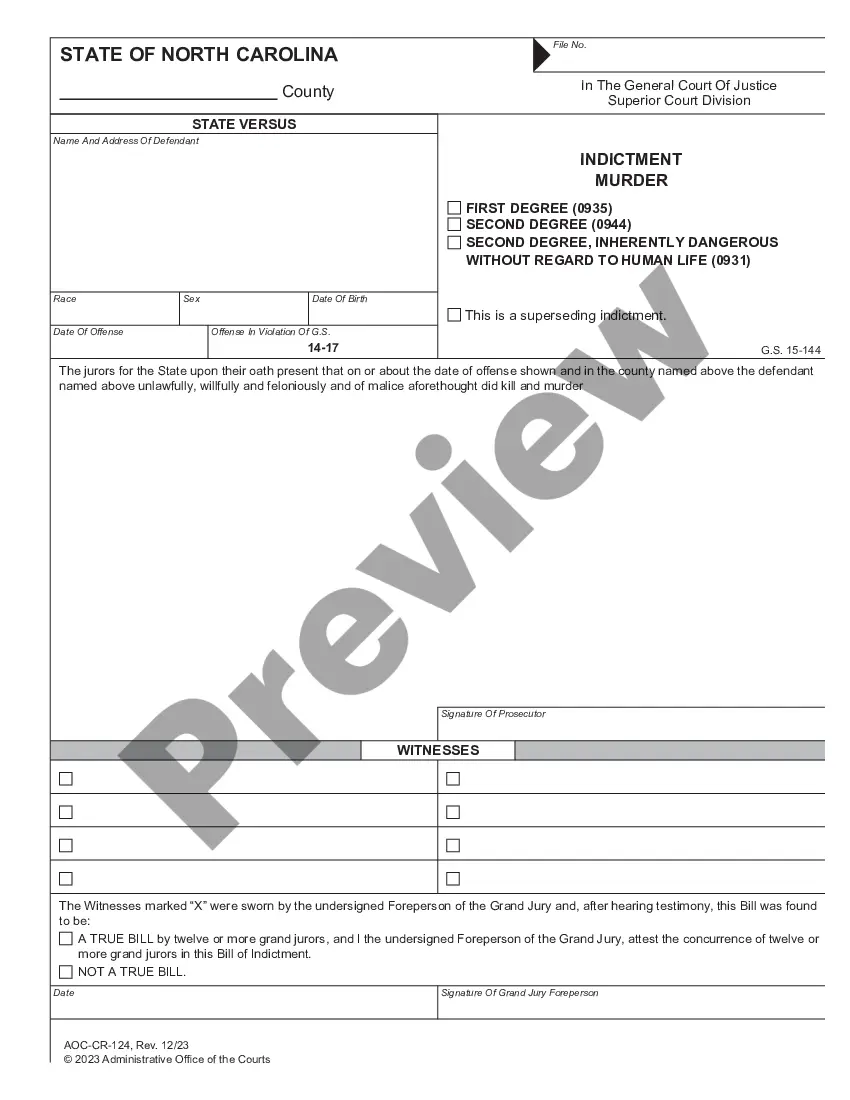

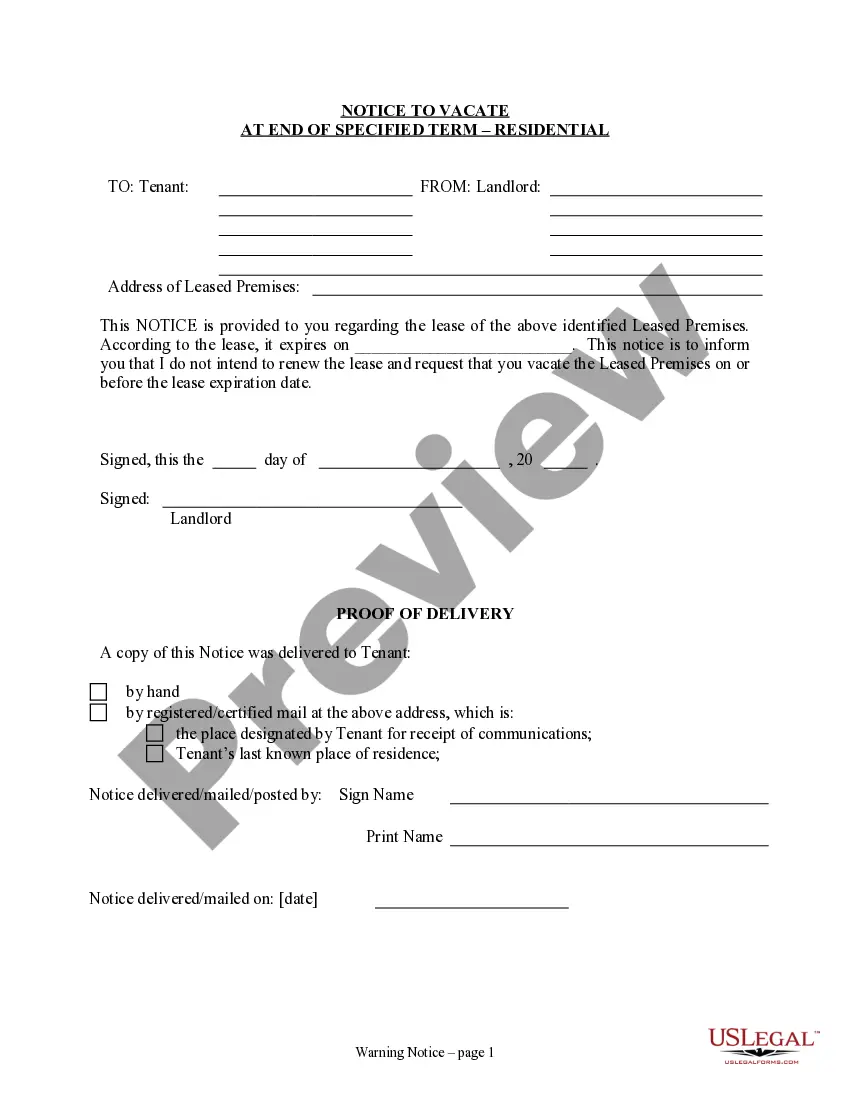

- If you have an existing account, log in and select your form template by clicking the Download button, ensuring your subscription is active.

- For new users, start by reviewing the Preview mode and form descriptions to find a document that aligns with your needs.

- If adjustments are needed, utilize the Search tab to find alternative forms that meet your requirements.

- To proceed, click the Buy Now button and select your desired subscription plan to access the full library.

- Complete your purchase by entering your credit card details or using PayPal for a seamless transaction.

- Finally, download your form to your device and access it anytime from the My Forms section of your profile.

Utilizing US Legal Forms is a straightforward process that ensures you have access to a vast array of legal documents tailored to your specific needs.

Start enjoying the benefits today by visiting US Legal Forms and simplify your legal documentation process!

Form popularity

FAQ

The four major areas of accounting include financial accounting, managerial accounting, audit accounting, and tax accounting. Each area specializes in different aspects of financial management, helping businesses make informed decisions. Understanding these branches is essential for anyone pursuing a career in accounting witt and wanting to maximize their expertise.

One of the most famous accounting scandals is the Enron scandal, which involved the company using complex accounting practices to hide massive debts from investors. This scandal highlights the importance of ethical standards in accounting witt and transparency. Learning from past mistakes can help professionals enhance their own practices and avoid similar pitfalls.

The WIP accounting standard provides guidelines for recognizing and reporting Work in Progress in financial statements. These standards help businesses accurately reflect their manufacturing costs and project valuations. Following these guidelines can improve compliance, accuracy, and financial reporting on platforms like US Legal Forms.

