Beneficiary Rights Trust For The Disabled

Description

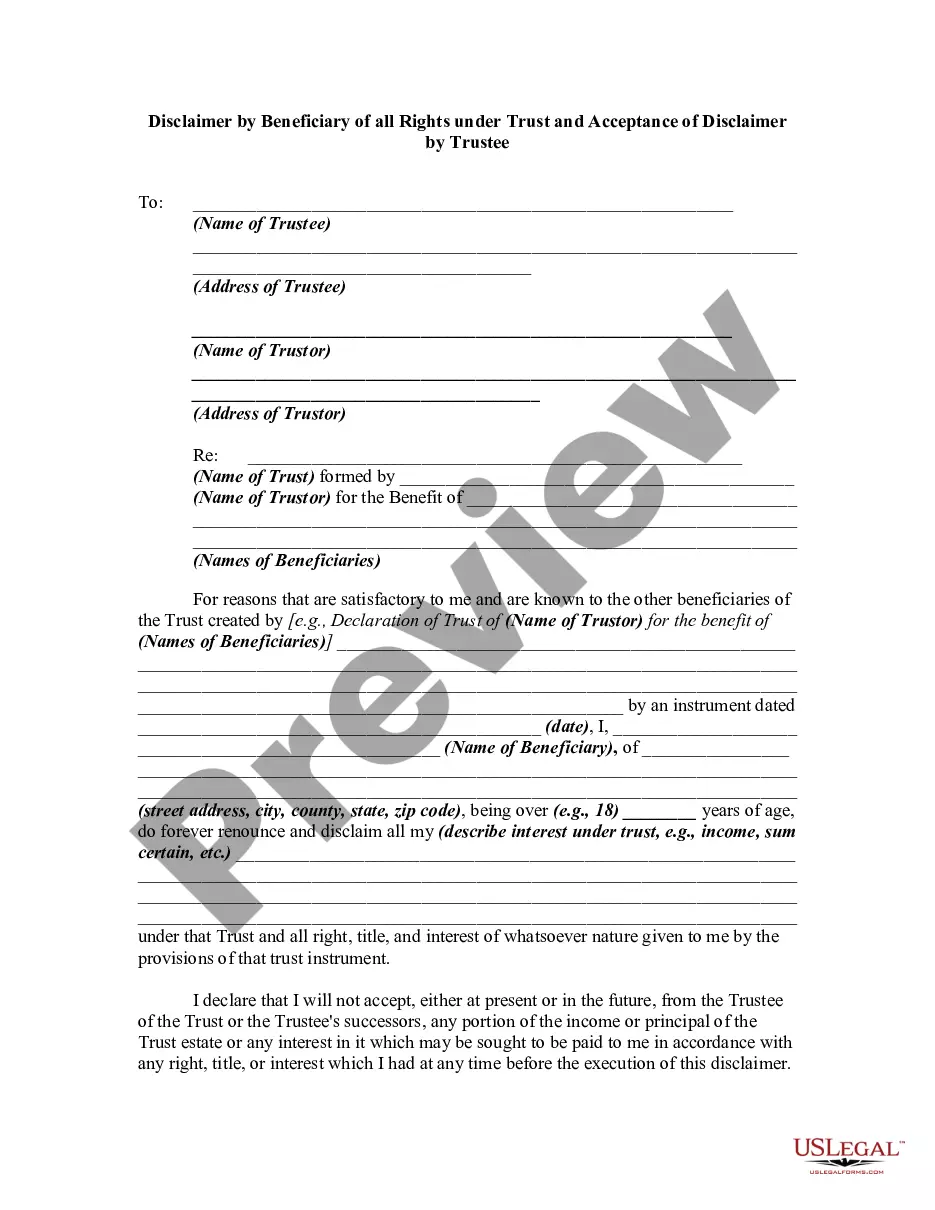

How to fill out Disclaimer By Beneficiary Of All Rights In Trust?

- Access your US Legal Forms account if you’re a returning user. Simply log in to download the specific form template you need. Ensure your subscription is current and renew if necessary.

