Disclaimer Beneficiary Form For Checking Account

Description

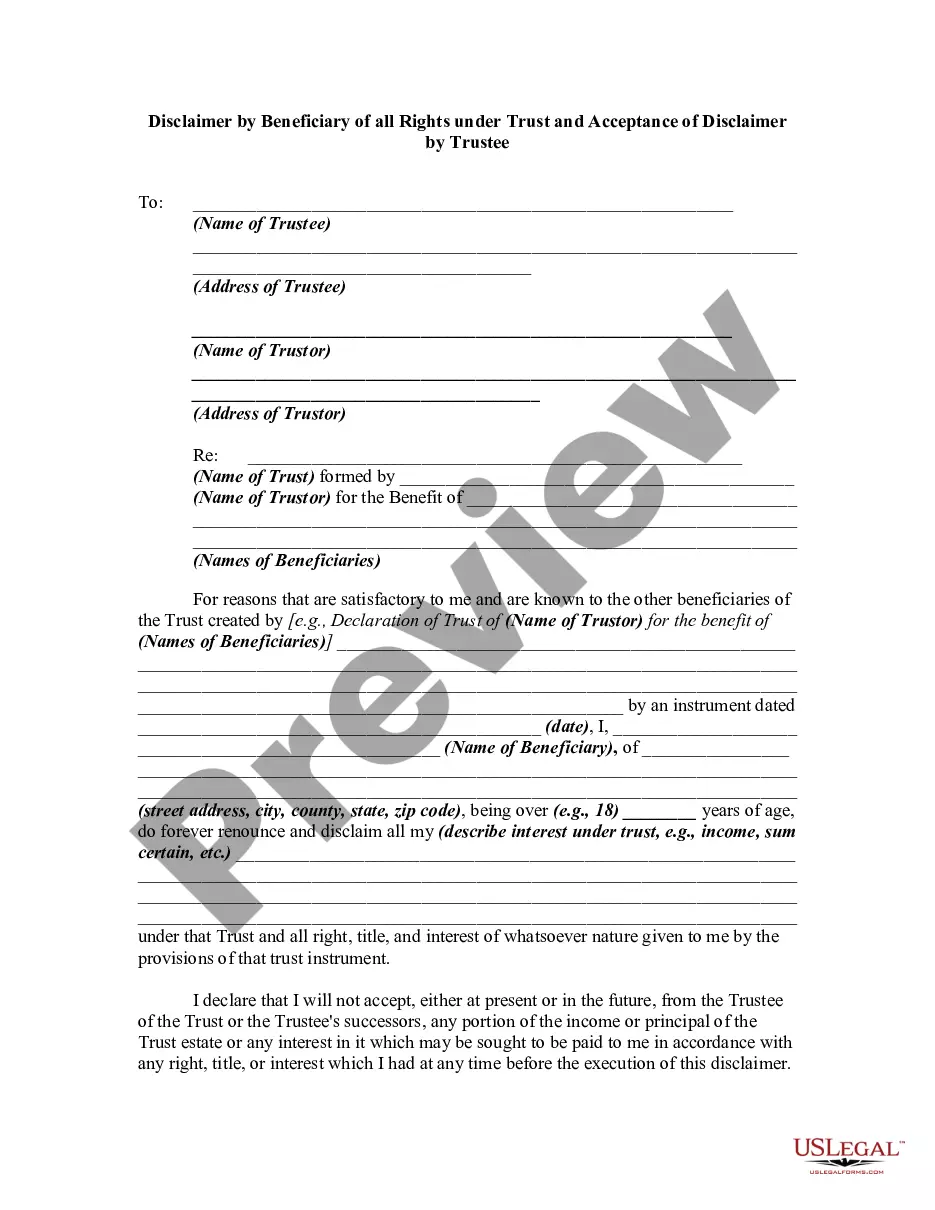

How to fill out Disclaimer By Beneficiary Of All Rights In Trust?

The Disclaimer Beneficiary Form For Checking Account you see on this page is a reusable legal template drafted by professional lawyers in accordance with federal and local laws. For more than 25 years, US Legal Forms has provided people, businesses, and legal professionals with more than 85,000 verified, state-specific forms for any business and personal occasion. It’s the fastest, most straightforward and most reliable way to obtain the paperwork you need, as the service guarantees the highest level of data security and anti-malware protection.

Getting this Disclaimer Beneficiary Form For Checking Account will take you just a few simple steps:

- Browse for the document you need and review it. Look through the sample you searched and preview it or check the form description to ensure it fits your needs. If it does not, use the search bar to find the correct one. Click Buy Now when you have found the template you need.

- Subscribe and log in. Select the pricing plan that suits you and create an account. Use PayPal or a credit card to make a quick payment. If you already have an account, log in and check your subscription to proceed.

- Acquire the fillable template. Choose the format you want for your Disclaimer Beneficiary Form For Checking Account (PDF, DOCX, RTF) and download the sample on your device.

- Fill out and sign the document. Print out the template to complete it manually. Alternatively, utilize an online multi-functional PDF editor to quickly and accurately fill out and sign your form with a eSignature.

- Download your papers again. Utilize the same document once again anytime needed. Open the My Forms tab in your profile to redownload any previously saved forms.

Sign up for US Legal Forms to have verified legal templates for all of life’s scenarios at your disposal.

Form popularity

FAQ

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor, ...

You make your disclaimer in writing. Your inheritance disclaimer specifically says that you refuse to accept the assets in question and that this refusal is irrevocable, meaning it can't be changed. You disclaim the assets within nine months of the death of the person you inherited them from.

Most beneficiary designations will require you to provide a person's full legal name and their relationship to you (spouse, child, mother, etc.). Some beneficiary designations also include information like mailing address, email, phone number, date of birth and Social Security number.

It is an action taken by the beneficiary of an estate or trust to formally give up their right to receive or take a beneficial interest in an asset (or assets) to which they would otherwise be entitled from an estate or trust. A beneficiary can disclaim all or a portion of anything they are earmarked to receive.