In accounting terms, WIP represents the costs incurred for products that are still in the production process. This includes materials, labor, and overhead expenses that have not yet been finalized in finished goods. Understanding WIP is crucial for companies to assess their production efficiency and financial health.

The WIP standard refers to the accounting principles used to evaluate Work in Progress in a manufacturing setting. It helps ensure that the costs of materials, labor, and overhead are accurately allocated to projects. By adhering to these standards, businesses can achieve better transparency and control over their production processes.

The accounting entry for Work in Progress (WIP) typically involves debiting the WIP account and crediting the raw materials or labor accounts. This process reflects the costs associated with unfinished goods in production. Understanding these entries is essential for accurate financial reporting and helps businesses maintain control over their production costs.

Accounting can be considered an art because it involves creative problem-solving and the ability to interpret financial data in meaningful ways. Just as an artist conveys a message through their work, accounting witt allows professionals to present complex financial information clearly and concisely. This creative aspect helps businesses navigate their financial landscapes effectively.

Staying organized as a financial accountant requires diligence and effective tools. Develop a routine for daily, weekly, and monthly tasks, and implement software to manage your records efficiently. Incorporating USLegalForms can help you maintain order in your accounting witt and enhance your overall productivity.

Organizing your accounting requires a systematic approach to categorizing documents and information. Create folders for different types of expenses and incomes, and maintain an updated record. Utilizing solutions like USLegalForms can help keep your accounting processes streamlined and efficient.

To set up an accounting structure, start by defining the key components of your financial system—income, expenses, assets, and liabilities. Use accounting software or services like USLegalForms to create a clear framework that suits your business. Consistency in your accounting practices will enhance your financial management.