- If you’re a new user, first preview the form options available. Review descriptions to ensure that you've selected the appropriate document that aligns with your requirements and local laws.

- Utilize the search feature to find additional templates if needed. Ensure all your requirements are met before proceeding to the next step.

- Select your desired document by clicking on the Buy Now button and choose a subscription plan that suits your needs. An account will need to be created to access all resources.

- Complete your purchase by entering your credit card information or using a PayPal account.

- Once your payment is successful, download the form for completion. You can find it in your profile's My Forms section for future use.

In conclusion, using US Legal Forms simplifies the process of creating a beneficiary rights trust for the disabled. With an extensive library of over 85,000 forms and expert assistance, you can ensure your documents are legally sound and tailored to your needs.

Start protecting the rights of your loved ones today!

Form popularity

FAQ

To fill out a beneficiary designation form for a trust, start by gathering all necessary information about the trust and its beneficiaries. Clearly write the name of the trust, the trustee's details, and the names of the beneficiaries, making sure to specify their relationship to the trust. It's beneficial to consult with a legal expert to ensure compliance with laws surrounding a beneficiary rights trust for the disabled. Consider using US Legal Forms for user-friendly templates and guidance tailored to navigating trusts effectively.

The purpose of a special trustee is to manage and administer a trust on behalf of a disabled beneficiary while ensuring their specific needs are met. This person has the responsibility to make distributions that enhance the quality of life for the beneficiary without jeopardizing their government benefits. A knowledgeable special trustee understands the intricacies of a beneficiary rights trust for the disabled, providing peace of mind for families. Utilizing services like uslegalforms can make finding the right trustee simpler.

To set up a trust fund for a disabled person, you start by choosing the right type of trust, such as a special needs trust. You will need to appoint a trustee, who will manage the funds in accordance with the trust's terms. It's important to outline how the trust will operate, ensuring compliance with laws to protect the beneficiary’s rights under a beneficiary rights trust for the disabled. Platforms like uslegalforms can assist you in drafting the necessary documents efficiently.

A qualified disability trust is a specific type of trust that provides financial support to individuals with disabilities while allowing them to maintain eligibility for government benefits. To qualify, the trust must meet certain IRS and legal requirements, including having only disabled beneficiaries and being irrevocable. Establishing such a trust can ensure that the beneficiary's rights under a beneficiary rights trust for the disabled are protected. Consider using a reliable service like uslegalforms to help you navigate the complexities.

Setting up a trust for a disabled person involves several important steps. Begin by consulting with a legal professional experienced in creating beneficiary rights trusts for the disabled. Together, you can establish the terms of the trust, select a trustee, and outline the specific needs and goals for the disabled beneficiary, ensuring their future financial security and support.

While a trust provides significant advantages, one downside is the limited access to assets for certain beneficiaries. For a disabled person, a beneficiary rights trust for the disabled can protect their income and benefits, but it also restricts immediate access to funds. It is crucial to balance asset protection with the need for financial liquidity.

One downfall of having a trust includes the potential for complicated management and maintenance. Trusts require regular review and updates, which can become burdensome for families. However, using a beneficiary rights trust for the disabled can alleviate some of these concerns, as it is designed specifically to meet the evolving needs of disabled beneficiaries.

The biggest mistake parents often make is not clearly defining the trust's purpose and the beneficiaries' needs. Without specific instructions, the trust can mismanage funds, compromising the intended benefits. To prevent this, consider using a beneficiary rights trust for the disabled to outline how assets should be managed and disbursed for your disabled loved one’s best interest.

One potential disadvantage of a family trust lies in the limitations imposed on asset distribution. While a beneficiary rights trust for the disabled can protect a disabled person's benefits, a general family trust may not always have the same provisions. This can lead to unintended consequences for family members, especially if the trust is not carefully structured and managed.

A special needs trust is often regarded as the best option for a disabled child. This type of trust, including a beneficiary rights trust for the disabled, allows individuals to receive funds without losing eligibility for essential government assistance. The trust can be tailored to meet your child's specific needs, providing them with financial resources while maintaining their benefits.